On Options

Well, it was another wreck of a day for da bears (new high on the Dow, once again), so.......let's talk about something else, shall we? Seriously, one of the most frequent requests I have been getting in the comments section has been to talk a bit about options. So here we go.

Considering the market's behavior lately, let's make this a happy story and focus on a call option. In particular, a call option for a stock I suggested way back in an October 6, 2006 post. The stock was Immucor, symbol BLUD.

At the time, the stock was at about $25. Now let's suppose you had so much faith in this chart that you didn't just want to buy the stock, you wanted to buy the call option (in order to leverage your investment and possibly enjoy great percentage gains).

Well, let's slow down for just a minute and do the most important thing first: figure out a stop-loss price. In other words, figure out at what price we would consider our speculation incorrect. In the case of BLUD, the deepest point of the most recent dip in this chart was at $21.57, about $4 less than its current price. So we decide that if the price ever dips below this level, we will close out our position at once.

Next we have to pick an option - - we'll want a call option, of course, since we're bullish on the stock. I typically look for a number of properties in the option I choose:

- I'd like it to be a little in the money; so in this case, we'd want a $25 call, since the stock is a little over that amount

- I'd like the expiration to be at least two or three months down the road. If you get the "front month", the time decay will eat you alive. But if you buy an option that's a year down the road, the movement in the stock will have a very dampened effect on the price of the option. So right now it's January, and I'd be looking at Marches or Aprils (at the time of the BLUD suggestion, a January option would have been appropriate).

- I want to see relatively beefy volume and open interest. It's not easy to find with options (except for huge ones like the S&P 500).

- I want to see a bid/ask spread that's not big enough to drive a truck through. If an option is bid 5.30, ask 6.50, I'm not interested. Focusing on rule (3) will help get you away from overly fat spreads.

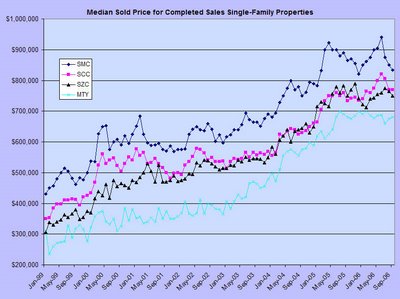

So, for instance, here's a chunk of an options screen showing the S&P options; the one I've highlighted is interesting since its volume and open interest stand out above the others, plus, it's in-the-money.

Once the order is placed, I immediately want to get a contingent order placed. This means that if the stock goes above (in the case of a put) or below (in the case of a call) a certain price, a market order will be immediately placed to close that position at the best available price.

Those are pretty much the steps. Once they are in place, one of several things can happen. The stock can move in the direction you anticipated, which will benefit the option even more. Or the stock can move against you, pushing past your stop price, and closing the position at a loss. Or the stock can just meander along, which isn't something you can tolerate for long because the option will expire at some point!

Now let's see the happy ending to this story. BLUD went up about 30% since the suggestion back in October. But the option went up hundreds of percent! That's the beauty of leverage. Now, I admit, this is a fairly idealized example. But the important things to note are: (a) some of the rules to follow (b) the importance of stops (c) the power of leverage, if things go your way!