The stock market has been going virtually straight up since October 13th, much to the chagrin of dyed-in-the-wool bears (waving hands wildly, pointing at self).

Nothing would be better for the bears than for everything seem to be in favor of the bulls and then have the carpet yanked out from under their grimy little hooves. As a reminder, what's in favor of the bulls right now is (1) the Decennial Pattern (2) strong seasonal bias (the so-called January effect, which tends to take place in December!) (3) recent broad-based strength, particularly in the NASDAQ.

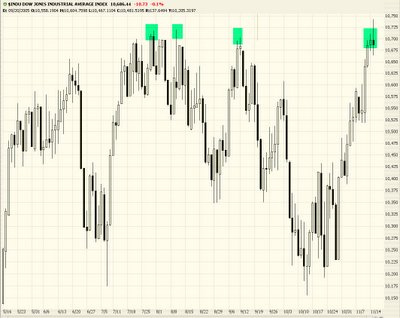

One day does not a trend make (or break), but today was heartening nonetheless. Witness first that the market opened higher and spent most of the day sinking. The Dow, approaching 11,000, may be turning tail again. A double top would be potent elixir for the bears. (Reminder: click on the image to see a bigger version of this graph, then click Back to return to this scintillating post):

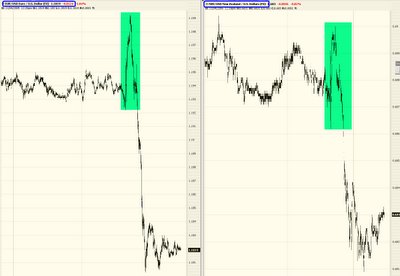

I also want to point out that, across the board, both indices and individual stocks alike had examples of the bearish engulfing pattern (one of the easiest-to-spot and powerful candlestick patterns). Check out the SPY, and notice how it stands out from the price action over the prior six weeks:

Google, which has had a swashbuckling year, seems to do little but go up. Although I am loathe to call a top on this powerhouse of a stock (which, by the way, happens to represent a very fine company!), here is another fine example of a huge bearish engulfing pattern.

It's important to get a sense as to the scope of the market. I am, for example, long puts on Boeing (symbol BA). This is based on a recent trendline break. Boeing has recovered from this break, but the damage may have been done already. Although the above graphs are very recent history, look at the graph of BA below which spans about 12 years. Witness just how far BA has ascended over the past couple of years, and imagine the possibilities should the market ever start really falling (ahem, if it ever gets any traction in the downward direction). There's a looooong way to go.

For those interested, below are my current positions. I will once again state that this blog is merely a place for me to spout ideas and thoughts on the market. Your analysis is up to you. So trade at your own peril! Anyway, the underlying symbols for my put positions are:

BA

CI

DIA

GOOG

MAR

MMM

SBUX

SPY

And the straight short positions are.....

AIG

APC

BMHC

BZH

DOW

EMN

ET

FDO

HLT

KRC

MON

PETM

SGMS

YELL