Beware the False Breakout!

It was naturally disappointing yesterday to see that, in spite of INTC and YHOO getting slammed, the market in general recovered handsomely and actually ended up for the day. This result in a clean breakout of the IWM (Russell 2000 ETF) to a new lifetime high.

Whether this breakout sticks or not remains to be seen. Breakouts need (a) strong volume and (b) plenty of follow-through. Today, due to new (smaller) bombings in London, the market is weak, and the Russell 2000 is over twice as weak as the other major indices. So I thought it would be a good opportunity to take a look at failed breakouts and why they are so meaningful.

Let's start with an example. Below is a chart of ABRX. As you can see, it broke out above a dish pattern (in fact, I wrote about this chart when the breakout took place). The price clearly goes above the horizontal resistance line, but there are a couple of problems. First, there's no meaningful increase in volume; and second, the price tends to wobble above and below the trendline for a few sessions, indicating hesitation on the part of the price.

I've highlighted where this "breakout" took place; take a look at what happened shortly thereafter.

So the failure to follow-through was clearly fatal and invalidates the breakout. Let's look at another example, symbol BKHM. Here is the breakout, and it has extremely strong volume, which is just what you want to see. In fact, the volume surges twice as the price moves upward, and indeed, the stock price did ascend after this breakout.

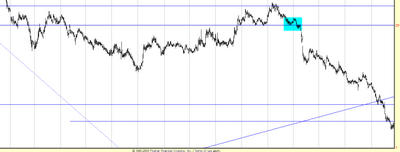

But if you kept that horizontal line on your chart, you would have later seen the price violate it, turning support once again into resistance. This is an extremely serious problem, since the importance of the breakout is completely invalidated by it sinking beneath its breakout point. Let's see what happened next (again, I've highlighted the original breakout point so you can see the price location).

If the recent breakout to new highs among the major indices fails, that lends more strength to my bearish arguments. Stay tuned!

No comments:

Post a Comment