Knowing When You're Wrong

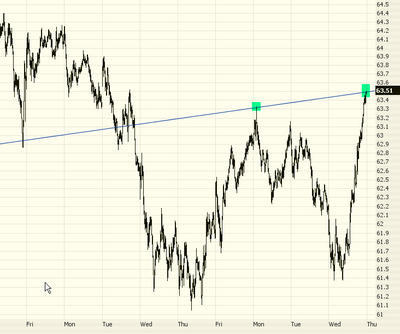

For those of you who follow this blog regularly (and there are millions!) you may recall I made a strong suggestion that Carter's (symbol CRI) was headed for a tumble in this recent posting.

Well, I was wrong. The stock did go just beneath its neckline, and then ZOOM, it shot up like a rocket. Anyone who stuck with this short would have gotten creamed.

The reason I'm pointing this out is to show that technical analysis has two roles: (1) to indicate trades that have a strong likelihood of moving in a particular direction (2) more importantly, to have a precise point where you know the prediction is invalidated and the trade should be closed. In other words, technical analysis shows you when you're wrong. Other approaches permit you to talk yourself into "hanging on just one more day" until you're broke.

Take the above example. Yes, the stock moved under the neckline. But it moved back above it! At this point, you know that this trade isn't going to work out, and you close it for a small loss. Small losses are totally OK! It's the big ones (which you would encounter if you just blindly stuck with this trade) that kill your account balance.

Modesty is key to successful trading. Part of that modesty is to recognize quickly when you are wrong, get out of the trade, and move on a little poorer and a lot wiser.