Five Reasons This Bear Loves This Market

Today's market action was exactly what a bear likes to see: a rise at the early part of the day, a gradual softening, and then a steady fall until the close. This kind of "gotcha!" to the bulls is psychologically key in pushing a bear market forward.

But my fondness of the current market extends far beyond just today's action. Here are five specific reasons I'm feeling optimistic about the prospects for a continued fall in the stock market:

(a) Crude Oil's Not Helping - a lot of people have blamed the softness in the market on the huge increase in energy prices. If that was true, then today would have been a terrific rally, because oil is falling fast. But this isn't the case. Oil's getting cheaper, but stock prices are still soft.

(b) Huge Bearish Engulfing Pattern - all right, this one was just today - but it's important. Take a look at the graph below. There's a marvelous example of a bearish engulfing pattern (this chart is the MDY). The market opened higher and closed beneath yesterday's open. Very discouraging for the bulls.

(c) Bounce Off Resistance - Take another look at the same graph. See the descending trendline at the top? A series of lower highs and lower lows. And today the price couldn't penetrate this resistance line. Just another affirmation of a top.

(D) Major Trendlines are Broken - On all the indices, multi-year ascending trendlines have been broken to the downside. You can see an example of this in the longer-term MDY chart below (reminder: you can click the image to see a larger version). There is another, lower, trendline that hasn't been broken yet, but I'm confident it will be sometime this month.

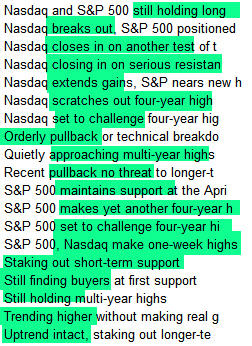

(e) Utter Complacency - People still think the bull market is intact. They still think that, at worst, the market will return 5% each year (indeed, this is the 'bad news' that is shared in popular circles.....that modest returns must be accepted instead of 25% annual returns). Here, for instance, are the subject lines over the past several weeks from a major technical analyst - look how, day in and day out, every single subject has a positive spin:

As has been widely reported, September is typically the worst month in the market, and it's somewhat discouraging to me that it was actually an 'up' month. But charts are more important than time-based folklore. Let's see how October turns out.

No comments:

Post a Comment