$18 Billion in 8 Minutes

I've been watching the stock market a very long time - something like 25 years - but I don't think I've ever seen something like what happened to Google (GOOG) this morning.

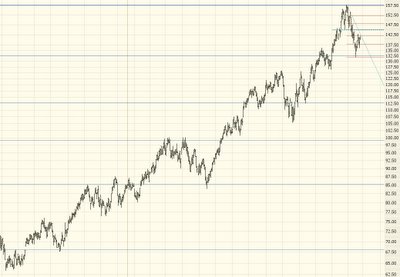

The stock was cruising along, up a few bucks, even in the face of a somewhat soft market. Then George Reyes, the company's CFO, made some remarks at a conference that growth at the Internet giant was slowing. The stock instantly collapsed, and $18 billion in market cap was wiped away in the span of just eight minutes. As you can see in the graph below, it's recovered a portion of these losses since then (how is THIS for volatility, folks?)

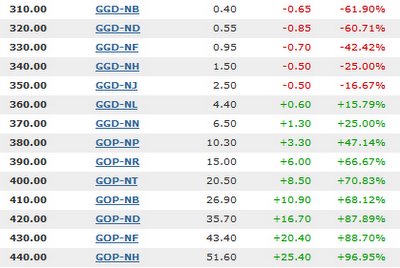

What's quite interesting about this fall is that it stayed tightly bounded by the (cue spooky music) Fibonacci retracement levels. The recovery of GOOG over the past couple of weeks didn't push past its former retracement (not by much, at least), and when this atom bomb was dropped on the stock this morning, it didn't fall below the Fib resistance level beneath.

Cool stuff!