Some Bearish Picks

If you ever want to see a great contrarian indicator, check out the SUPER HUGE font MarketWatch used to trumpet the new highs earlier this week. Wow! Got a feeling these guys enjoy "up" days? And a saucy headline, no less......

Anyway, a bunch of folks have written to ask me to post some specific bearish recommendations. Since the market is getting mushy again (Can this blasted market please just make up its mind, one way or the other? Please???) I'd be happy to offer some up........

First is Arch Coal (ACI), a huge gainer last year. It's gapped down recently, and this makes for a nice clean stop price...

Mail order apparel company Coldwater Creek (CWTR) is losing momentum and represents a low-risk short opportunity:

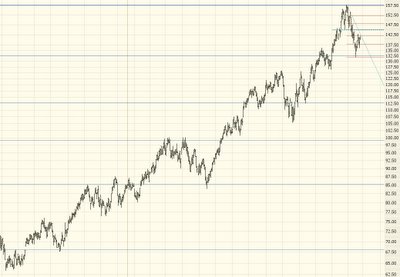

Federated Stores (FD) has broken though an important trendline, and as you can see, it looks like the broad trend has turned downward.

Perpetual favorite Google (GOOG) has recovered partly from its large fall over the past several weeks and again represents a great high-point short opportunity (or, for those comfortable with the risk, puts)....

I also like Harrah's which, although it's well above the ascending trendline, seems also to be losing momentum.

Lastly, the oil services sector, discussed several times here, has shaped up in a very nice short opportunity. As I've mentioned, there is an active options market on OIH if you're seeking potential multi-hundred percent gains.

Best of luck to you!

9 comments:

Thank-you! and welcome back MR.BEAR!!!

Hey Tim,

Would you mind some time going over the filter criteria you like to use for searching for potential bearish plays. I am finding great candidates for bullish plays by tossing in Min price at $20 and avg vol @ 250,000 VV @ min 30 max 50, The results are some nice breaks from bull flags because of the limits i set for VV

Thanks

Trading Guru, Alan Farley, being short-term bullish, stated on his website: "The SP-500 and Nasdaq indices gained relative strength during last week's sideways market. This increases the odds that the next large-scale move will be to the upside." It does look like the $compq has formed a bull flag that if broken out of, there's not much for short term resistance.

Hey Anonymous:

Don't know if you noticed, but this is a BEAR blog. Therefore, you and your 'guru' can check out some other sites that don't mind being fed BS. We here know what's up, and it won't be the market for too much longer!!! It's Q1 2000 all over again!!! I can't believe it!

It's OK, Pappa Bear. I'm all for contrary opinions! If this is just a bunch of bears giving each other bear hugs, we're going to lose sight. Remember, we're here to make money - whether the market goes up or down.

My only frustration is that this market can't seem to make up its mind! The fact that the Dow 30 is basically unchanged for seven YEARS is incredible to me. I realize other indices have done better, but let's face it, we haven't been in a clearly defined up or down trend for a long, long time.

The market is frustrating, but I am still of the opinion that the market hasn't fully corrected the 'tech bubble' excesses. The only reason the market has been able to climb back is because of the extraordinary amount of fed easing. If there is any upside left in the market, it is minimal (2% at most) and the bulls don't have much time to prove themselves (2 to 3 months, tops!) I am for contrary opinions too, but I just don't see the reason for the bull case. Maybe anonymous can explain it in rational terms, and please remember to include the US consumer in this analysis.

Sorry if I offended you papa bear. I enjoy this blog very much and would rather not leave. Just keep in mind that I don't offer a contrary opinion just to ruffel feathers. If anyone disagrees with my analysis please, let's have a friendly discussion and tell my why you disagree, but to totally ask me to leave I think is out of line.

As for rational terms, I felt that there's simply a bull flag forming on the nasdaq, nothing more, nothing less. And as you can see, it did break out today. Also keem in mind, that you and I are probably looking at the market at different time frames. My previous comment stated that I was indicated that I was bullish on the "short-term". Your comments indicated that you were bearish on the longer term, which I have no opinion either way. If we have a bear market, that would be wonderful. Sideways sucks. Profitable trading to you, Papa Bear.

:-).

What civil readers I have :) Thanks......

Dear Anonymous: Maybe it was my mistake in reading too much into your posting, but it came across as s/thing a bull would post! Life is not all roses and it's very frustrating listening (or reading) the bullish case day in and day out. I thought last week was a totally sh.tty week, and it's astounding that only a bull would find s/thing positive about it. One day the bulls will wake up and see that it is only them feeding on their on BS! Which by the way doesn't stand for BEAR S.IT makes you think! Plus, without a name, I am not sure which anonymous blogger you are, as there are a few who come here and just talk trash. Anyways, this is a free country and this is not my site, so you are welcome anytime! I'm as grateful as anyone at having blogs such as this that are in pursuit of the 'truth' rather than the daily BS found everywhere else.

Post a Comment