Repelled!

As a devoted bear (ahem: duh) I have been nervously eyeing the Dow, which has been the strongest index of late and has threatened to cross above 10,725 in a meaningful way.

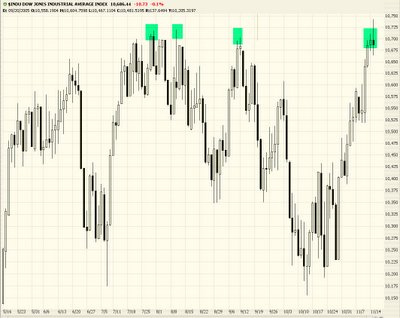

Over the past several months, the Dow has tried to pierce this level, as shown below. It has failed every time. And any failure to push past a resistance level only strengthens the bear's argument that that level will not be surpassed, and the fall will be just that much stronger when it comes.

I was disheartened to witness the Dow push through this level today, but the curious thing was that the 22 stocks in which I have short positions didn't follow suit. In spite of the Dow's strength, many of them remained weak.

Three hours before the close, the Dow peaked, it started falling, and it never looked back. Not to say today was some kind of amazing plunge - the Dow only lost about 10 points. But what's crucial is that the Dow was pushed away yet another time from this resistance level, and just about every index wound up in the red.

There are many time-based reasons the bulls have an upper hand. The decennial pattern (described here) is terribly potent. Plus the timeframe of November 1 to April 30 is traditionally the stronger half of the year. So the bears have plenty going against them. (I would note that, with 2005 almost over, the Dow is down a fraction of a percent. Hardly jibes with the awesome gains illustrated in the decennial pattern article).

As the Fibonacci retracement indicates below, this level of 10,725 is a key line in the sand. As long as it can stay below it, the odds of the market "cutting loose" to the downside stay strong. If this line is penetrated in a meaningful way and the prices close above this level, I will have to reconsider my position.

No comments:

Post a Comment