Home In the Range

What a week! And a great week it was.

For those of you insane enough to have owned July puts on Google until today, congratulations. The slight earnings disappointment from GOOG nicked $40 off their stock price at one point, and naturally the options were going insane.

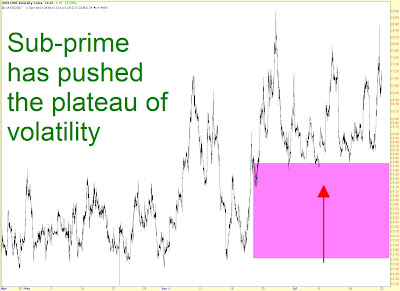

The sea-change that has taken place is that all the sub-prime woes have elevated the volatility in this market. It's very plain to see from the $VIX graph below.

But this market right now is all about one thing - range, range, range. As David Byrne once sang: "I go up and down/I like this/curious feeling." If you are able to pay close enough attention to it, and you've got your groove on, you can make a lot of money.

But a glance at the Dow graph below shows that the price is currently about in the middle of a very sweeping range. And now we're in no man's land. Do we bounce off the horizontal line and fly well above 14,000? Do we push our way through the muck beneath that line and start and honest-to-goodness bear market? Or do we continue to fart around ad nauseum. I dunno. And you don't either.

The Russell is even more "range-y". Hell, I was in and out of calls AND puts all day long on this, and nary lost a cent in the process. It was quite a ride. But I'm about as flat as Kate Moss right, since I'd rather enter Monday morning with a relatively clean slate. (e.g. mountains of cash).

One last intraday index to show you - the S&P 500. I'd say we are at an important "bounce or break" point here. It will take a lot of strength for either the bulls or the bears to reach escape velocity from the range shown here, but once either side wins, it's going to be dramatic.

The rest of the charts are just short/put ideas. I sold a lot of "I told ya so" graphcs today (e.g. items I had suggested which went very much as planned), but I don't want to waste your time with those. You know I've got good ideas from time to time, don't you? Once in a while?

Here's BP.

CAH looks ready to break its neckline.

Colgate (CL) might have finished a nice triple top here.

CVX also looks good.

I'm putting GOOG here not as a suggestion, but mainly to show how nicely it retraced its entire hard-fought gain in just a single day. Who knows - those who bought in the low 500s might be very happy in the long run. After all, it's still a nice bullish pattern. But today it was a better buy!

HES, like many oil-related stocks, looks great to short.

I suggested MLM a while back (howdy, Leisa!) It's doing well.

I made so much cash today I decided to risk a bit on a couple of RIMM puts. This sucker has to fall some day.

Here's a final thought for you. See ya Monday.

28 comments:

Great day for those trading against GOOG indeed. Despite my lt & st bearish technical stance on this giant, I didn't have the nuts to hold puts going into earnings.

Wouldn't be suprised to see the stock eventually try to test the old highs. Today's gap will provide plenty of resistance as a bunch of the longs buying at the recent peak will celebrate an opportunity to get out break even.

JB

http://dormroomtechnicals.blogspot.com/

Wicked volume on spy's today. Wicked volume on goog before the close yesterday too. Of course, no one knew anything there. I'm in cash too Tim. With one Sept put on DE. This afternoon makes me wonder if we might go sideways a bit. Does make it interesting to trade in. Yes I said trade Gary, because that it what I do with most but not all of my holdings. Works for me. Never dull either.

Where was that SWC promoter today? That puppy lost 8.98% of its hyped up value today. Ouch! Do you think there was a stop in place?

Have you noticed the divergence between AAPL and T? The iPhone helped one of them at least.

BAC, LEH, LEN, & RAIL helped me have a better Friday. I trust that all of the rest of you chartists had a great end of week as well!

You know, I've seen that movie, conservatively, about 50 times, and I don't think I ever noticed Cleese kind of hanging around on the left for that whole beginning part.

hmm... it's kinda quiet...

where are the bulls and their unnecessary comments?

Quick. What's a 1% correction on a 40% gain......

Well, that's right. It's called an uptrend.

I always look to take profits, even if I take them early. Too bad I trade indices only but I swear I spoke out loud on thurs about owning Goog puts...instead i bought xtra gamma on the NAZ. Well done TIM. And guys watch out for the YEN. it's movement yesterday monring was in fact what led me to get short. It's knocking on 121 and despite the extremely dovish posture by the BOJ (had it not been for that I'd reckon this mrkt would be at least 30 points lower), that's an important technical level. I'm as flat as Kate Moss too going into next week....LOL

They should not let gay men choose super models. Because they are attracted to men they tend to think masculine looking models are hot. Case in point: http://images.google.com/imgres?imgurl=http://images.askmen.com/galleries/model/gisele-bundchen/pictures/gisele-bundchen-picture-1.jpg&imgrefurl=http://www.askmen.com/women/galleries/model/gisele-bundchen/picture-1.html&h=490&w=376&sz=48&hl=en&start=13&um=1&tbnid=XfBx5S5ZDQIMTM:&tbnh=130&tbnw=100&prev=/images%3Fq%3Dgisele%26svnum%3D10%26um%3D1%26hl%3Den%26client%3Dfirefox-a%26rls%3Dorg.mozilla:en-US:official%26sa%3DN

Gisele is the most manly looking supermodel i have ever seen. I think only guys who have (1) homophobic tendencies and the (2) girly men types think she's hot.

Where have all the bulls gone, they stop snorting when the market is down. Gosh!, what happened to the "Global Economy" crowd , or the S&P is so undervalued crowd. SWAT!!!!By the way URBN is sporting a wonderful bearish saucer.

like fund said, its a reaction in a bull market. I still say that solars have bottomed on their reaction and that next week will start another upward swing in the indices. Get ready to go long...

I guess the bears are just going to keep calling a top everytime we get a down day. It was one day for heavens sake. How many times are you going to do this? Can't you at least wait until the market has put in a lower low? I just don't see how we can put in a top until all the bearish sentiment is reversed. When everyone is finally afraid to ever short again then we'll be at a top. We still seem to be a long way from that yet.

SWC plummetted 9% on Friday. This is an excellent entry for people who wants to ride the palladium bull. You need to know this metal! Just as copper bought 20 folds return in PCU 4 years, palladium bull will give SWC a 20 folds return in 4 years. Click on my name and go to my new blog to read about it. Better yet visit stockology.blogspot.com

Personally I'd rather buy silver its ridiculously cheap right now. SLW has much better financials than SWC. Before the secular bull in commodities is over I suspect silver will return 2000-3000%. I have my doubts about Palladium doing the same. Of course if you don't want to deal with financials and management, etc. you can always just buy SLV.

Just a hello to those who came to talk talk in Sacramento (including AssetStrategist). Enjoyed speaking with you today!

My move to slopeofhope.com should be ready to roll. I just gotta start posting THERE instead of HERE!

The Russell 2k is just mad right now, I went short at 850ish, closed at 840ish less than 24hrs later. Did the same thing all over again the following day!

But yeh I'm currently flat too on the expectation the bear run will continue for the mean time. I expect the russell to slow down a bit but maybe another 4% by the end of year so long as something doesn't trigger a bear market. In which case, hold onto your hats!

Lets see, 850 + 4% would give us

884. Yeh that /feels/ do-able.

But then some jitters could easily send us back to 750 in next to no time. And if I missed something like that I'd be extremely miffed.

Regards,

Locster

I am hoping this post will see the light of day since Tim is doing his President Chenet impression and destroying all evidence of the Bulls who have made 100% this year and would rather bury their hard work than show it ...fact is the FED wants you and Tim long stocks or else there will be a rececession or worse and then Tim will get his way , it has been 6 years since a 10% correction and the Bulls have played the Bears like pussycats and now the subprime and sector rotation and all the scary stuff will happen which only means wait till the 4th quarter 10-15% run up ...sentiment can get us one more run short term to new highs and then you have to give Tim and the Bears their 10% but that doesn't mean us Bulls are going to sit by while they make all the downside dough ..we are smart enough not to get sucked into one side and are able to "hedge " ourselves as good investors do .

Best of Luck

Tom

Tim For V.P. if G.W> doesn't make it ...he can shred the truth as well as anyone . And I thought there was some 1st ammendment blood in Tim Knight ...hate to be disappointed ???

WTF -- Tuna Can Tommy is a cheap site shill AND a left wing nut??

It is infernal idiocy for one side of the market to constantly resort to inanity when describing the other side.

Most on here think there are two sides to the stock market. The Bull camp or the bear camp.

However, for me there is only one side. The right side. I love to make money, so whichever side will make me the money is the side I want to be on. And right now, it's the Buy Long side.

We're entering a historically weak period for the markets. However in Sept, I'll be buying Long.

I concur with Gary, Silver related isues are still cheap. I'm long CDE.

GOOG may have found support at the horizontal line you drew, Tim, but more likely it wanders down to it's lower trendline and more solid support @ $500. Once again it was crucified by weak hands holding a $550 stock that should be split to 1/10th of that. Then you wouldn't have these retail investors jumping ship over a 3 cent miss. Bottom line - they may have over-spent on personnel this past quarter, but they are still growing EPS at 40% while selling at a forward multiple in the low 30's. Think I'll buy some more here. This stock goes to $1000 within 3 years.

There is going to be a flight to quality in this market - therefore, those quality names will move that much more in uncertain times. I'll suggest a few from my porfolios - GOOG, AAPL, SGR, FSLR, T, BEAV, ISRG, FCX. And everybody should have a few speculative plays for the fun of it - a couple of suggestions are WDGFF (gold play off the pink sheets, up 33% the last month and currently at new 5 year highs), ENCY (bio-pharma play that recently dropped 66% on a rejection by the FDA to approve it's drug Thelin, despite recently signing a major distribution contract for Thelin in Canada & Europe.) Somebody is buying ENCY in a big way this past week as they have retained Morgan Stanley to explore "Strategic Alternatives" - and we know what that might be. i.e. a fire sale. The stock was trading at $6 in Jan. You connect the dots.

I've reposted my son's CDS Primer from February on my site today. It's not necessarily the best (and certainly not the only recap)...but it's brief and puts the debacle in perspective...unlike Professor Bernanke.

http://www.ronsen.blogspot.com

I am not "destroying the evidence" - - it just seems that everyone here hates TTT's guts and I don't want to waste their time. Anyway.

Making huge profits has always pissed off the Bears so it seems logical you would blackball anyone making money...????

TTT

Tom,

No one is getting blackballed. One day you're fawning and sycophantic. The next day you're abusive.

Just stop the posts. No one will miss them.

dammn i confuss lo

Counter Depth French Door Refrigerator

How to Get Into Acting

Breville Smart Oven

How to Impress Woman

Picking Lottery Numbers

Canon Powershot A800

Adidas Barricade

Adidas Barricade 6.0

Cuisinart TOB-195

Acne Conglobata

Acer 11.6 Netbook

500 payday loan

acne inversa

VIZIO M261VP

checkmate payday loans

Pengurusan Masa

Counter Depth French Door Refrigerator

How to Get Into Acting

Breville Smart Oven

How to Impress Woman

Picking Lottery Numbers

Canon Powershot A800

Adidas Barricade 6.0

Cuisinart TOB-195

Acne Conglobata

Acer 11.6 Netbook

500 payday loan

acne inversa

VIZIO M261VP

checkmate payday loans

Pengurusan Masa

nice

Excellent post! I, personally would like to thank you for writing and posting these very informative write ups. So great! Keep up the good work! DUB turbo

I just found your blog and want to say thank you ! It is really nice post thanks for sharing and just keep up the good work !

Flash Photo Gallery ! Medprax™ ! Bangladeshi Exporters ! Cars for Travelers

Post a Comment