Thanks for coming back this weekend (or Monday......) to see my post. I had to do some thinking, charting, and scanning to reassess the market.

Oh, before I begin, a shameless plug: for those who have been holding off buying Chart Your Way to Profits, check out the reviews of my book. You'll be able to get some third-party opinions from those who have actually read it. The one negative review was from someone who didn't realize the book was largely about ProphetCharts and JavaCharts. So, consider yourself warned.

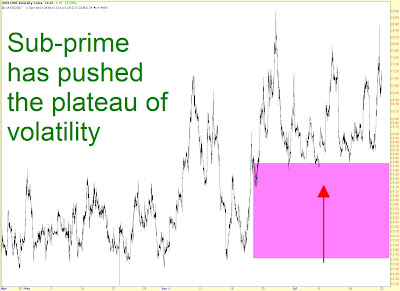

I really tried to look at the whole market with a very open mind, because the strength of the bulls since July has been frustrating, confusing, and vexxing. I keep coming back to the graph below, which shows the S&P 500 over the long haul. I simply cannot see that we are set up for a bullish surge. I don't want to hear about liquidity, the global economy, or the trillion dollar oil surplus seeking a home. This blog is about charts, and the charts, to me, don't say "buy."

Looking at a short-term S&P chart, we can see that we're getting dangerously close to the high set back in February. It isn't the all-time high (set early in 2000), but it's getting close to that as well. The big question now is, does the market (a) sink from here (b) push up to a double top and then sink (c) blow past the February high and make an assault on the all-time high from the bubble.

To me, an important indicator to watch is the NZD/USD market. The New Zealand kiwi has been extraordinarily strong. The weakness in late February was a good early indicator of the tumble the markets took. But, since then, this currency has basically been going straight up.

Another item I watch is China - one shorthand way to do it is via GCH (Greater China Fund). One interesting tidbit is that it seems to have retraced up to a retracement level. We'll see if it backs away or not.

I wanted to show a few examples of why it's careful not to fall in love with a particular point of view. In particular, why it's important not to anticipate pattern completion.

Technical analysis is a helpful tool - especially in markets that are friendly toward one's general investment disposition. For instance, if the market were, by and large, weak, the short ideas I've suggested over the past months would have been quite successful. But the fact is that we're swimming against the tide, and that makes it very, very hard.

And I'm not saying the market would have to be in some horrendous free fall. But if things were easing down, week to week, and month to month, that's where using T.A. to smoke out good short opportunities is invaluable.

But when you're swimming against the tide, you have to be extra vigilant. Take BP, for instance, shown below. I mentioned this as a potential short. It had a beautiful topping pattern. It broke below its neckline. And it started falling.

But what happened next? It got strength. It went above the same neckline. Thus, the pattern was rendered moot. And then it soared! Being able to escape the "jaws of death" like this is a real sign of strength that must be feared by bears.

Here's a similar situation with FTO. A gorgeous head and shoulders in the making. But the pattern did not complete! You can see what happened next. That's why scoring a little more profit by seeing a completed pattern in your mind's eye is seldom worth it.

For our next example, here's HES. I've often pointed out how, once a trendline is broken, the price obediently stays beneath it, and maybe "kiss the underside" of the trendline. That's all well and good, but it doesn't mean a collapse is at hand. A price can stay beneath its trendline for a very long time and still make tons of money for the bulls.

My general feeling toward the index is simply that I don't know what the hell is going on. A terrible confession, eh? But these markets are bewildering these days. You're going to hear the same story from me - - we're pushing toward either a double top or to new highs. We're awfully close to one or the other.

$NDX is a skosh weaker. It could back off from the horizontal line I've drawn. Or not.

I was blown out of my precious $RUT puts. But that's what stops are for, right? I don't like the look of this index nearly as much as I used to.

Some indices - such as the $XMI, shown below - have wasted no time in going to new lifetime highs. Disturbing. The bulls are in their ninth month of totally owning this market.

Most of the strength these days is in really "old school" stuff. I'm talking about Steel.....Uranium......Copper........and, for God's sake, Railroads! This is no "new economy" play here. It's 19th/20th century stuff. Here's uranium company CCJ, for instance:

Goldman Sachs gave me at least a little relief. Even on a strong up day, it was weak.

Tech giant IBM, on which I also own puts, also was surprisingly weak.

I'm looking at MLM for a new short position.

I've been short MSTR for a couple of weeks, based on the failed breakout you see highlighted here. So far, so good.

MWP is in a tight range. It's going to break one way or the other soon. I have no position at this time on this one.

Someone mentioned last week the stock ONT. I felt strongly bullish on it based on the breakout and volume strength. It has moved up handsomely since then and looks better than ever.

SCHN (Schnitzer Steel - try saying that five times fast) has a hugely bullish pattern too.

SWN, mentioned here bullishly before, looks even better.

If you think oil stocks are going to weaken, XOM is a pretty-good looking short/put candidate.

As you can see from today's posting, it's more of a bullish/bearish mix. My frothing-at-the-mouth bearishness has become really attenuated by the market's action recently. It's disappointing. I shall continue to watch, wait, and hope.