Spock Grok

I was going to write a huge entry today about emotions and the market. But it's already four hours after the close, and I'm still stung with guilt pangs from such a late posting last night, so I'm going to leave my essay for another day.

I will say, though, that I yearn to be like Spock during times like this. The problem with these range-bound markets is that, for a bear, (a) when at the low end of the range, I'm flush with profits, I'm totally committed to my positions, and I'm into way more risk than I should be since I've been doing so well; yet (b) when at the high end of the range, when I'm sacrificed some or all of those aforementioned profits, I'm skittish and risk-averse. Obviously being just the opposite would be helpful on both counts. Spock is a cool customer.

Of course, we're all only human, and markets run completely contrary to human nature. That's why there are a handful of big winners - - those that defy the greed/fear trap - - and the rest of us are just schlubs. Let's face it - emotions and the financial markets are just another example of one of life's bad combinations.

I haven't mentioned China in a while. I'll say this.........long term, I think China is going to be king of the world, or at least a prince. Whereas its neighbor Russia will, in my opinion, collapse back into socialism or communism within the next decade. My optimism for China's long-term prospect's aside, what we're witnessing now is a bubble, pure and simple, driven largely by embarrassing naievete on a greedy yet clueless investing public.

The Dow fell 148 points today. It doesn't mean much until and unless we break 13,250. If we do, I'll probably return to being the arrogant pr*ck you all love so dearly. Until then, my hands remain peacefully clasped on my lap.

The Russell 2000 had an even worse (that is, better) day. My index puts on the $RUT did great.

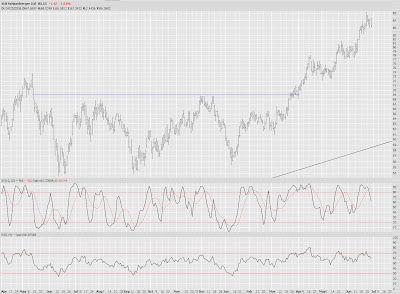

The S&P is approaching the re-entry point on that channel is busted above a number of weeks ago.

I've stopped buying puts on AutoZone - there's only so much punishment I enjoy - but this stock is really looking toppy.

Ol' beanie has mentioned BIDU so much I might as well put up a chart. My hat is off to any chart that can do this on a day like today.

I added to my Capital One Financial (COF) position.

The DIA puts aren't as clean a deal as the IWM or RUT puts, but they're OK - - decent volume and a 10 cent not-too-terrible bid/ask spread. I did a day trade on these today with good results.

Goldman Sachs (GS) continues to be a put position I believe in.....although the big plunge never seems to happen to AJC's employer.

I've mentioned McKesson (MCK) many times because of its Fibonacci fans. Add to this now an imminent head and shoulders breakdown.

Someone mentioned SHLD in the comments section today.......thanks very much! I've mentioned Sears over and over. It's been inching down. Only today did it really take it in the groin.

VMC is kind of an interesting pattern, inasmuch as it seems to be breaking below a pretty wide consolidation rectangle.

I heard this tune today, and it reminded me of the markets.......to everything there is a season. Bears: I swear it's not too late.