The Wimpy Bull

Well, how's this for a contrarian indicator? The esteemed newspaper Barron's had this on their front cover:

Complacency is now complete in the public's mind! (I guess the grumpy bear in the lower right are readers of this blog!)

Anyway, for most of the day, the bulls were in charge, especially in the land of oil, commodities, and gold. Copper and gold have just gone bananas. Anyway, the Dow had a nice healthy 40 point gain for virtually the whole day, until big-eyed Maria B. mentioned Ben Bernanke felt the public had misinterpreted him as an interest rate dove.

The mere second-hand mention by a reporter of the chairman's finessing of his statement caused the market to unravel in a matter of minutes.

Is this really the snorting bull that's going to push the Dow past 12,000? This is a weak-willed, lily-livered bull. Any little risk, and it runs for the hills. Added to which, oil and gold are so stratospheric, when those eventually decide to come back to earth, it's going to be another big negative pull on stocks.

By the way, here are my current positions on which I am long puts:

$SPX

AHC

APC

ATI

AVB

BHI

CLF

CMI

CRS

ENER

EXPD

FLR

IPS

IWM

IYR

JOYG

KMI

NTRI

NUE

OIOH

PD

UBB

X

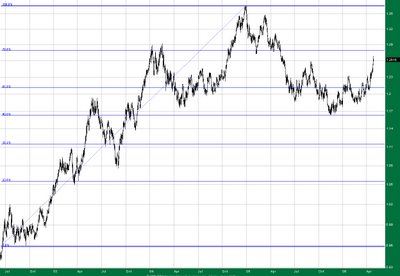

I don't do much FOREX in this blog, but I wanted to mention that EUR/USD looks like a good short. I'd put a stop in at $1.2931 on this one.

2 comments:

I wanted to apologize for everyone for how long tonight's posting took. (*#*(#*)(*^%()# blogspot was having some kind of technical issues. Grumble....

Regarding DNA - - I still think it's a great short. I (stupidly) closed it out for no good reason, and it looks like it's doing just dandy - it's down nearly 3 points this morning alone. Congrats!

Post a Comment