Busting the Bounce

I said at the start of this week that the market was going to go up for a number of days in order to create great selling opportunities for the bears. It seems this is precisely what has happened. The Dow had a particularly strong Thursday and Friday, and I'm sure the vast majority of people are thinking that the recent weakness was just a little correction so that the huge bullish gains can now resume.

Well, good. That's what we want them to think. The bull trap is just about finished being set. I wouldn't be surprised if the trap was sprung as early as Tuesday (remember, Monday is a market holiday). But even if not, it's coming soon. Almost certainly next week, by my estimation.

The $VIX, which had soared with the market weakness last week, has plunged back down again. This is great, because it makes those SPX puts that much more reasonable to purchase.

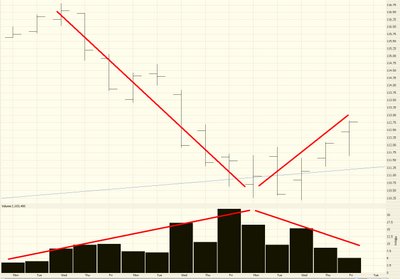

Here's something interesting to note as well - look how the volume got stronger on the way down and is completely weak and wimpy on the way up (this example is the DIA ETF, which is very representative of the market as a whole). Limp retracements are just what the (bearish) doctor ordered.

As for the Dow itself, it looks like it's heading back toward its retracement level. We're very close at this point. A decently strong opening on Tuesday (up 40 points or so) followed by a loss for the day would be sensational. Not necessary, not nice.

The NASDAQ Composite is also just about ready to kiss the underbelly of its broken trendline.

As for the S&P 500, this likewise is moving toward the underside of a broken trendline, having bounced strongly off its Fibonacci support level a few days ago.

Now for a few specific stocks to consider shorting (or, if you're so inclined, and if they're available, buying puts on). Here's Anderson (ANDE), a huge topping formation:

EME also a nice rounded top:

IPS likewise had a huge runup, a recent breakdown, and a subsequent partial retracement:

Lehman Brothers (LEH) is also retracing to the underside of the trendline (I'm not stating stops for these, but obviously you should have a sensible chart-based stop order for every one of these positions; oh, and as always, click on any of these images to see a much larger version).

MBT has a beautiful, large rounded top:

And the topping pattern on WLP is kind of cool since it's actually tilted upward, but the retracement obeys this bend nonetheless:

US Steel (symbol X - who knows why.....) is also a crystal clean retracement to the underside of the broken trendline.

Great stuff! A down week next week would make for some very happy bears, me included. Thanks for all the nice emails and comments, everyone. It's great to have such a smart bunch of folks reading and contributing to this blog, and it's encouraging that apparently people keep coming back for more each day.

5 comments:

Im all for a continued pullback, and I would love to jump a bandwagon about things going further down next week. But you know what? I don't think it will happen just that quickly. Does it ever just happen that nicely, ever? Well, that nice bounce last week, was a little too nice.

1. Volume. Yes, there was a MUCH larger party when the markets were tanking. But the DOW fell 500 points in like a week. OF COURSE the volume would just spike like crazy! So, just because the dow has been going up a little more steadily the last couple days, the volume has somewhat gone back to pre-(dow falling like crazy) times. So, while it would be nice to just look at the volume in the last couple days compared to what has been going on the last couple weeks, that would be a little deceiving. Also, did anyone notice the volume for the QQQQ the day it bounced up (May24)? 234,998,203 SHARES, HOW the heck does the QQQQ get traded 234,998,203? ITs average volume for the last week (when it tanked like crazy) was HALF that May24th volume!

2. Momentum. The csticks the last couple days on teh sp500 and dow have been REALLY bullish (full white bodies). I hardly doubt that this train is gonna crash in a matter of days! But the nasdaq/qqqq didn't make quite a nice body on friday. what do they call that, hanging man/hammer - whatever the name is, I like to call it, PICK UP THE DAMN pace! I don't want it to keep going up when the other indices are poised for a downspin (again)

3. The oscillators. stoc, and macd are still really oversold (naturally), I would be way more confortable put-ting these indices when the oscillators have got back towards more neutral/close-to-overbought levels.

we'll see what the (bearish) doctor prescribes.

Costas, you're largely right. I've actually been planning a "Best of Hurricane" post sometime next year once this has all started crumbling so we could review how GOOG, NTRI, and all the rest have been doing. Until then, I'm just keeping my mouth shut.

Super Bull's bear case is problematic at best but number 5 is by far the worst piece of evidence - the stock market, since the beginning of time, has always done better under the Democrats than under the Republicans. You can look that up. Number 1 suggests that there is this new economic concept - "inflation" in the system. A brief look at history would reveal that there has been "inflation" in the system since the beginning of time. Inflation is meaningless in the long term and the short term. I've been around a week or two and I can guarantee I have lived through and profited in some of the most horrendous inflation laden periods of all time.

As far as housing is concerned - once the Fed starts cutting rates to head off the recession from becomming a depression prices will again go up. Probably faster this time since a lot of people who missed the last bubble are waiting for the next one.

Now for the weeklies. Last week I said there was a good possibility for a continued downtrend but I was wrong. If I had been more observant I would have seen the long tail on last weeks formation and that would have been a counter suggestion to my thinking - whatever. This week we are seeing a clear cut hammer formation in every index. "Hammering out the bottom" as they say. Bull trap? Bull crap. Just wishful thinking. This market has a long way to run yet.

'Cane - NTRI is dead, HANS is topped and GOOG might bounce around in the 350-450 range for a bit longer before it too implodes (nothing new coming out of the goog fountain). Don't forget once Goog starts going down there is going to be no bid for a long way. BIDU also appears toppy.

HANS looks like a bullish Flag formation: http://stevepuri.blogspot.com/2006/05/hansen-natural-corp-hans-descending.html

My guess that the market is going to be a little frustrating for both bulls and bears as we enter a trading range for the summer. With money market accounts paying respectable interest, I can understand why anyone would want to sit out and lay by the pool until later this summer.

The market hasn't had a decent sized pullback for 3 years, and we're due. We have the mid-term election cycle and summer seasonality all lined up. It'll be so obvious in retrospect!

Post a Comment