Blowing the Froth Off

Yesterday I wrote, "Below is the Dow 30. I could make all kinds of technical jargon, but I will offer only this: the market is really, really, really extended. It will not keep going up every day, people. Promise."

Well, promise kept. All the indices got beat up. The NASDAQ 100 was down 2.2%. The Dow was down 142 points. I have embraced a sober view of my bearishness, however. As the chart shows below, there are plenty of times the market has pushed up against its resistance trendline, only to ultimately push higher.

So I'm not going to be beating any "the market is crashing!" drum. It's down today, and that's great. And I hope it goes down a lot more. But there is no sea change in the market's direction yet. It could consolidate and push inexplicably higher yet again.

The oil sector threw me for a bit of a loop this morning. I got instantly stopped out of my OIH position at the open this morning (it gapped up) only to see OIH fall the rest of the day. Crude oil might have topped out, but it's very hard to say. A day like today would definitely give pause to the energy bulls.

The NASDAQ is clearly the weakest index in the U.S. these days, and the $NDX has finally snapped below its supporting trendline. This is great news for the bears. As you can see, this trendline goes a way back, so this is a pretty good signal of a change for the better.

Take a look at stock CHRW as a short candidate with a stop of $50.25. I like how it's retraced part of its recent fall and seems to be re-weakening.

The same can be applied to E*Trade (ET). I usually don't buy puts on stocks this inexpensive, but the trend change seems so clear (and its ascent so mighty) that I made an exception here.

Not a recommendation per se, but one chart I wanted to offer as a great example of "lower highs and lower lowers" is AIG, which got whacked today. It also is very trendline-compliant. This is a really beautiful graph from a technician's perspective.

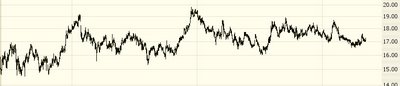

One last, random comment. I'm just curious - can someone tell me who trades Time Warner? And why? This has got to be the most boring chart in the world, yet it trade millions of shares a day. Do you get a free sandwich or something if you place a trade on TWX? I'm just wondering, because the nearly-flat graph below represents about three years of activity.

2 comments:

there is no way i am the only one who was looking at the QQQQ, and just mesmorized, by how fast it was tanking. I was so used to seeing this thing chug out 5 to 10 cents on any given day, (20 cent movements was something to talk about, no?) BUT, to fall 90 cents in one day? wow.

50 points on the nasdaq, and falling out of its price channel??? the dow tumbling back into its trading channel, and the sp500 still in its channel - what does this all mean?

how can anyone work 9 to 5 while all this is going on?

i love it.

"I'm just curious - can someone tell me who trades Time Warner? And why?"

Haven't you ever met long-term investors? All they care about is stability, for whatever asinine reason.

Post a Comment