The Waiting Game

OK, I've got a confession. All that stuff about the bulls being in control and the bears needing to hide in a cave? Deep down, I don't really believe it. I think the market has been living on borrowed time, and it's all going to blow up at some point. It's waiting for that "some point" which is exasperating.

I looked long and hard for stocks to buy in the current market. In spite of being labeled a permabear, I'm honestly quite good at finding bullish charts. But all I see are hyperbolic insanities. I have no basis of declaring that HANS won't double or triple even from these levels. But I simply cannot buy a stock that looks like a hockey stick. It's the "greater fool theory" once again - these securities just keep getting bid up, ascending higher in price based on little more than momentum.

Very little happened in the market today, so there's not much to say about current action. Even with Dell offering an after-hours earnings warning, which slammed its stock, the Globex isn't budging in either direction. I wanted to point out a couple of interesting short plays. Neither of them are slam-dunks, because they've been quite strong over the past couple of years, but they are worth considering.

The first is Allegheny Technologies (ATI), shown below. I've mentioned this one more than once, but it's an intriguing chart. It's clearly below its ascending trendline, and the ascent over the past few months has been so massive (with diminishing volume) I'd say this was a pretty good short, with a stop price at $80.

A similar short suggestion, with similar rationale, is Carpenter Tech (CRS) with a stop at $140.

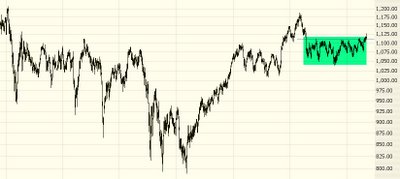

The "very bullish" chart of the American Major Market Index ($XMI) should be taken in context, by the way. If you look at the chart of the past several years, including the highlighted inverted head & shoulders, you can see that it's nothing to write home about. Even if it manages to hit its full inverted head & shoulders target, it's not going to get to any new lifetime high.

Lastly, take a look at the (recently very boring) GOOG. Its nearest Fibonacci retracement level is $394.58 by my calculations. Just look at this intraday chart over the past week or so - it is just amazing to me how the price is clinging - closer and closer, in fact - to the Fib level. Spooky!

1 comment:

haha, I guess, all my bear-buddies out there, we must have all gone fishin' at the same time, because no one seems to be trading in our favor! I did find ONE bullish stock, waiting for a breakout within a couple days. PPCO - its a triangle formation, getting close to its point. Had amazing volume today by the way.

Hey Tim, question for ya, did you sell all your puts, or are you still holding on to them, or did you convert them into bull put spreads?

Post a Comment