Buy Buy!

Two days into 2007, and each of them an up day on the Dow. The bulls are still having their fun. Granted, both days combined don't even equal 20 points. But the bulls are still lovestruck.

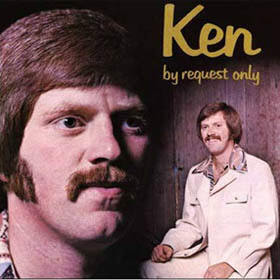

OK, that probably woke you up. I hate to be punitive, but no one commented on my gallery of Worst Album Covers yesterday, so I wanted to supplement them.......from the pious.....

...to the romantic....

...to the deepest male emotions.....

....to Ken.....by request. I imagine this is simple a blank vinyl disc.

ABT looks attractive as a buy. This market is really overpriced, I think, but this is still a handsome chart.

HAL, on the other hand, is more symbolic of what's happening. Broken trendlines, weakening stocks, all masked by a strong megacap market

I'm starting to lose faith in GOOG (and RIMM) as shorts. Today was a very strong day on both counts. I've marked by stop-loss price on GOOG here.

DST is sort of fascinating in how it shows trendlines "changing coats" from support to resistance. This kind of thing happens all the time.

BLUD, which I've mentioned many times before as a long, continues to be fantastic. Just look at this strength.

BAC, Bank of America, seems a possible attractive short as it seems to be changing direction here.

QID, the double-inverse NASDAQ ETF, is fascinating in the sense that volume is exploding and the price is finally turning around. Hopefully this is the shape of things to come.

OXY is a good representative of the weakening oil stocks.

Whereas the broad OIH continues to falter. I've been bearish on oil for a few weeks now.

HYDL, mentioned here as a short before, is also enjoying a downdraft.

Although I haven't mentioned HP (the symbol, not the company) in a while, this is a gorgeous example of Fibonacci retracements in action. Magical!

Finally, RTI looks like it may have put in a double top.

See you Friday afternoon......it'll probably be a late posting. It might not even happen until the weekend. But I'll get it done!

24 comments:

I thought I had left a post...it was that I thought that there was a migrant family living in the McKeither's woman's behive. However, I must not have entered the secret word correctly.

Glad to see you mention QID, think that may have been the 1st time. Im in QID with many shares, today however didnt help. I will look to add another position around 49.50-50 area. It was coming back nicely towards the end of 2006 especially with NDX dropping below 1750 this past week. That dip made me glad. I really thought it would continue to around NDX 1725, but the bulls took it over as usual. The NDX would not give up today, a straight run up right into the close. Quite amazing after bottoming under 1745 yesterday afternoon. If things look good with the job numbers the NDX can break new highs at 1825+. Who knows what that brings. I think I heard a few talking heads mentioning Nasdaq 3000 by the end of 2007 which worried me a bit since one of my largest holding is QID. Im looking to unload the position around NDX 1600 which is quite far from these levels. That would put QID around 63.5-64 level.

That would mean a 10% correction...

Trader 2006.

QID doing more daily volume than QLD does in a week.

I think by the end of 2007 QID will be doing 20 million shares a day easyyyy

This has become a buy weakness sell strength market and I believe it is important to be positioned early on both sides to avoid whipsaws. As oppossed to the last 5 months of just straight up. I hate that . This is more interesting!

The crazy volatility is getting out of hand way up here.

I hope for your sake that these cover did not honestly come out of your personal music collection...good God!

Why are we such trend fighters??? I don't get it. Why not ride with the general trend - which is bullish. Why be a permabear in a bull market?

1st of all, you DID NOT get my permission to post my album cover on your blog, you will hear from my lawyers

2nd I've been in QID for about 6 weeks this is the 1st time that I have played a hedged with longs on broken down flyers HANS CWTR TRLG also bought about 6 weeks ago

I coulda shoulda cashed some of the bounces on the broken ones for some quick gains

I sure like the hedge feeling and see why the big boys do it

I wonder if the volume on the Qid could be an arbitrage play with the QQQQ the spread between them

Like your commentary

Cody Matherson

The answer to "why be a bear" is quite simple, my bull friends. The sum of stock valuations measured by the leading indices and in conjunction with the general current and future micro and maco econimic fatcors are complete and utter bollocks. Total bollocks, my bull friends. As with all fantises, they do come to an end and that is why we bears cannot fell dumb enough to join in your bull fantisy rally. Its running out of steam - a 20 point rise in the first 2 trading days of a new year is one of the worst starts ever in recent years. Why is this happening? Because even the hedge funds recognise that the valuations are bollocks. Everyone is looking for an excuse to get out, but they will only do so if they can see that others are actually doing the same. So at the moment its a game of wait and see, which is why this market is on hold. Even if the rally continues, it will eventually be subject to a correction of substance. It is only the timing of this that remains open to debate and not the fact. We will have our day and I will get back the $12000 I lost last year by gambling prematurely on a market fall

downnosedive,

You are so stupid that you should not trade anymore. How many bears got killed from 1990-1999? Those freakin bears didn't even have a chance to short the market in 2000 because they were out of the game! roflmao

Shorties are just totally illogical since 2003.

Permabears like Herb Greenberg doesn't even own stocks! He talks a good talk about markets always being overvalued. But had he put money down, he would have been broker than a fallen vase.

Herb Greenberg is a total arse, a donkey's bollocks!!

Anonymous (naturally).....

No one-on-one name calling here, please. General put-downs (e.g. "bulls are insipid morons") are fine, but please don't call anyone out - bull or bear - with a put-down.

- Tim

whoa! I'm shocked that Kirk Van Houten (Milhouse's dad) would steal from Cody Matherson. Shame on you Kirk.

Check out that Russell 2k falling below its 50dma. Ain't that pretty.

R41

(Tony Montana to the liberal perma-bulls)

GGGGrrrrooowwwwllll

Yogi

WTF is wrong with QID, NASDAQ down 20+ points and it is up only 75 cents.

Tim

RIMM is mocking all your analysis, fundamental and technical. Sorry to put the pressure on you, but what is your analysis of RIMM right now? Thanks...

rimm goog nyx...lotta players are chasing what works, but most everything else is goin' to hell in a handbasket. And its about freakin' time. Russell, small cap index look particularly hideous here, lending credence to the observation that December was all about the hedgies nailing down their 20%. Let the bad times roll! Jeff

Tim, I bought puts on RIMM, AAPL, & GOOG at the end of the day. At what point would you stop out on these 3. You said 491 for GOOG. What about RIMM and AAPL?

You all suck badly.

Rimm shows how unhealthy this stock market is.

2000 all over again.

For all your "stock pick fishers" coming to Tim's site to have everything handed to you - go somewhere else please!!! Tim does an awesome job giving great charts to point you towards some really good candidates if you are really a trader then the obvious is right there in front of you - Trend, volatility, and price. What more do you need to trade? If you are unable to locate the support and resistance areas then you might not want to be trading!!! There are plenty of "stock fishing holes" out there so move on!!!

Sorry for the venting but it just upsets me to keep reading the Anom's spouting off about wanting the exacts so they can try to trade. Great week with some really great trades!!! I am looking forward to next week!!!

Mike

I don't like being a conspiracy theorist, but I have a feeling something happened this week with the high tech favorites like RIMM AAPL CSCO AKAM GOOG etc. Someone with plenty mullah decided to run the shortie stops maybe using QQQQ calls or NDX futures. I have no idea how this works, but Cramer talked about it on CNBC this afternoon, said he used to do it on Thursdays and Fridays back when he was a hedge fund manager. Just needs a "little money" to start, and then the shorts panic and scramble to cover which then feeds on itself until they are wiped out, at least the weak ones. After reading so many articles about RIMM valuation I just do not know what to think. Anyway, that's how the market works I guess. If people leave stop orders then what should we expect? Business is business. http://lauristonletter.blogspot.com/

Disclosure: I was stopped out of RIMM 2 days ago with 2% loss at 131. Manual stop in case anyone is interested. Is this how GS makes money? maybe... Tim, any thoughts?

Herb freakin stupid Greenberg, the stupidly insipid moron right now arguing against GOOG. If he only puts money where his mouth is, he would be broker than broken glass. GOOG is going to steamroll all the shorts from here to eternity. GOOG is going to see $2,000 .

Post a Comment