Yep

Thus ends another week. Now c'mon, folks, throw me a bone here - - I mentioned CRR just a few days ago as a bullish play ("For a bullish play, CRR looks like it is beginning to turn northward after a long slide.") and it climbed 40% in just a few days. That isn't bad, and it shows this isn't just an all-bears blog.

The Gold and Silver index is looking like a potential short.

Although the Transports broke above their descending trendline, the shooting star candlestick today is a little encouraging. The markets are sky high and simply seem able to propel higher each week.

The $OEX (S&P 100) is matching a recent high. This means either a double top or, with more strength next week, more kudos for the bulls.

I like the Morgan Stanley Tech Index ($MSH) as a place to buy puts. It's pretty risky, and the puts aren't that thickly traded, but the potential for a big reward is there.

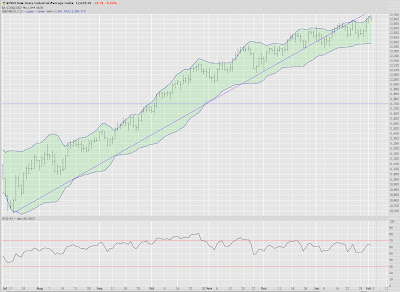

The Dow 30 lost a little ground today, and it remains clearly beneath its broken trendline.

Check out NVR versus the Fibonacci retracement. I'd say it's ready to turn tail.

China has been going absolutely hyperbolic in equities. GCH is a short play on this. But what's more fascinating to me is how well it has played against its own Fibonacci lines. I've highlighted the "bounce points."

Cabot Oil and Gas (COG) looks like another relatively low-risk place to buy puts.

I sold my Cummins (CMI) puts at a profit a while back. The stock has recovered since then, and it's so close to a double top at this point that I'm ready to leap in again.

Good weekend to one and all.........

7 comments:

Haha, Tim! I like the posts, and the new bullish plays that your highlighting...

If I give you kudos for CRR, will you give me kudos for saying something like, "Buy Google" - on Oct 19, 2006, the day before the stock exploded because of earnings?

I know, despite the upticking, we are still sideways (on naz), and the momentum to keep the highs on the dow and s&p are non convincing.

This reminds me of Jan 06. HOpefully we won't start seeing the market fall in March. I don't have the patience.

Tim

Excellent call on CRR (and NTRI among many others in the recent past). Fantastic!!!

"re puts: are you buying short term puts (like up to 3 months) and r u buying ITM or OTM."

I'm buying relatively short term (like 3 months out) and in the money. Which, of course, dampens my gains - - so even though aggressive NTRI puts produced multi-thousand percent returns, I only doubled my money on the trade.

Miami,

I don't think Tim has to subscribe to prophet.net since he founded the company.

I know little about technical analysis, I will visit more.

Tim,

I’ve been a denizen here for several months and tried to learn as much as possible from your insights and style. One area of trading that fascinates me is position sizing. Would you mind sharing your thoughts on the subject?

Thank you!

JSII

Check out the lovely ascending triangle breakout on HOLX, weekly chart... I'm waiting on a return to the topline, which may not happen.

Post a Comment