Well Put

Good day on the market today, bears. This time, after a look at a couple of indexes, I'm going to show just stocks on which I think puts might be a lucrative position. They have a number of properties in common - - the stocks are high priced (meaning the options can get really juicy). They have options with decent volume. And they seem to be running out of steam.

The stock market finally - FINALLY! - made its mind up on direction today, and it was down. As you can clearly see from the horizontal line of support, the moment it pushed through, it was party time.

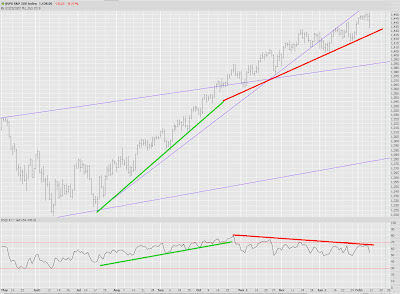

Looking at the past several months, you can very clearly see that early in this bull phase the price action and RSI were lined up (green lines) and yet, for a couple of months or more, RSI and price action have been absolutely divergent (red lines).

Going back to an even wider time range, you can see how lofty the S&P 500 is right now. Which is why my puts went up so fast today.

But let's not get too excited yet (lest I get another cowardly voicemail from an Australian hermaphrodite). There have been many times that the market has taken a quick, exciting drop. I've marked each of them here with red lines. And each time, it shakes it off and simply moves on to new lifetime highs. So I'm willing to concede this may be fake-out number twenty thousand and six.

The rest of today's entry is just stock charts, pure and simple - - again, with the focus being on puts. I've mentioned many of these before, and own puts on most or all of them. Goldman Sachs (GS):

Cabot (COG):

Capital One (COF):

Bear Stearns (BSC):

AutoZone (AZO):

Merrill Lynch (MER):

MicroStrategy (MSTR):

Research in Motion (RIMM):

Textron (TXT):

Exxon Mobil (XOM):

Have a good weekend. To most of you, at least.

7 comments:

Tim, I am new to options program but have mastered the short and long trading for several years. The puts charts you published look great. My question is, would you recommend the Febuary puts or March?

Neither! Don't you realize there are FOUR DAYS left for Febs before they expire? That would be insane. March is a little too short as well. April would be the minimum.

Instructive that "lofty" SP500 chart, really makes me excited about shorting more next week. Had lots of fun today daytrading RIMM from the short side today after writing about it on my blog yesterday (stiff resistance around 138). Today all the charts you have featured look "beautiful" to a bear's eyes (moi), without exception! Great job Tim and have a nice 'un too, and I swear I've never even been to Australia, but I'd love to visit one day if my puts keep working...

WOW...ANDE down 13% since your Wednesday post. Excellent call!

Would anyone else here like to thank Jeff for his helpful comments?

I will Tim, I have found your site to be very helpful. I also bought puts on this call from April to June. June on most. Thank You Brother.

TK,

Style question: I tend to buy deeply in the money options with very little time value in them. This tendency lowers my risk, but of course lowers my upside.

How about you? Obviously you don't do the same thing every time, but what is your tendency?

BTW, Jeff is a 12 year old. Best to give him a time out and ignore him. He thrives on negative attention... like jock itch... not that he's ever had that, since he has no balls, and doesn't post his own stock picks.

Post a Comment