Pfft.

I'm not sure if you've heard, but the Dow came within 30 points of its lifetime high set on January 14, 2000. That's right, you heard it here first. Or perhaps this is the 5,000th time you've heard it, since everyone in media is jumping up and down about this non-event. The bulls didn't pull it off today, but good try, buddy....

Looking back over the past decade, you can see what a wide range we're dealing with here, spanning nearly 5,000 points from 7,200 to 11,500. What would you rather be doing right now - buying or selling?

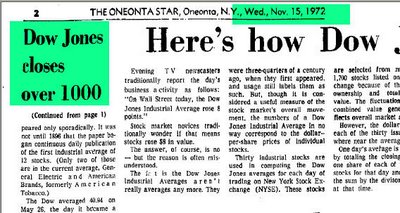

This obsession with Big Numbers isn't new. From 1966 to 1982, Dow 1,000 was all anyone could talk about. Take a look at this article from Time magazine 40 years ago.....click the image so you can read it, particularly the highlighted parts.

Things don't really change at all, do they? Here we are, 40 years later, and in the face of an unpopular war, tax concerns, economy concerns, and all the rest, the Dow is blasting to ungodly highs. Check out what happened after this article, though, marked by the arrow.

Six years later, as Dow 1,000 was approached yet again, we can see the obsession had not died down. This kept happening until 1982, when Dow 1,000 was cut through once and for all and became a dead obsession. Now we've moved on to Dow 11,750 as the new obsession!

Take a look at something really interesting, though. Here are the QQQQs with retracements drawn. Notice how they peaked exactly at the retracement point.

But here's an even more interesting point. Zoom in to a smaller retracement, and notice what happened today. It touched the 78.6% retracement to the penny. The fact that the $NDX actually went down today in the face of all this excitement is telling.

I tried to look for any stock worth buying - - anything at all - - and came across this one. This is how deeply I had to dig, coming up with something deep from the bottom of the barrel. All the same, it's an intriguing pattern.

Well, two days of window dressing left in this "month of the bears." September, you have really blown it. You're fired.

56 comments:

Terrific comments today, Tim. Thanks for the history lesson.

~ Nona

Tim,

Great site. I love a bear with a sense of humor and you got it bigtime. Hang in there.

Your Bearish Uncle Jack

I'm just waiting for someone to say I should (a) be more professional or (b) watch my comments since they are trying to protect their women-folk. Blinkered philistine pig-ignorance.

Tim,

Couldn't agree any more strongly with your thoughts on the QQQQ's. In addition to the fib retracement if you construct a trend line from the high's on 4/6 and 4/21 the QQQQ's were repelled from this trend line. I don't get the feeling you are the candlestick type, but a harami formed on today's action. Added to my QQQXR postion today at $3.30. We'll see.

Viking

No kidding. Lighten UP. You sound like an utter bore.

Tim

Hats off to you sir...excellent charts

keep it up

bond007

Here's what I think the crux of the matter is.

What Tim thinks is funny:

+ Bill Hicks

+ David Cross

+ George Carlin

+ Family Guy

.....etc

What the easily offended find funny:

+ Family Circus

+ Garfield

+ Cathy (comic strips, all above)

+ Jeff Foxworthy

+ Tim Allen and the like

Safe, sanitary, and stale humor, guaranteed not to offend middle America. Forget it. I'd rather laugh than be safe.

Good work Tim, I enjoy your analysis, comments and sense of humour. Keep it up, and don't get discouraged - either by this irrational market or some of these posters who will find fault with anything. You can't please em all, so just do what you are good at, and don't let them get to you.

"Grumpy as a bear"

At least that was a saying I grew up with. Lately it seems to apply to a few here.... maybe I'd be on the Puritan side.

I can't shake the feeling that October, or maybe even September (we do still have 2 days) will do the bears good. Seem foolish guessing though what the catalyst will be.

I'm glad you guys all find the picture so funny. I used to be like all of you that get an "innocent" chuckle when those pictures are posted. I guess after becoming a father of a child with Down's syndrome, it just doesn't seem so funny to me anymore.

Jim

Jim, the picture has been replaced, with apologies from the author.

PB, if you have a link to the aforementioned chart, we'd love to see it.

I am picturing Tim on CNBC screaming "sell it now or wait for another 6 years" in place of Bob P. rothflmao!

Fantastic Job! Tim!

J

Tim:

Here is a chart of US stock price deflate by commodities. Don't know if it is the same one PB mentioned.

http://bigpicture.typepad.com/comments/2006/06/martin_prings_t.html

enjoy!

Thanks for the reference to the chart. Just looked outside to see the Big Dipper in the Northern Sky, beautiful.

All Hail Ursa Major!

Tim,

I missed the original picture that you posted today. Any chance you can post the link to it atleast.

What the fuck is wrong with these morons? If they don't like the content, they should get the hell out of this blog.

Ron

It was just an image of a Special Olympics participant. I got shamed into removing it. No biggie.

Lets face it, regardless how many blasts from the pasts we are looking trying to stay in denial and say don't worry this is 1966 or 1974, being a bear has been costly lately. The fact still remains that the market is doing higher highs and higher lows, the 4year highs were broken, the volume has been heavier on the rallies instead on the declines. That is bullish action and untill we make a lower high and a lower low on volume to the downside, there is no hope for the bears only nostalgia of the 70's.

Everyone here is congratulating Tim for the excellent charts and great work. I want to congratulte him for the hard work of keeping this blog up with numerous posts and insights but some constructive critisism does not hurt once in a while. So I am critical to

the fact that Tim did not listen to the market and try to stick with preconceived notions on what the market should do or should not do. I have to admit I have been suffering from the same disease. So let all of us do a better job going forward listening to the market and stop sounding like a broken clock that is right twice a day.

Costas1966

Just my silly opinion:

If bearish in sentiment (always), you look around every corner for that next drop. Don't think any thinks it will go to the floor, but most runs down pay handsomely. From my short experience, seems as though you get most for your money in the first 3 days drop. Always better to be a little early, with a good tight stop.

TIM

CAN YOU POST US THE CHART SHOWING THE TRADING PATTERN IN THE TIME PERIOD SURROUNDING THE ERA WHEN THE DOW DID ACTUAL BREAK THE 1000 BARRIER? PERHAPS THERE MAY BE SOMETHING IN THAT CHART THAT COULD HELP US NOW. CERTAINLY IF THE CHART HAD THE SAME KIND OF ECONOMIC AND POLITICAL CONTEXT AS YOUR CURRENT POSTING ACCOMPANYING IT, THAT COULD ALSO FURTHER HELP. WHAT DO YOU THINK? THE ONLY CHARTS WE CAN FIND ON THE INTERNET IN ANY DETAIL SEEM TO RELATE TO THE LAST 6 YEARS ONLY

Tim,

Thank you for your understanding and removing the picture. I wasn't trying to be a prick about it, the humor hit just a little too close to home for me.

Jim

Retard, retard, retard. There I said it. Its a joke Jim get over it before we start thinking your "special" too.

Tim, don't let anyone censor you!

-Timmy from south park

I am not a Puritan.

Not in the least. But getting a cheap laugh off someone else's misfortune isn't something I can really bring myself to enjoy. I apologize if my honest and even-tempered disapproval of that image ruined the party, that wasn't my intention. But for anyone who jumped to label me as a Puritan or whatever...pretty lame. If you met me, the word Puritan would never cross your mind.

I wont be back on this comment thread, not to avoid an argument, but to not contribute to a flame war about something which is clearly off topic.

Tim, I applaud you for removing the image, although i didnt want you to. I just wanted to say my piece, and I expected the responses I got from some of your readers.

I find your blog interesting and a good contrarian viewpoint which I read almost daily for your insight and bearish perspective. Hope you dont hold it against me.

I agree with Ron and "Timmy from south park". F you Jim, it's not our fault you have a retard for a kid.

That's what I like about this blog-everyone keeping it real. Fuck being PC, this is about making $$$$, not hurting peoples feelings.

Now let's get that goddamn drop in the market we've been waiting for!

(By the way, Tim- I can't wait to see what picture you post tonight ;)

Steve S.

re:SLV

I'm flat but it looks like it's struggling with the 20/50 DEMA. I think there's a good chance it retraces to 105-100. Also we saw a gap up and reversal. Close below 115 will be it.

re:TLT

Yesterday's engulfing pattern sez "a" top is in...finally. My trailing buy to cover stop is at 90.20 which is 1.5X the ATR. My entry sucked.

re: PEIX. sell stop at 13.75. Again, my entry was bad.

re:USGL

Confession time. One account I have doesn't allow stops in OTC so I stayed long, the other did so I got stopped out.

note: % of SP500 stocks trading above 50 DMA is 81%. Risk is increasing. JMO.

bsi87

Tim - Thanks for clearing up the Left Scale/Right Scale charting w/prophet tools.

NOTICE! My Small Cap Swing Indicator is on a whipsaw edge, and only 6 stochastic points away from whipping back to a SHORT signal. If the Rusell 2000 and S&P 600 are down much more than 11:00am ET, it will flip back to SHORT. I had little faith in the LONG switch yesterday, and it is looking as I suspected - that's why I stayed 100% short w/Russell 2000 products.

bsi87, what does that mean that risk is increasing if 81% is above their 50dma? That should be a good thing for the bulls? Are you saying for the bears the risk is increasing, because more stocks are trending higher???

smallswinger - I agree buddy. The long signal was probably because we are starting to see a top - there is so much uncertainty around reversal points, (easily seen through clustering of day's actions).

Im holding on to my puts too... I hope the pain can stop soon...

EddieFl said...

Hide the playboys mags, lock up the whiskey, put cigars away, Ladies, one-piece bathing suits please. No bikinis.

---------------------------------

Damn f'n right, EddieFl! Screw those bitches that complain- they can find a PC blog if they want. It's just a pic of a retard, anyway- big f'n deal!

Forgot to sign- that last post was me :)

Steve S.

The one thing that concerns me about the potential for a continued upside in the short term is that the retail investors haven't been in this run-up yet. The good news is they are usually the last to the party so after they are fully invested the market will get dragged down- but there's potentially some fuel on the upside if retail investors get excited hearing about new highs in the Dow.

-Keith

Shaker,

What do U think the SPX indicator means?

bsi87

i feel like a retard holding puts

Tim - Closer inspection of your QQQQ chart showing a "retracement to 78.6%" seems to be in error.

The Fib pattern you have drawn is normally used to measure a decline from two points so you can evaluate potential retracements. All you have shown is that the advance from 2004 to the high in 2006 has seen a couple of corrections and is now back to 78.6% of that original advance. That is not the same as "retracement", in my mind.

To measure a "retracement" of the current advance since July requires a Fib chart of the previous decline, i.e., from Jan 2006 high to July 2006 low. If you do this the retracement for the QQQQ is around 66.7%, between the .618 and .764 Fib bands.

Check it out a little closer. I think I'm right on this.

On other words, you are measuring a recent advance against an earlier larger advance rather than measuring a recend advance against a previous decline.

A true retracement is to measure an advance against a previous decline or to measure a decline against a previous advance.

At least, that is how I've always seen it done and how I do it.

Tim,

My relatives were Puritans from New Hampshire, therefore, I would like to complain. It seems everyone in this country is a victim in someway. Not sure why people complain so much. Most people have a good life in this country.

Al K.

"Not sure why people complain so much. Most people have a good life in this country"

Al K.

--------------------------------

I agree, Al. It could be a lot worse- we could be living overseas with the towel-heads!

Steve S.

Steve S.

"i feel like a retard holding puts "

Look again,patience.....

THe reversal whenit happens will be the nastiest thing you have ever seen. I doubt this is it today. The bulls are going to take the market to new highs, looks good for election.

Be patient and pick your spots, the market is slowly falling apart...you need to look at individual stocks, breadth, volume to see this...plus earnings are in two weeks....it is going to get nasty.

markets looking good for the bears but lets see if they keep it down till the closing.

Trader 2006.

Ah, yes, but there is nothing wrong with the Puritan picture. He appears to be a healthy and sober individual, predisposed to careful thought. The basis of our country's founding!

Glad to see the Dow is down. So far, at least. I'll take what I can get!

Tim, I especially love the last two sentences of your post:

"September, you've really blown it. You're fired."

Every time I read it, I laugh. Ditto your caption headline:

"Pfft".

About that first photo (since replaced). FWIW, my late sister had Down's Syndrome. Even so, I didn't consider the original picture to be offensive but I can understand that it my be painful to others, especially to a parent.

As for some of the language on this site, well, I guess I'm a bit of a Puritan. But I'm also a grown-up who once worked in advertising. I didn't like a lot of the language I used to hear in the office either, but I hardly quit my job over it.

Likewise, I would never leave your site because of the language used around here. Gosh, I would miss so much. And I'd miss it too much.

"The bulls are going to take the market to new highs, looks good for election."

Conspiracy? I don't put much into that theory. Remember, markets have historically done better under Democrat Administrations.

-Keith

Is anyone else here trading options on the VIX? I just bought my first VIX calls yesterday and think there's some good opportunity here...for a purely speculative play.

With the VIX basing for a long time between 11 and 12 I think the downside is very limited. And from early May to mid June the VIX doubled in a hurry.

I think we'll see much higher volatility in October. Just a thought for a new opportunity.

i knew it....djia up as I write this..

trader 2006

TIM

CAN YOU POST US THE CHART SHOWING THE TRADING PATTERN IN THE TIME PERIOD SURROUNDING THE ERA WHEN THE DOW DID ACTUAL BREAK THE 1000 BARRIER? PERHAPS THERE MAY BE SOMETHING IN THAT CHART THAT COULD HELP US NOW. CERTAINLY IF THE CHART HAD THE SAME KIND OF ECONOMIC AND POLITICAL CONTEXT AS YOUR CURRENT POSTING ACCOMPANYING IT, THAT COULD ALSO FURTHER HELP. WHAT DO YOU THINK? THE ONLY CHARTS WE CAN FIND ON THE INTERNET IN ANY DETAIL SEEM TO RELATE TO THE LAST 6 YEARS ONLY

sanjay i knew you would.....turn it off and lets fall 1%%%

Trader 2006.

lets get these markets to all time highs so we can get on with this drop already. This to time consuming.

Trader 2006.

Last dance before crash

imo

ill buy more qid at 59-60, should be back at 65 in 2 weeks

trader 2006

Careful guys, remember last day is the last day of the quarter be careful of more markups..... and don't think that those pesky bulls will give up so easily near the high....they will try to push it again tomorrow.....

I'm buying tomorrow.

By the way: VOLUME SUCKS on some stocks.

bsi87, there has been a lot of info on USGL on Bill Cara's blog the past few days. My $rut puts are painful, at this point, i'll hang on for some more pain before the this baby tanks next week.I'm a sick dude cause the pain is starting to feel good!

I love the pain too man.

I also love the doji on the nasdaq (at time of writing).

Do you ever get that feeling like you can JUST FEEL something bad about to happen? Theres way too much optimism - news everywhere talking about all time highs, Uncertainty at the tops - its classic may happening all over again.

I LOVE THIS pain because I know that soon, it will be all worthwhile.

Gentlemen, 12 minutes to close and 11723 and a new closing high in sight. Please raise your glasses as we now start to gentley steer the bulls out of the room and over the bannisters where they will crash and reel inagony below.......!!

"Do you ever get that feeling like you can JUST FEEL something bad about to happen"

Well, the uneasiness and testiness has definitely been ratcheted up a level. You can *feel* it. I'm getting antsy.

HMmmm this is odd..... we are right near the highs.... you know they are going to take it to the high tomorrow if not today....cause they need to headlines to offload.... I am going heavy duty shopping tomorrow.....

This is nonsense.

AKAM looks stretched here above $50. I have shorted it at 50.02 with tight stops. Will hold it over the weekend.

Thoughts?

buying tomorrow? What fukkin' markets are open saturday??

You anonymous posters are a bunch of crack smoking fags!

Everyone expected a closing high, that's why we never got it. just like evryone expecting a decline in Sept.

- Trader Fred

Post a Comment