Gold, Oil, and the Fifth Anniversary

I read in the comments section how my (cringing) post of bullish picks was the sign of capitulation and a turning point. He's right. If I - the bear of bears - the Cassandra of Cassandras - start hunting for something to buy, you know that the market's about to fall. And so it has. All this great contrary advice for free!

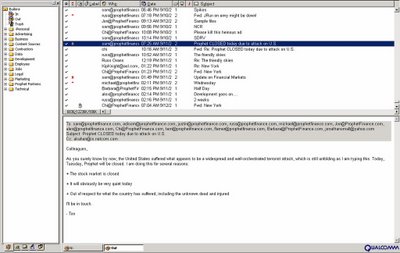

For those of you who just flew in from a deep-space colony, today marks the solemn 5th anniversary of the attack on America. I preserved my email that day, shown below. Note the interesting subject lines that precede and follow it. My favorite is "Development goes on" from our dearly departed Alex.

So - - oil - - OIH - - has finally broken its neckline! YES! Huzzah! Cheers and felicitations! Traditional H&S measurement methods would indicate a fall down to $90. I'm not so sure. The traditional measurement rarely works, in my experience. Suffice it to say those of us positioned bearishly on oil are having a fantastic morning. I know I am.

Gold is likewise getting clobbered (and, likewise, I've been pointing to it as a great short). Unlike OIH, the H&S is in formation, not complete. But it's a honey. And if it does complete, the gold bugs are going to be chased away for another twenty years.

It wasn't that long ago that we were flooded with advertisements and marketing messages about gold. $2,000/ounce gold. Buy, buy, buy! I guess I'm not the only one that creates contrary indicators.

22 comments:

From Bernie Schaeffer:

"[..]the latest Commitment of Traders report, which shows significant bearishness in the "small trader" category. As of Friday, the net position of S&P 500 futures contracts among these "small traders" reached its lowest level of the past five years. The net short position dropped on Friday to 7,651 contracts after reaching a more extreme net short reading of 13,276 contracts the previous week. This represents one of only two period in which the small traders had a negative outlook on the market was (the other being late April 2003). For those who aren't glued to a market monitor as a hobby or for a living, April 2003 was a great time to enter the market, as the S&P 500 Index (SPX – 1,298.92) and other major indices had just finished building a bottom that was followed by a rally of more than 20 percent before the end of 2003."

is the market volatility back?

On 9/06/06 my Small Cap Swing Indicator moved to a

SHORT signal when the market gapped down. Mid-day

on 9/11/06 it is is near the normal limits, though

the max for SHORT is -107. A switch to LONG could

happen any time, now.

Here are the recent values of the latest swing signals.

. . . . . .Small

. . . . . . Cap . . . . . . . . Russell

. . . . . .Swing . . . . . . . . .2000

Date . . . Ind . .Signal . . % Chg

08/28 . . +05 . .LONG . . +1.1%

08/29 . . +23 . .LONG . . +1.2%

08/30 . . +39 . .LONG . . +0.8%

08/31 . . +48 . .LONG . . +0.0%

09/01 . . +52 . .LONG . . +0.1%

09/05 . . +62 . .LONG . . +0.8%

09/06 . . -19 . .SHORT. ..-2.1%

09/07 . . -43 . .SHORT. ..-0.8%

09/08 . . -61 . .SHORT. ..+0.3%

09/11 . . -70 . .SHORT. ..-1.1% . Intraday @ 12:30pm ET

Normal LONG target: . . +65 to +75 (max: +95)

Normal SHORT target: . -65 to -75 (max: -107)

Looks like large daily volatility is back! I personally see more short side decline, though support points are starting to develop.

Sorry - the intra-day Russell 2000 at 12:30 was -0.06% (...typo)

has anyone ever seen any stock getting as many upgrades as AAPL had in the past few days all at mid day crucial TA juncture break or make point? It is just incredible.

- J

Too many AAPL lover at wall street.

Again, I say all predictions of a fall in the indices (namely the ' ole DJA) are wrong Im Afraid. We approach expiry and what happens? The DJA is actually up 16, can you believe it !! Instead it should be falling as the successful long positions close out, but it goes up. This market the most subborn son of a bitch since 2001. No falls are coming this way

The strength of this market is surprising. Just when we think it is about to fall big time, up it goes again. Who the heck is buying up everything?

Think this market may be back in the red by the end of the day.

Mike

strength in the last attempt to squeeze whatever weak shorts left.

take notes july tank was without banks, now that the banking indexes are rolling over......

I am having the worst day I have had since 2001.

Gold/silver crashing. 3 down gap days in a row, after a fakeout breakout last Wed.

The homebuilders are having a massive short squeeze...JOE up 5 points in a few minutes. Their home building business is SO GREAT they decided to just quit building any homes. Now it's just their valuable (NOT) swamp land.

The economy is supposedly slowing...possible recession ahead. So, the retailers are just zooming up today. Home Depot, Target, you name it.

...and I was having an incredibly good year...

..sigh...

DOWNOSEDIVE : Appreciate your insight on the "current-right now" market that is on the minds of the one's ,like me, that want to bet on the direction of the DJIA and the S&P.Oviously charts are fun but they are wrong just as much as they are right.For those of us that like to trade options on the indexes representing the DJIA,this is a good moment RIGHT NOW,DOW at 11,400. S&P At 1300, and OEX at 600. I'm going to buy some in the money OCT OEX puts and will hedge with some SEPT OEX 605 calls.(Just 4 pts out of the money and only about a buck a piece,very cheap)Good luck to all.

Denver

QID volume is 3X the volume on QLD.

Trader 2006.

11:28am,

I hear you. The homebuilders are going to drop even harder. There is a glut of homes on the market and housing markets is approaching a massive slowdown.

As for retailers. All i can do is laugh, I had RTH 3 weeks ago at $91.00 sold it way early and now its above $94, go figure. Seems like the consumer doesnt care what happens, they continue to spend.

Trader 2006.

Denver - a good honest action post. Too many people are saying 'if this', 'if that' then I might do something. Good luck to you and do let me know how you get on. This underlying strength to just too much to dismiss. No crash and set to rise even more strongly towards year end

downosedive the market is going lower.

Don't go long now. That was missed 700 Dow points ago.

sanjay I would so like things to go as you regularly suggest, but I think you are waiting for a false dawn, despite your regular intelligent and logical analysis. The markets have really broken the mould this time and I dont think they will recorrect. Are you trading any indices at present? Im only interested in the DJA. Always appreciate your comments on this site

To anon at 11:28, I'm with you on gold/silver.

Fortunately, I reached my pain threshold last week and dumped my gold/silver holdings for a small loss. That false breakout caught me going long and I exited after they (gold and silver) broke down past their breakout prices.

That's what you have to do in this market. Don't trust ANYTHING. If you're playing the breakout, make sure you put your stops in. Don't just assume that it'll complete the breakout because it *should* technically.

Always remember there are very powerful forces out there working together to take your money. Never forget that.

-Tony

Back to Downosedive :

Thanks for responding back.I more than less agree with your opinion in to the end of the year projections of DJIA.I am taking a calculated gamble here for the next 2 weeks "hoping" the market will hit 11,300 at least one more time before we take off for an end of the year rally.My threshold of pain on my OCT 610 Puts is 11,500,whether it happens this week,next week,or hopefully not at all.As we all know,no matter how much chart comparison and TA we do,every time we pull the trigger on a new trade,IT'S A GAMBLE.If these charts and TA worked like we want them to,we'd all be billionaries ,and not be reading anyone's blog.If we by chance DON'T have a year end rally and can somehow have a selloff at least back to 11,000 at least one more time into Oct.,that would be fantastic.Lots of easy money to be made on that.The Oct 610 puts would at least double and maybe triple if that would happen. They are 14 on the ask right now. At 11,000 you should have a bid of at least 35.Five years ago 300 pts. would happen in the 1st "2" hours of a given morning. Now it takes 2 or 3 weeks for that to happen,and it's really a struggle to get day to day follow through.Pardon me for remembering the good old days.Thanks for the outlet to vent Tim!Good luck to all !

Denver

downosedive and anon, you seem to be dismissing the fact that most of the big funds have to reset by oct 31st, yes there will some buying as well, butin the past, sept. and oct. have been the worst months of the year, for the markets, it doesnt matter to me which way it goes, i try to trade accordingly, but this market is very, very odd right now, friday will be the day!!

Denver, well I think its quite plausable your projections will come good. Im on the fence now, having suffered heavy losses in this current quarter. Blown my confidence at present!

plunger - yes of course your observations are valid and I would heve definately agreed .....until these last crazy 3 weeks. I just think this might be the year when Sept/Oct do not turn out to be bad months, so taking short positions would be crippling. We all expect the markets to at least correct what we view as being grossly overbought valuations. But perhaps weve been wrong all along and these valuations are sustainable and able to withstand the remaining bad economic data for the next few months. We all need to bear in mind prices today typically reflect a view at least 6 months ahead minimum. So as has been said a number of times before, todays bad news in principle may well have been factored in at the beginning of this year when the DJA was stuck just below 11000 - its a past senario?

watching the PM miners these last 4 days has reminded me of something it's easy to forget:

THE MARKET CAN CHANGE DIRECTION *VIOLENTLY* AND WITHOUT WARNING AT ANY TIME

and when the buyers disappear into the woodwork and there are NO BIDS..prices can fall VERY FAR, VERY FAST

be careful everyone

Post a Comment