Living with Uncertainty

For those of you hoping to grab on to an anchor of confidence and certitude with today's blog entry, please look elsewhere. All the "shoulds" do not apply anymore. One person in the comment section has mentioned more than once, "The markets can stay irrational longer than you can stay solvent." Hear, hear.

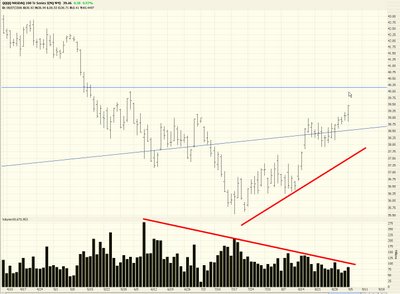

So many stocks have appeared to be in predictable bearish patterns, only to defy it and crack through any bearish predictions. Witness MBT.......

And MicroStrategy......

Lehman is another good example. Notice the area I've circled. That's the bears saying "I'm going to take you down" and, in response, the bulls say "oh, no you're not....." The bulls are extremely powerful for the past six weeks.

OIH looked like a slam-dunk head & shoulder pattern. Now it's looking like a tease.

The Russell 2000 is broad enough to give us a bit of perspective. We've come a long way up since the mid-July lows. We're in a middleground at this point. Are we going to push higher or resume the fall we started early in the summer?

A close-up of the RUT shows how the "lower highs" (good for bears) has given way to "higher lows" (bad.....). Mid-July was the turning point.

The NDX got up to its 50% retracement level today. If this strength continues, the green shaded area looks like cleaning sailing.

The $OEX is very, very close to its former high from the summer. I keep wanting to ask this index, "aren't you tired yet???"

One small sign of encouragement is that, in spite of the summer being over as far as the financial markets go, the volume isn't anything to write home about. The steady softening of volume continues.

One potential put I will sheepishly offer is that of ESRX. Looks like a nice clean top pattern to me with a stop close enough to make potential losses minimal.

This "month of the bears" (September) has had two up days so far. Not so good, folks.

64 comments:

Nenner said today would be the high, so don't lose hope. Volume is still low, still way overbought, let's see how tomorrow goes....

Topping is a process, not an event! Now I know what THAT means! Loose money slowly if you're a bear and perhaps a bull! Why are our markets acting like third world bourses? 5 points??? Gimme a flippin' break! All I can play for now is a significant drop in the first Q. These moronic bulls might just ignore everything until the signs are clearly on the wall (or the unempoloyment line)

A big THANK-YOU to Tim for letting me vent!

- slightly poorer Trader Fred

This blog has been interesting to follow over the last few weeks, to say the least. I love the "stick the head in the sand" mentality that runs rampant when the market proves us wrong. For a really good read, and lots of other useful tools, checkout TAToday.com . That guy puts his ego and his money on the line everyday for all to see, I think its the only website/blog of its kind that I know of. Great insight into the psyche of a full-time trader and lots of other stuff, all free. http://www.tatoday.com/

-MT

where does the dow have to fall in order for it to totally fall apart and head lower???

Also notice no volume, does this mean this rally means nothing since there is no volume to back it up?

Quite a disheartening post today with quite a bit of alarming sounds; however the alarming sounds should have sounded 6 weeks or even 4 weeks ago. It is kind of late now. Too late to flip and go long now in any aggressive way.

Lets face it this market is neither bull or bear. It is a trading range and the top of the range is 1% away. Going bullish now even with a marginal new high considering the lack of volume could be suicidal. All the shorts thats have covered recently and lost money, they risk anihilation if they go long now. If you still want to try the bullish side then shorten your holding period and tighten your stops, that is what comes down to.

Costas 1966

Hi Tim,

I enjoy reading your blog and continue to learn from your postings. Your charts are outstanding.

Don't take this wrong, but do you think you might have a bias that is just a little too strong on the short side?

All of the reasons for being short are 100% valid. Sure seems like the market doesn't care what we think it "should" be doing.

I would like to hear what your thoughts are on 3 to 5 day forecasts or scenarios.

Keep up the great work.

Dave

MM

Dan Fitzpatrick had a good article in RM recently. Specifically, he states that there are no "easy" trades or ways to make money in the market. So many of us have been plowing the same ground on the long-in-tooth bull cycle, presidential cycle, sun spot cycle on Pluto's getting degraded. All portend ominous and obvious things for the market. Accordingly, they should have been the "easy" trade AND for that they shouldn't have been easy money--for there is no such thing. Tim, I know that you know that. I'm not sermonizing here. But Dan's article reminded me that whatever seems like a foregone conclusion will not be. Sure one cannot fight the tape; but that doesn't mean one suspends judgment. I think everyone's trader/investor bones and bunions are sending the right signals. But there is always the chance that for everything that that we know is right and true for the market to go down there is a tilting countervening dynamic (liquidity, greater business cap ex)that mitigates if not controverts. Hopefully there will be more jubiliation than commiseration here soon! Gird yourselves.

Come on!!! On July 1 the 10 year had a yield of 5.25%...it is now 4.73% as of 8/31.

In order to keep the same relative value, the S&P would have to trade at 1430 not 1310.

This is not magic...just look at relative valuations. If the bond market backs up, the S&P will be hurt...if the bonds continue to rally, get on board.

Good Luck

John

Futures are surprisingly lower this morning by a fairly large amount.

Interesting.

tim, we like to short... who cares if the whole market is going down... in a bull market, some stock somewhere will go down, and in a bear market, some stocks will go up...

so just keep the topping charts coming - that's all we need...

thanks!

Futures down big...

YM down -52

ES down -6

The Trader II

todays "opening" looks good for the bears, lets see what happens by mid-afternoon, if they rally this market back from a low opening into positive territory I will be very suprised. I think today should be a complete down day across the board.

NICE!!!!!!!

Contract Last Change

CME E-mini S&P 500® 1308.50 -600

CME E-mini NASDAQ-100® 1594.25 -1050

If today reverses the losses I will have to shoot a damn bull just to feel good!! kiddin'!! No I'm not!

yea if this nasdaq that was down over 20 comes back to being down say 5 or 6 points I will reallllly be ticked off. nasdaq down 18 dow down 36.

sanjay a dip would be the dow at 11200-11250 and the nasdaq around 2125-2140.

Today isnt much of a dip considering the markets have been in rally mode for 6 weeks.

hope it stays like this until about mid afternoon, then we get the huge sell-off

Neener is scary.

We should get a 2-3% selloff for the S&P over the next 2 weeks. Target is 1291 in ES. Hope you guys got short the last few days.

The Trader II

my portfolio is soooooo NICE AND GREEEEEEEN.....feels good

we get a 2-3% selloff im covering my shorts and staying cash until I find a direction.

Trader 2006,

Why are you not signing your posts since couple of days?

Oil is at a good buy entry below 68 with stop at 65. I think we head up to 75 now.

The Trader II

as far as I can tell we are in rally mode.

* indexes are above 50 and 200 day SMA

* VIX shows complacency

* intermediate slow stochastics is bullish

Today, 9/06, my Small Cap Swing Indicator switched back to the SHORT signal when the market gapped down.

Here are the recent values of the latest swing signals.

. . . . . .Small

. . . . . . Cap . . . . . . . . .Russell

. . . . . .Swing . . . . . . . . . 2000

Date . . . Ind . .Signal . .% Chg

08/28 . . +05 . .LONG . . +1.1%

08/29 . . +23 . .LONG . . +1.2%

08/30 . . +39 . .LONG . . +0.8%

08/31 . . +48 . .LONG . . +0.0%

09/01 . . +52 . .LONG . . +0.1%

09/05 . . +62 . .LONG . . +0.8%

09/06 . . -15 . .SHORT. ..-1.7% . . Intraday @ 12:45 noon EDT

Normal target for LONG: . . +65 to +75

Normal target for SHORT. . -65 to -75

The bulls can't get it up!!! HAHAHAH ---- impotent MF's!!

Trader II

Anonymous said...

Trader 2006,

Why are you not signing your posts since couple of days?

9:25 AM

My posts today were 6:21am and 9:04am

forgot to sign it, too excited about todays drop..

Trader 2006

Havent posted since last week, my computer at home has problems posting on this blog.

I disagree, Dow will end today in the green by the end of day.

Naz is too far down, it probably won't make it into the green today. But maybe tomorrow.

Sellers have stopped as of 11:30 AM, just like clockwork.

Unless sellers start up again after 1:45 PM, then the indices going into the green should be easy.

10:29am

Green on the dow is possible but I think we see selling into the rest of the day.

Trader 2006.

How can this not worry the bulls!!!! Piece from an article.

The housing bubble is a $10 trillion equity balloon that will explode sometime in 2007 when more than $1 trillion in no-interest, no down payment, adjustable-rate mortgages (ARMs) reset, setting the stage for massive home devaluation, foreclosures and unemployment.

Trader 2006

Closed my PCU long. 9% in a few days is too hard to pass up.

re:OIH. shoulda put the short on but maybe I'll get another shot to short tomorrow.

went long WNR at 23.30. IBD pick. Stop at 22.65. Bounced off the 50 DEMA.

PEIX. Swing traders' wet dream. Looks like it's headed back to 14/15 bucks. No position.

re:SLV. Be nimble, Tony. She's trading below the open and rejecting that 132 area. Retracement to 120?

bsi87

" disagree, Dow will end today in the green by the end of day.

Naz is too far down, it probably won't make it into the green today. But maybe tomorrow.

Sellers have stopped as of 11:30 AM, just like clockwork.

Unless sellers start up again after 1:45 PM, then the indices going into the green should be easy"

ONE WORD - COMPLACENT

Markets looking close at intradat lows...

today it actually feels good to own QID and SDS. Looking to close out those positions around DOW 11150.

Trader 2006

yeah, but remember! Bull markets climb a wall of worry AND a pile of shit! No matter what the news you HAVE to buy! Don't you get it? There is nothing to fear! JUST BUY!

" The bulls can't get it up!!! HAHAHAH ---- impotent MF's!!

Trader II

10:09 AM "

Looks like another moron with plenty of time in their hands.

Long Oil here. Oil contracts tagged the 50 weekly dma. It have held up like a rock the last 3 years. Should see a bounce to 72.

Lot's of luck.

The Trader II

agree oil headed back up

Trader 2006

Trader 2006, the bulls are thinking about 2 words right now. Soft landing. They dismiss the notion that housing will cause a reccession. The new argument they came up with is that housing construction is only 6% of the economy therefore too small to throw the economy into a recession.

What they are conveniently missing however is that is not the housing construction that is important but the housing wealth appreciation and the wealth effect as it's result. Housing wealth aprreciated from 10 to 20 trillion dolars becoming bigger than the capitalization of the US stock market at its peak in 2000, which was 18 trillion dolars. If the popping of the bubble of the US stock market resulted in a recession in 2000 I am sure the popping of the housing bubble will result into one as well, considering that housing is owned by a bigger percentage of the US population.

COSTAS 1966

Today is a good day.

Lets hope to see a follow through into tomorrow.

Trader 2006.

ES getting murdered. Down 15 points from yesterday's high at 1316.75.

Looking for another 10 points.

The Trader II

This could actually be an interesting day.If the S&P can close below 1300 and the OEX can close below 600, and then NOT rally in the morning, there could be some "RELATIVELY" easy money to be made on the'just OUT OF THE MONEY'puts on both of those indexes.This market(AT 1PM EST ) has the look that us PUT players really look for.Good luck to all.

P.S. Just heard a guy on CNBC say that oil has topped out for years to come and that gasoline at the pump should go to $1.35 a gallon.Hello Bull market if that starts to become reality.

Denver

Hey Denver! --- guess it is true, free crack with gas purchase! Why do you think oil topped out or will decline? Could it be demand is faltering? Use your noggen, bull!

Trader II

Costas your right on the money with that. However whoever believes this sentence should think twice.

The new argument they came up with is that housing construction is only 6% of the economy therefore too small to throw the economy into a recession.

Most of the articles I have been reading state that 30-40% of the jobs created in the last 5 years are due to the housing boom. With a housing bubble bursting already, this is severely going to hurt the economy no matter which way you look at it. The markets continue to "hear" "soft landing". Thats what they they think they hear. This is not the case. This economy is in trouble.

$10,000,000,000,000 equity balloon ready to pop. Soft Landing, hahah

Trader 2006

hahah gas at $1.35, that is funny.

That is not happening ANYTIME SOON. Mark this post if you want. Demand is still high in India and Japan.

Trader 2006.

And if oil comes down there will be other problems to worry about like a recession and a $10,000,000,000,000 equity balloon ready to pop.

Trader 2006.

To think the possiblity of 2 bubble poppings at the sametime, hehehehe.... let the fun begin.....

Sanjay I hope the decline in oil to the low 60's doesnt give this market a catalyst. If the market was able to trend higher when oil was at 60-70 in late 2005 and early 2006 then seeing the markets drop while oil sells off is quite possible as well.

Trader 2006.

Last hour today -First hour tmrw, may give the put players a chance to get some or all of their money back.I don't see oil retracing more than a couple of dollars.Being short right now,I'd like to see $80 oil,but the way this mkt is acting these days,$50 a barrell oil would probably be the catalyst to get us back to 10,000,since so much of S&P's value is in the price of the oil stocks. Who knows?

12:18 you really think so, that with oil declining that it could hurt the s&ps value due to oil stocks falling, what % of oil is related to the s&p.

Trader 2006.

Hope we close at day lows.....

AMZN falling, doesnt deserve to be above 30 or even 25 in that matter.

Trader 2006.

Some of you guys get way too happy on a day like this, then again some of you deserve it. I made out like a bandit shorting the ES the last few days. We'll see what tommorrow bring.

Lot's of luck!

The Trader II

To: Trader II

From :12:18

These oil or oil related stocks are all heavily weighted in the S&P 500 - MRO, MUR, BHI , OXY, HAL, XRX, DYN, SLB, DVN, COP, APL.

To what EXACT degree I don't know,but you still have things like JDSU in there that really don't have much to do with the movement of the market.And those I mentioned are only some of the oil stocks I could remember,there are quite a few more.

Too bad we all can't meet in a bar after about 4 shots of Petrone.

Some of you guys get way too happy on a day like this, then again some of you deserve it. I made out like a bandit shorting the ES the last few days. We'll see what tommorrow bring.

Lot's of luck!

The Trader II

Like your not happy.

Trader 2006.

Amazing how one day in the red can erase an entire week of gains in the major indices.

Nice to see that what SHOULD have happened actually happened, unlike the craziness of the past 3 weeks.

Anyone actually entering shorts here? The way this market is acting, it's likely to rebound tomorrow and re-gain all of the losses from today.

bsi87: Thanks for the technical on SLV. I've been watching it. Yes, the 132 level has been a bit of a resistance, but it's still early yet. I doubt that 120 is in the cards, but a trip back to 124/125 isn't out of the question. There should be pretty heavy support there.

Besides, this is my long-term money, so I'm holding for at least a few years on it. And I only took out a 25% position on the breakout day. I'm adding at 125 if we get there. Same with GLD. I'll add at $61 if it gets there again. I'm pretty sure that in another 6 months to a year, both GLD and SLV will be significantly higher than they are right now. That's all I'm looking for with those two investments.

As far as trading goes, I'm still stepping aside for now. As I said, the way the market has been acting, it's still yet possible that tomorrow ends up in the green for the indices.

We'll see.

-Tony

V

I

C

T

O

R

Y

J

I

G

Victory jig? One down day and you dance a victory jig?

I'm pretty happy right now, but, one down day does not a bear market make.

on my god has HELL froze over the DOW is down.

the only gas ever to see a $1.35 a gallon comes out of your ass denver,

no matter how bad ,the economy gets we'll never swee that price again.

i agree with the earlier post tho, you guys are way to excited for one down day, i thought this was a tech. analysis blog?

Tomorrow is another day, AMD is down afterhours which should take the semis down somewhat. Ill look to take a small position in SMH if it gets to $32.50 for a quick trade.

As for the overall markets, today was needed. Tomorrow is another day. If we fall again tomorrow I will sell some of my QID to free up some cash in case QID drops to 60-62.

Trader 2006.

great day (finally). Couple of short picks - THE and TRID. Dead cat bounce in TRID (in weekly) over. Bearish engulfing in THE off 200DMA and fib resistance.

- kk

QID and SDS positions are now in the black. Im gonna set tight trailing stops and hope this baby tanks tomarrow! trader II, the " freecrack with your gas purchase" comment made me swallow my "crack" pipe.Keep up the good work. I know why the market went down today, Im sure "Downosedive" went long! Keep the set ups coming boys. Chronictown

the bears have spoken...we're headin downward boys and girls, join in...

To all the bloggers who don't know why the bears are so happy about a one day drop ... ALL of August we've been waiting for a drop, what does the market do? Creeps up like an STD from Britney Spears! Much needed relief for the thirsty bears!

- MAY THIS CONTINUE TOMORROW!

Tomorrow could be an up day, I would not be suprised by a small rally. Again, AMD will most likely drag the semis down.

Trader 2006

AAPL is kissing the up trend line from underneath. It stopped there August 3rd. Will it blast through that line this time around? We are probably looking at 50mil share day today when all said and done.

Dang! near 2bil market cap through an USB analist reach note. I wonder how much the analist fart would worth.......

Post a Comment