Give It Up!

“To the last, I grapple with thee; From Hell's heart, I stab at thee; For hate's sake, I spit my last breath at thee” - Melville

Well, bulls, you had all week to try to make your new high, but it didn't happen. In spite of having the entire world on your side, as well as CNBC, you couldn't pull it off. I saw some articles torture the data so they could try to make news out of the week. For instance, I read that the high price on Wednesday exceeded the closing price from January 14, 2000. And they tried to spin that as a "new lifetime high." Who cares? Give it up!

Before going into stocks, let's take a peek at our beloved OIH. I wasn't too happy with today's action. My 131.07 contingent order didn't get taken out, but I'd prefer seeing the price fall away from the retracement. We're still in play, however, and so long as we don't violate our stop, we remain positioned in puts galore.

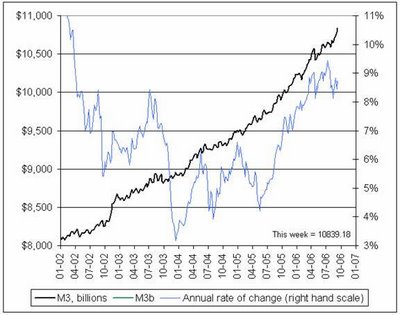

The Federal Government started hiding the M3 figure earlier this year, but some intrepid souls have been able to compute it in any case. The graph below illustrates how the Feds have poured cash into the economy to keep things floating. They're eventually going to run out of this fuel, you realize. This house of cards can't stay propped up forever.

I've got puts on QQQQ and $NDX. Today was a nice bearish engulfing pattern. In mid-July we had a different (bullish) candlestick, the hammer, which proved quite prescient.

The Dow, which is what everyone has been watching, fell 40 points today. It came within 9 points of its all time high at one point. Hey, bulls! Psych! All the same, there's no doubt the past few years have been good to them in general. Notice the huge push up in 2003 and the less pronounced push up since then.

I am trusting Mr. T to keep the markets down on the Russell 2000. The most recent horizontal line drawn is my line in the sand. We want to see prices fail below this line to affirm the death of the bull market.

Meanwhile, the $XMI, which had the most bullish of all the index patterns, seems to be pooping out.

Now for some specific stocks on which I own puts and obviously feel good about from a bearish perspective. Cummins (CMI):

Capital One Financial (COF):

Monsanto (MON):

Panera Bread (PNRA), which a blog reader said was too dangerous to short. Well, so far, so good.

And old favorite Sears (SHLD). I mean, come on, people. It's Sears. Have you walked around a Sears lately? Not unless you're shopping for a lawnmower or mattress. What a hole!

See you next week. Victory, come visit us in October!

33 comments:

Man... I bought some OIH on Monday. Should I sell it?

Tommy, how 'bout selling some calls against it?

- Trader Fred

Tim,

Curious about where you found the M3 data.

It's interesting that it dropped off right before the big drop in May and recently has gone near parabolic like the markets.

Will "Dow 36000" author on CNBC mark the F&$King peak of these sheets?

I have a feeling that next week might be a good one for da' bears. The semiconductors look like they are starting to fall apart. Plus a number of other good put candidates are starting to show up in my screens but no signals of any call candidates.

For all of you talking about Republicans vs. Democrats - remember that the budget wasn't balanced and the economy didn't take off until we had the Rebublican Congress in the 1990s.

For the long term economy and a bullish market I'd rather have a Republican Congress and a Democrat President anyday.

Remember, Congress controls the budget (though they haven't had any self control since Bush was elected). Or, the President proposes and the Congress disposes.

But enough about that, as I've said before, I WANT the market to fall, but the reality is that it's rising. I've been on the sidelines because I couldn't commit to being shorter than I already am.

I'm sorry, but the post above is factually inaccurate...unless he thinks Clinton was a Republican. Since the 1920, Democratic administrations have presided over greater stock market advances than Republican...that is a fact.

What we need is gridlock...prevents either party from screwing up the economy with spending or taxes.

Tim, is that quote from Melville, or from THE WRATH OF KHAN?

John-

I think you mis-read the post that the anonymous poster had. He said he'd rather have the "gridlock" government (Rep. Congress & Democrat Pres) like you advocate. So really he wasn't wrong.

-Dave D.

Ja,

Herman Melville has no shame: he lifted that quote for his novel Moby Dick.

"Tim, is that quote from Melville, or from THE WRATH OF KHAN?"

Both. Khan was quoting Melville.

And, please, folks - - as rough as this place gets, let's please not waste everyone's time with politics. The only divisiveness welcome here is bulls vs. bears.

Hi Tim,

SHLD.. Dont you think it has the 'Eddie Lampert' factor? No matter how the sales sink.. The company's cash pile is going up. Dont you think its good for the long term?

Thanks

Prab

Tim,

great charts. just wanted to add in my thoughts. i think dow is going to hit 12,000. think about it - we have had a rally of more than 1500 pts. many here call it manipulation, ppt etc. on the same notion, why isnt it possible for the same set of people to take dow to 12000 before duming their position. after all, its just additional 300 points from here. i think thats the magical number. the dump would start after that to 10k. near term a 1-2% pull back looks possible.

im putting all my money left into an ultrashort qqqq etf. looking to make a few 100k in the next 3-4 months.

>>>Tim,

Curious about where you found the M3 data.<<<

Yeah, would have been nice to have the source for the chart.

http://www.peternavarro.com/dailyblog.html

Hey,

What do you guys think of Sony???? Looks like a wedge forming.

I'm hoping for a rally today. Because my homework has been slack lately.

Sony is not the best setup. you need to wait for the retest of the support at 39.3. The long setups i like are klac (smae risk profile as klac) vimc (riskier but moves much faster even better setup than klac)

costas1966

for all you bulls out there here's one of the most sane honest looks at the market i've seen in a long time. talks about the similarities between the sept./oct. rally of 1973 and today and the ensuing 40% drop that followed then. gives a common sense look at the market and the economy right now also. very , very bearish but sensible:

http://articles.moneycentral.msn.com/Investing/ContrarianChronicles/BewareOfTheBubbleonians.aspx

and another rally go figureeeeeeee.....lets close at record levels so we can put this aside...im asking for a 44 point rally...

Trader 2006.

ok 44 point

now what

a quote from an james puplava re:state of affairs in 2000

"Those who are predicting a soft landing for the U.S. economy, which implies continued economic growth, are counting on the consumer. To generate economic growth, it takes increasingly larger doses of credit and debt creation and a continuous flow of foreign capital to finance it. Any let down in either the stock market or the economy will not be permitted by policymakers because our economy is so highly leveraged. In the minds of policymakers on Wall Street and Washington, the boom must be expanded. This means the Fed will continue inflating money and credit. If the economy begins to soften, conventional wisdom believes that the Fed will merely lower interest rates to restart the economic engine. Therefore consumers and investors reason that they need not worry because Washington and Wall Street have eliminated the business cycle and bear markets.

However, the Fed is in a Catch 22 situation. The rules of the game have changed. The U.S. economy and financial system is dependent on uninterrupted, huge capital and credit inflows from overseas. As of last year, foreign institutions and individuals hold more than $2.7 trillion in U.S. financial assets. There is a strong linkage between the dollar and trillions in assets being held by foreigners. Capital markets remain competitive within today’s global financial system. Markets compete for money. Lower interest rates, a plunging stock market or a declining economy could lead to wide-scale capital withdrawals from the U.S. financial system. The international jet stream is the road on which this money travels. As easily as it has entered, it could just as easily evaporate. This would limit the freedom of the Fed to skipper the economy away from a threatening recession through created money."

July 18, 2000

© Copyright 2000 James J. Puplava

he has same feeling now about economy only worse.

anonymous ... great article, but who cares, we're setting all time closing high today! Come join the party!~

- Trader Fred

My Small Cap Swing indicator whipped back to SHORT on Sep 28th. The new SHORT signal reached -25 as of Friday’s closing prices. It is at -39 intraday on 10/2 at 1:30pm ET.

Here are the recent values of my Small Cap Swing Indicator for the last four or five switches.

. . . . . .Small

. . . . . . Cap . . . . . . . . .Russell

. . . . . .Swing . . . . . . . . .2000 . . . Cumulative

Date . . . Ind . .Signal . . % Chg . . . . % Chg

08/28 . . +05 . .LONG . . +1.1% . . . . +1.1%

08/29 . . +23 . .LONG . . +1.2% . . . . +2.3%

08/30 . . +39 . .LONG . . +0.8% . . . . +3.1%

08/31 . . +48 . .LONG . . +0.0% . . . . +3.1%

09/01 . . +52 . .LONG . . +0.1% . . . . +3.2%

09/05 . . +62 . .LONG . . +0.8% . . . . +4.0%

09/06 . . -19 . .SHORT. ..-2.1%. . . . . -2.1%

09/07 . . -43 . .SHORT. ..-0.8%. . . . . -2.9%

09/08 . . -61 . .SHORT. ..+0.3% . . . . -2.6%

09/11 . . -72 . .SHORT. ..-0.1%. . . . . -2.7%

09/12 . . +18 . .LONG . . +2.4% . . . . +2.4%

09/13 . . +41 . .LONG . . +0.8% . . . . +3.2%

09/14 . . +54 . .LONG . ..-0.4%. . . . . +2.8%

09/15 . . +65 . .LONG . . +0.2% . . . . +3.2%

09/18 . . +70 . .LONG . . +0.0% . . . . +3.2% (short triggered)

09/19 . . -06 . .SHORT. ..-0.5% . . . . -0.5% (& confirmed)

09/20 . . -05 . .SHORT. ..+1.2% . . . .+0.7%

09/21 . . -13 . .SHORT. . .-1.0% . . . ..-0.3%

09/22 . . -37 . .SHORT. . .-1.2% . . . ..-1.5%

09/25 . . -43 . .SHORT. . .+1.2% . . . ..-0.3%

09/26 . . -39 . .SHORT. . .+0.4% . . . ..+0.1% (long triggered)

09/27 . . +17 . .LONG . . . +0.4% . . . . +0.4% (& confirmed)

09/28 . . -19 . .SHORT. . .-0.0% . . . . -0.0% (whipsaw short)

09/29 . . -25 . .SHORT. . .-1.0% . . . . -1.0%

10/02 . . -39 . .SHORT. . .-0.0% . Intraday @ 1:00pm ET

Normal LONG target: . . +65 to +75 (max: +95)

Normal SHORT target: . -65 to -75 (max: -107)

I remain 100% invested in SHORT positions as of Friday’s close, 9/15/2006.

Here is the real source of the re-constructed M3. They regularly keep it updated. Props to them!

http://www.nowandfutures.com/key_stats.html

sticking with my 1600 on NDX by October 20th.

Trader 2006.

now this is what i like to see.

Trader 2006.

Errr, what just happened???Bad news???

daytraded QID in at 61.25 out at 62.25...

still own a postion for the big drop...

Trader 2006.

The bulls are behaving like a bunch a nancy namby pamby drama queens........."ohhhhh just look at the DJA, you can flirt, but cant touch sweetie". So pathetic, give us all a brake and just set a new all time high, then we get down to the serious business of egging on a proper plunge

trader fred how much $$ you playing with ?? a .016% gain? thats about 16.00 on grand, @ 160.00 on ten grand? seems like a small gain for risk? how do you trade small increments and make it work?

re:USGL

it was rallying but on lower volume. about a 13% gain so I closed the position. Up against its 20 DEMA too. Looks like it might test 3.50. jmo. Whole precious metal complex looks vulnerable to me.

re:WFR

IBD pick. Open at 36.05.

Do your own homework.

bsi87

Great Blog buddy.

Post a Comment