Keee-Rist. It's about flippin' time. The Dow fell 73 points today, after going up for the past 1,342 days in a row. Earlier in the day it looked like another "drop and pop" session where we'd have another new high. Not this time. Some people with triple-digit IQs are actually getting a tiny bit of press and a few people are paying attention. Of course, any fall in the market which doesn't last for months on end will simply be labeled profit-taking.

If the market does ever get around to being sensible and falling for a while, one juicy thing for us put-owners is that the intrinsic value and the volatility premium will go up. The $VIX is at nearly the lowest level in human history. Just look at how much higher it was in June (ahhhhh, now those were good times).

We're just going to look at some indexes today. You guys have seen enough stock charts.

The NASDAQ hasn't been as lusty as the big caps lately. Here's the NASDAQ Composite. It's not in any clear technical formation per se. But at least any short position would be stopped out promptly, since we're so near multi-year highs. In other words, the "I must be wrong for now" levels are not far away, so the risk is pretty low.

The Morgan Stanley Tech Index (which I affectionally call "mush" based on its $MSH symbol) has thinly-traded puts. Indeed, I am the open interest on the options strike that I own. Considering the massive amount of overhead resistance, this could be a fantastic triple top.

Here's a somewhat long view on the S&P 500. Those diagonal lines you see are Fib Fans. Back in mid-July, when I said we had bottomed out, I wish I had the foresight to look ahead to just how far we would have climbed. I'm afraid the bearish goggles I was wearing didn't let me do that. But I haven't changed any of these studies. They clearly permitted the index to push its way this high. But it makes sense that it's reversing at this point. There's a ton of reasons for it to turn now.

The Transports have not been confirming the Dow Industrial highs. This shows a clean progression of lower highs. Not good for the bulls out there.

The Gold & Silver index ($XAU) could go either way. I bought puts on this today, but I've got a really tight stop at about the $141 level. This isn't a head and shoulders anymore. But it could still blow through that lower resistance level to the next line down.

Check out the ungodly high RSI on the $XMI. Total nosebleed territory.

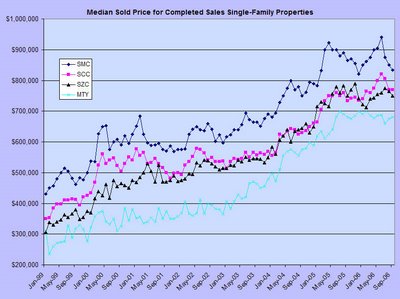

I really hope next week brings us more of today (and less of the prior four days). The economy is weakening. That's not speculation - that's a known fact. The housing bubble is shrinking. I think a comment I saw on this blog Wednesday represents the bullish mentality: "Forget about nuclear weapons and all the other turmoil for now and just enjoy the ride upward." That's crazy. My view is that the market is going to get crushed, and I want to make a fortune in the process of watching everybody else lose theirs.