Isn't It Epic?

What a day! The bulls and bears are in an epic battle. First the market went up. Then it lost its footing and fell. Then it was down nearly 60 points. Then it erased all those gains and pushed up nearly 50 points. Then it fell yet again for the Dow to have a loss for the day! It's just getting shoved all over the place!

The market definitely "feels" different. I think this Monday's tumble has freaked the bulls out a bit. Our bullish friends aren't quite as cocksure as they were before. It's a nauseating battle for control.

The candlestick graph of the S&P 500 shows a big honkin' spinning top for the day, which is the very essence of the uncertainty going on. Neither side is in control. Know this: if we take out the lows from Monday, the bears are going to have the upper paw.

The purported reason for any recent weakness has been the U.S. dollar, which has tumbled again lately (take a look at the highlighted area below). I've drawn a horizontal line indicating the support level which, if taken out, will really start to freak people out.

Just to drive the point home, the S&P 500 has played the "I'm falling! No, I'm moving to new highs!" game before. Take a look at the areas I've highlighted below which shows quick tumbles recently. We saw what happened last night. Let us pray to the ursine gods above to have mercy on us sinners.

Like I said above, the market feels different. I think the chart below shows why. The unrelenting, horrible uptrend we've been burdened with was snapped Monday. As the lines indicate, this could be the day where the uptrend ended and the downtrend began.

A closer look just shows how fierce the battle is being waged. These is a minute bar graph. Just look how wild these swings are!

A daily graph of the Russell 2000 ($RUT) makes me think it would take a supercharged rally to elevate the market into new high territory again. The psychological damage done by Monday was pretty bad on the bulls.

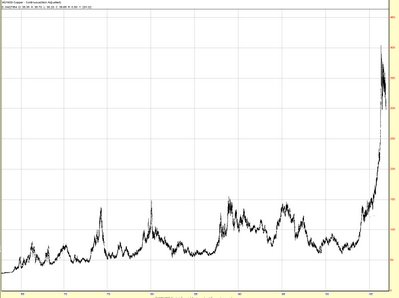

One short that's been getting bludgeoned has been gold. In my defense, I never said this was a slam-dunk pattern. It was on the fence. But recent strength has been staggering. This position is close to getting shuttered.

Just one stock today - one I've shown before - Lehman Brothers (LEH). This continues to be weak. Nothing sensational. No collapse. Just a nice, steady weakening.