All News is Bullish News

Now that the Democrats have captured the House (and quite possibly the Senate), they've already started rehearsals for the new government's parade in January. I managed to get a clip.......

I was watching the election returns until 4 this morning, and I kept watching the GLOBEX go lower, and lower, and lower. It was clear the market was going to open down hard. And in the back of my mind I kept thinking, "somehow or another, I bet this stupid market closes up for the day." And sure enough - a new high on the Dow! Disgusting, revolting, and sickening. I hate this market.

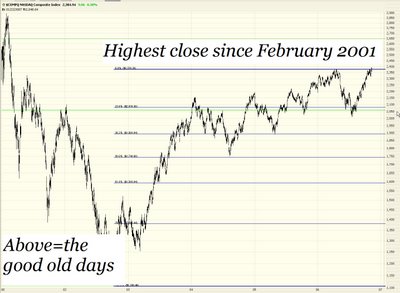

Bear markets aren't fiction. They really do happen sometimes. Let us wistfully enjoy the prices of yesteryear, such as the NASDAQ's plunge from 2000 to 2002.....

Boy, those were the days. But no more. You can see how the $VIX just keeps getting ground down to nothing. The last time the bears were partying was in June/July of this year. It's been unrelenting misery ever since.

The NASDAQ was especially strong today. It's about to push into wide open territory, with no recent overhead resistance. Cisco's strong earnings posted after the market's close today is only going to help the bulls.

The $NDX has a skosh more to go to get into the same "open air", but it's probably going to happen. At least I don't own $MSH or $NDX puts anymore (I dumped those yesterday morning).

The S&P 500's chart over the past ten years is a fascinating one. This chart still looks really toppy to me, pushing right up against the upper boundary of its ascending channel and smack dab in its retracement area. But, God almighty, if a massive sweep to the left in U.S. politics isn't going to ding the market, what is? It would honestly take a major terrorist attack, bigger even than 9/11, at this point.

The only slightly bright spot today was the $XAU (gold and silver index), on which I own puts. I've (badly) drawn the former head and shoulders pattern on this. One could be generous and call this a "complex" head and shoulders at this point. All the same, it's got a nice clean stop.

11 comments:

Everything is coming up roses now that the Democrats have regained the House (sarcasm indended)

Democrats Poised To Retake Congress, Fix Everything

Click on this hilarious Audio Link:

http://www.theonion.com/content/node/54409

Hi guys,

This market is absolutely crazy...money is chasing money...fundamentals don't matter at this stage. I've made trades here and there but.... I haven't bet against this since the summer. However I'm starting to look for shorts, but won't start purchasing until maybe early next week. It sounds like every bear has given up to me... there can't be any left out there....just wait until the money runs out... we aren't going to dow 15,000 before a recession.

The truth of the matter is Australia just raised interest rates, england may tomorrow....uh hmmm the fed can't be liking all of this excess liquidity especially now that the election manipulation (data, decisions, $$$) is over.....

"Before I get to one sector I'll be watching, I want to mention that the latest Commitment of Traders report was released late last week. It showed another increase in the "smart money" commercial net short position.

The positions are now truly at an extreme: The current $39 billion hedge against a market rally is now the second-largest in history, behind $40 billion on March 6, 2001, after which the S&P 500 lost 11% over the next month. As Jason Goepfert over at Sentiment Trader says, "This has been a yellow flag for a couple of weeks, but that flag is quickly turning bright red."

Everyone knows how extended this market is, but trying to call a top can be an expensive venture. However, pay attention to the professionals who are the closest to the action."

Cheers

oddly enough... http://www.bloomberg.com/apps/news?pid=20601087&sid=a46X5pPMmH1U&refer=home

Bank of England poised to raise rates..... Australia just did yesterday. Does anyone see the pattern??? I am betting that the fed raises rates one of the next two meetings now that the election is over. Let the market get nice and out of control before the next meeting...

We are no going to DOW 15000 anytime soon- this money chasing game will end shortly.

Think if the market in narrow moving range till christmas we could see DOW 12500 by year end.

Double bottom proved to be very powerful push past months.

DOW

Today's best double bottom: LVS

Now is the day to go short because it appears that the last bear "tim knight" has turned bullish. I will buy puts on the QQQQ tommorrow. Expiration Mar07 to make max profit. Mark my word now.

Isn't a Head and Shoulders Pattern only a confrimed pattern once the neckline is broken?

Wouldn't that make this formation on the XAU still just a potential and potentially meaningless Head and Shoulders?

I think it might be time to pull out my bear suit and come out of hibernation......

Lets see what happens this afternoon. Patiently waiting for buying power to fade.......

I'm starting to look ....

"Isn't a Head and Shoulders Pattern only a confrimed pattern once the neckline is broken?

Wouldn't that make this formation on the XAU still just a potential and potentially meaningless Head and Shoulders?"

I'm sorry I wasn't more clear. This is NOT a head and shoulders. That was violated when it moved above the neckline. I was being a bit facetious when I saw it could be a "complex" head and shoulders.

Particularly given its strength today...

Alert Alert- market is getting whacked... and I'm not participating yet.

EVERYTHING IS GETTING WHACKED....

the key thing today... remember those goons who kept saying "gridlock is good for the markets" THERE IS NO GRIDLOCK..... DEMS WON EVERYTHING.

Market doesn't like it!@

ya baby, great break down for the close, i was nervous about my call spreads.

miners are kicking tail. long Usgl,AUY,KRY, bought 20 golden eagles. Whats a girl ta do?

Post a Comment