Cut and Paste

I'm starting to think I should just cut and paste a generic blog entry each day: "The economy is on a precipice. The housing market is failing. Stocks are insanely overvalued. And a new high was reached today." It would save me plenty of time and effort.

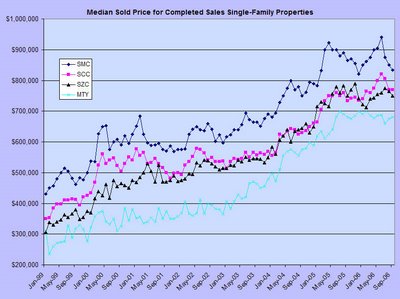

Today it was reported that houses suffered the biggest year-over-year fall in over three decades. My local market (the crazy SF Bay Area) is looking like this lately:

So how did the market react to the news that the principal asset of every American is collapsing in value? It spiked to a new high! Of course! Here's the S&P 500 with the RSI indicator. The index is at the top of a channel and the RSI is in nosebleed territory.

I have no position in Red Hat, but this is an amazing stock. Below is the entire history. You can see broad trends of higher highs/higher lows and lower highs/lower lows over the course of its history. I guess the news that Oracle is going to provide support to Red Hat users at a deep discount tossed a nuclear missile at this stock (which had amazingly high volume - something like over 80 million shares).

Now here's a chart I simply cannot figure out. It's symbol IYR, which is an ETF for real estate in the U.S. This chart just goes up and up and up. Even on a day like today. Clearly this has nothing to do with domestic housing (I suppose). I would think that the shrinking of the housing bubble would be causing damage here. Not in this market.......

Perversely, in this bearish blog, my "long" suggestions are doing great. Once again, the hotties are Redback Networks (RBAK):

Sears Holding (SHLD):

and Immucor (BLUD):

I am having absolutely no fun in this market at all. You can tell by my posts. I hate not understanding a market, and I absolutely do not understand this one. Not a great thing for me to say in my own blog, but that's the truth.

12 comments:

I posted in this in the previous comments post, but would still like to get your take on RHAT, ORCL, and CRM.

Are you still suggesting a long position in RHAT, or do you think ORCL will zap their market share?

I'm also looking into shorting salesforce.com (CRM). Whats your take on that one Tim, if you have time.

As always, thanks for the advice.

Chris

Trader - you have made an inprotant point and one that has been worrying me for quite a while. 650points up in about 5 years, isnt at a level that suggests a reversal. With companies and the general economy in better and more profitable shape than 5 years ago, why should this level be considered overvalued? Its only when compared to the summer recess down to 10700, that we all shout about an outrageously overblown market. But this is all worrying for bears, because by this thought pattern the DJA would have to reach over 15000 to be classed as overblown compared to its peak in 2001. However, heck, at the moment we just a consolidation down say 200 points would be welcome, before continuing upwards again, but no.....it just goes up & up & up without a break and thats why we become more convinced each time that it just must drop soon and thats why I called this a dumb ass rally in yesterdays post

Tim, As I'm sure you know, IYR (and ICF) are comprised solely of REITs. If you superimpose a 1yr. chart of DJR (reits) over HGX (homebuilding) you see quite a divergence. I think that the homebuilding boom was born of the artificially low interest rates beginning in '03. As interest rates have risen more people may be in danger of losing their homes due to ARMs, no down loans, home equity cash-outs etc. Since our fiat dollar is now worth about 4 cents, it makes sense to own real property, especially if you can buy on the cheap. If things continue to worsen for middle and lower class, the REITs will be there to rent you a house or apt. Like buzzards circling.

I know by now everyone is tired of hearing from me, but if you look at the 10 year, it has declined in yield by 7 basis points in the last week. I know this does not sound like much, but at the same time earnings have come in better than expected.

In the simple discount model I use, assuming S&P raises their estimates this week by 3%, the value of the S&P 500 would have to be 1,420 tomorrow, just to get back to the spread versus the ten year that existed last Friday.

However, a sure sign of a top is I lifted my hedges today...didn't work anyhow. S&P will probably close at 1200 tomorrow.

John B

I'm sorry, but learned a long time ago not to spend too much time worrying about things I can't control. My analysis is strictly from the viewpoint of a money manager who has to invest to meet a targeted payout in a specified period of time. He only has two choices, the S&P or the ten year. He cannot deviate.

Based solely on which produces the higher expected rate of retun of the horizon, he will select that investment, Right now, the S&P is producing an excess return over the 10 year more than two standard deviations from average over the last 25 years.

Again, this is only an observation. The greater problems you mentioned are beyond my capabilities to address and probably beyond most of this board members. To me they fall into the category of things I can't control but only react to and hope I don't loose.

Good Luck

John

Alert Alert: GDP # is in the morning, and the yield curve is the most inverted it has been. Time to come out of hibernation.

I bought some SPY puts near the end of the day..... Do you know how alot of people on this blog sound? Like they have given up.... This reminds me of the selloff this summer to be honest...the bears were flying high and the bulls were like I never think stocks are going up again.

I'm not saying the world is ending but I think it is time for a correction..nor am I calling a top. But I am curious to see how the market reacts on a pull back.

I'm looking to start getting aggressive trading starting tomorrow. I've been monitoring my positions on paper just to see how the market is acting, and believe it or not...not too bad. haha alright well maybe alittle excessive;)

Careful before elections guys!!!

the 55 day ema on the dow has reached around the level of the old high in MAY. i know some use the 55 day ema as a gravity/correction level. This sets up a good time for the much needed correction down to the 55 day EMA which would set up a nice support area for the rally to continue on. thats how im gona play this beast, THE TEMP BEAR MARKET IS GETTIN STARTED DOWN TO 11650

anyone know of any good TA forums? this comments section is the best ive found of any good discussion. Glad to of found dis blog, really enjoy it, and your day is coming Tim, keep yo head up

Great postings tonight!!!! Both sides spelling it out, Where is smallswinger and his indicators? I grabbed some index shorts for tomorrow, Lets have the correction and another run till mid november!!

Another remarkable up day. This market doesn't know the meaning of closing red. I'm afraid we have a long way to go before we see a move down. It's great to know that when you see red during the day on an index, you can buy it with faith that it will turn green by day's in. This is just the beginning guys. Many charts are beginning to breakout to the upside whether we like it or not. Get in while you can. Good luck tommorrow and remember to place your buy orders early.

As I was saying yesterday, euphoria was kicking in.....so guessing that the market would get hit was no magic trick. I just closed the Spy puts that I bought at yesterday's close.

I'm looking for buys monday morning. Then I suspect that the market may correct abit more.....but I'm staying open minded....and even though all my economic indicators say this is going to be a hard landing, i've learned that it is what the irrational greedy hogs of the market think about it!!!:)

Anyways.... hope all had a great day and eventually all markets do become rational. Elections are in 2 weeks.....:)

I just can't get over how you sit here with your puts, and cry when the market is screaming upwards like a woman in labor. Follow the freakin' trend and make some freakin' money. The trend is your friend, not your bullcrap views that you think the market is gonna tank while we're racing upwards right after a DJIA 30 point drop and people are immediately buying. I'm just saying wake up, and get a more broad view, being stuck in the cynical mindset of your own proposterous world is going to lose you more money than you want to post on your blog. I sure hope you're hedging! Don't take my post offensively, I only offer a different view, and insight you may not have seen. Thanks Tim, you're the best.

Post a Comment