Done and Done

OK, let's get this over with. Let the gushing begin. Fox News (with a custom-made graphic, no less):

CBS MarketWatch:

Forbes.com:

So, unless you missed it - - the Dow crossed 12,000. Finally. Whether this is a one-day wonder (which, as of this writing, it is) or a permanently new plateau of market strength remains to be seen. I was heartened to see that, in spite of the Dow's fireworks, my portfolios were holding steady. That's probably because the advance is so narrow, and most of the Dow's strength is coming from IBM. The fact that the NASDAQ is down on such a momentous occasion is interesting.

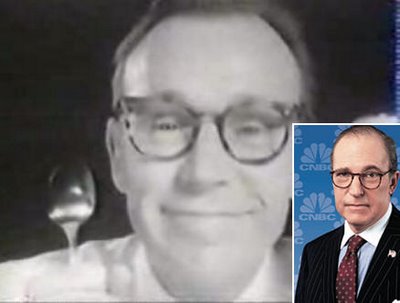

One reader wrote to me this morning and pointed out the gent (the one weighing less than 200 pounds) from yesterday's commericial bore a striking resemblance to Larry Kudlow. One of those separated-at-birth things. I am inclined to agree.

Of course, I have trouble explaining my fascination with the commercial. Perhaps it was the Ricki-Lake lookalikes that struck a chord. Besides being a little soft around the middle, I share with them the complete absence of any remaining dignity.

Turning our distended bodies to the markets, my gaze falls upon the NASDAQ 100. I dunno, to me this doesn't look like a market that's about to explode higher. Particularly since its larger brethren (the Dow) has been making such headlines of late.

Here are a few specific stocks I like (for shorting/put-buying, as you might guess). CBE:

CKFR:

COF:

Deere (DE):

FDX:

Monsanto (MON):

And Marathon Oil (MRO) which seems to be at an apex of sorts....

Sorry I didn't get to do a posting yesterday. I met a ton of people at the (regretably named) Money Show yesterday and wasn't in front of my computer until midnight.

10 comments:

Im just wondering........what if, what if the major supporters of this market have programmed in sell orders above the 12000 level. Looking at recent trading behaviour is clearly showing that whilst the intraday highs are still getting higher, the actual close levels cant hold 12000. The whole scenario is just starting to look as if support to push higher and hold MAY not be there after all. Speculative desire to push higher IS there as witnessed by the daily intraday new highs each session. I cant help wondering whether just maybe any further advance might be put on hold for a while. Im not suggesting a crash or even a downward consolidation of much consequence, just a tiredness in the upward trend. Those who didnt cash in on this mornings 90 point plus rise, must now be cursing

I'm just getting irritated....they gapped up the market 40 points.... it is way to risky up here for my liking to do anything- especially with your election a few weeks away.

Everytime the market goes down... the PPT buys it all up...like earlier today. I don't think the bulls will rest until a DOW 12000 close.

Lets see what happens in the next hour- 3-4. I think they will try to push it near the close.

All the retailers are on their way now....its rather pathetic.

Tim

Short Marathon Oil? Oh come on have a heart, I used to work for their UK operations! Oh bears can be sooooo cruel at times!

People - are we starting to get a consus here? Suggestion of around 7th Nov elections as being a turning point. Interesting thought. Maybe, just maybe...... This market is sentiment driven, it just might be that with the 12000 level hit and together with the elections, a sense of anti climax may occur and some correction with it??

Bsi87, are you still long USGL? Ive been looking at KRY ,any thoughts on gold or the miners?

Great post, AT.

Jeez, I don't miss the anonymous hoards one bit.

Hmmm.... there is alot of low volume stocks today, not quite sure what to make out of it. I don't think any big decline or correction will happen until after elections though. I'm actually waiting for a quick pullback next week though.

Interesting to note I am making lists of all the stocks that gapped down this week and it is getting HUGE-the interesting point is that the earnings aren't HORRIBLE...but stocks have run up so much, it is a sell the news.

Man this patience thing is killing me, I haven't made a trade in a while. I've done a heck of alot of research lately though....

Here are some charts to check out, triple bottom on ARG- measures to 42. H&S on HOT measures to 70 over 4 months, same with ENER and ZOLT....

Cheers

Andrew

Oil and metals are strong today!

What a snoozer today..... 2.5 weeks until this election stupidness is over....there is no volatility in the market and that or a full fledged bull market is what makes everyone lots of cash.

This is neither.

I still can't bring myself to buy anything long quite yet... this market isn't about to run off on us, with companies earnings and profits not expanding.

Anyways....lets just get them to close the market over 12000 today, enough already..... I want to get back to the business of money making.

Apple Google and IBM are all good companies, and I wouldn't be short anyone of them..... not in this environment anyways.

When the bears start turning into bulls, then that is the sentiment I want to see...it says that we are getting close to a top...not that I'm trying to call one.

But keep in mind that the yield curve is still inverted- and 90% of the time a recession has followed, stocks have rallied for the past three months (not on fundamentals but on performance chasing), the transports which should confirm a breakout on the DOW are laggards, tech and semi's are lagging. The way the market is behaving I am assuming that there will be no slowdown.....but there will and equities are not priced for it.

Oh and I forget....the elections are in 2 weeks and isn't it ironic that gas is at year lows and the stock market is at all time highs as the Republicans trail in the polls....oh and who appointed Bernanke.....BUSH. Oh and every piece of bad news is ignored while the $VIX is at its lows....COMPLACENT.

My point is this, enjoy the rally...I'm keeping an open mind but I plan to get short within the next 1.5. Breadth is horrible...It's amazing the media coverage outside of the US- its so realistic and doesn't paint such a rosy picture like the CNBC cheerleaders!!!

Post a Comment