Eight is Enough

Well, the octet of upswings in the market met a welcome halt today. Between the real estate market going down the toilet and the Fed gritting their teeth and confessing that the economy is starting to weaken, the market got the kind of one-two punch in the face it needed.

One catalyst for the drop in late February was the carry-forward trade. The NZD/USD nicely captured this (shown in green). As you can see, this FX has been pushing higher and higher (in spite of staying obediently below the broken trendline). A weakening here would portend good fortune.

Much of the indices resemble the NASDAQ 100 ($NDX), shown below - - basically, a slip from the huge upswing we've seen over the past six weeks (which I consider a retracement that will precede a much bigger drop).

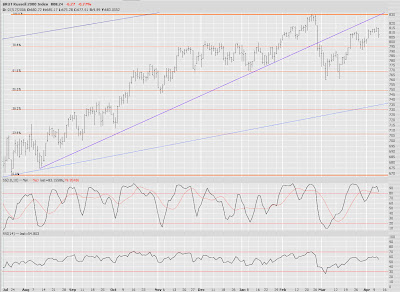

My favorite index puts - the Russell 2000 - had a pretty good day. I've adjusted the stop to 816.13 on these.

And here's the S&P 500 ($SPX). Check out the RSI and Slow Stochastic indicators.

Gold & Silver ($XAU) seems to have reached the top of its descending channel. I've got a big block of puts on this index now too.

One of the most resilient indexes, the American Stock Exchange Major Market Index ($XMI), may have double-topped. I hope so, at least. God can't hate me that much.

A high-risk bullish play might be found with - believe it or not - some of the battered sub-prime lenders. Check out Fremont (FMT). The monster volume and triple bottom might mean a nice bounce higher. Of course, you could also wake up one morning and find one of these companies has declared bankruptcy, a la NEW. That's why I'm not going to touch it myself.

General Growth Properties (GGP) finally took a tumble on some very sizable volume. Lots of room left before it hits that trendline.

Tired old has-been Microsoft (MSFT) seems to have a nice H&S pattern.

NutriSystem (NTRI), favorite stock of departed commenter hurricane5, is again in my portfolio. No surprise here, folks - I've got puts on it. Another nice H&S pattern, in my opinion.

PSB continues to shape up nicely. I'm jumping the gun a bit on the pattern, but as long as it's shaping up as roughly drawn here, I'm a happy fella.

Reynolds (RAI) is finally started to sink. It's about flippin' time.

Someone commented that getting a long series of modestly down days would be better than one whammo day like we had on February 27th. I'm inclined to agree. But cruel fortune doesn't care. We simply have to take it a day at a time.

31 comments:

Nice again.

There is a small problem with the charting and that is it doesn't show 80% of the market in historical terms or fundamental/ technical terms. The chances of getting more than another .75% is small and the fact that there was a poor a/d line and volume for the Bears leads us to assume you will be praying for more 1 win in 20 days type action. Sure you will get your .75% every once in a while ( is that the first Bear win of the Month ?) But we are in a global Bull market and all the puts in the world ( when will you run out of money ??) won't change it. Maybe one more day and part of another and earnings will beat the Bears as lowered expectatuions are on the Bulls side.

"But we are in a global Bull market..."

I have a feeling you would have said EXACTLY the same thing in early March of 2000. Lots of people did.

Can someone tell me why the 47 strike puts for QQQQ are the same price in April and May, does this type of mistake happen often?

Tim, nice set of charts today, thank you. I am thinking of buying some GGP puts, whats your thoughts on Jul 60 puts?

JC

"Tim, nice set of charts today, thank you. I am thinking of buying some GGP puts, whats your thoughts on Jul 60 puts? "

July seems far enough out - - I think those are what I have. As always, just a personal opinion. Not investment advice. Ever.

Absolutely beautiful ... One bearish wedge after another ... this one is ready for its next step down.

http://stockcharts.com/charts/gallery.html?ctx

I'm ready to load the boat on this next dip boys. Long and hard upwards.

I reiterate that the bull market will terminate any day now and today's sell action might very well be the beginning of a protract and severe bear market. Real estate market is already in a recession and inflation is running very high. The only sensible thing to do is SELL, SELL, and SELL.

Maybe you could clarify your GGP thoughts on the trendline. Why did you draw the trendline where you did? Could another trendline be drawn connecting March 13, Jan 8, beginning of march, and finally today's low? Should I be looking further back in the timeframe to see more points connect for the trendline you drew? Thank you very much for your time

"Maybe you could clarify your GGP thoughts on the trendline. Why did you draw the trendline where you did? Could another trendline be drawn connecting March 13, Jan 8, beginning of march, and finally today's low? Should I be looking further back in the timeframe to see more points connect for the trendline you drew?"

The trendline goes back farther than you see. I'm a stickler for accurate trendlines. Sorry the graph didn't show it all, but I wanted to zoom in on the detail.

I wonder if some of the good news in retail this morning might offer support to the markets? Oil stocks still doing very well, I think we will be down today but not significantly. Maybe tomorrow' data will do the trick bears

I reiterate again - a bear market won't start until the insiders have sold out or themselves gone short. Until then we trade - with an upward bias.

There are millions of day traders and black boxes buying the dips continually seeing every 6 point drop on the S&P as a buying opportunity - just like the bears see everying 6 point drop as a reason to run out and short. Since the market is biased long - the shorts always lose out - there is more buying power with the day traders and hedge funds than short sellers.

By the way - doesn't GE report tomorrow? Their report could be interesting - they have mortage exposure - and it is Friday the 13th?

Thanks for your input yesterday Leisa.

good trading

Tim...

Global BULL come on! Stocks just go up in price all the time! They never go down!

ROFLMAO...

China is mimicking the NASDAQ of '00...watch out.

"I reiterate again - a bear market won't start until the insiders have sold out or themselves gone short. "

Really? Is that what the insiders did in late 1999 and early 2000? So they didn't get their butts handed to them? That's a relief.

Phew...!

Overlay a NASDAQ 99'-'00 chart with the current Shanghai index.

Tim

'99 '00 was a bubble - we aren't in a bubble now.

Insiders distribute differently in slow moving bull markets - last year in May '06 was a perfect example - from Dec '05 to May '06 there was a slow rising bearish wedge with a multimonth divergence in the A/D line - the insiders got out starting back in Dec '05 - and were already short come May.

'99 '00 was a bubble and insiders behave differently here. They egg the bubble on as long as they can -

they have more shares and make the most - so they encourage - in fact create it.

They don't distribute in a bubble because the top isn't decided by them - its decided when the last buyer buys.

In a bubble the insiders sell out and short once the market starts falling - because all the others are still denying that the bull run is over and are buying when its falling - this is where the insiders are selling out.

As far as Shanghai Index is concerned. This is not a real stock market - they don't even have rule of law over there - it is all poker/monopoly money - that market could triple from here - and it would mean nothing. In fact it's market cap is so small anyways - it is irrelevant. When the news tries to make mountains out of molehills such as they did in Feb 27th blaming Shangai for a global market meltdown - this is hilarious - the insiders laughed to the bank buying shares on the cheap on Mar 13th.

As for the current market - there could be another spike down in April - another 95 point drop - but this is a setup - as the insiders haven't sold out - and in fact bought the last 95 point drop.

So if there is a second drop the ABC correction is complete - and the market is going to surge to new highs. This would be the largest bear trap in history - have you seen the NYSE short interest? Even with all the recent scares and pessimism it is still very very high - above most long term averages.

The Immeditate term term Bearish case is very very weak here - in the short term maybe 50/50 with another quick sharp artificially created panic. Remember - you buy Selling Panics.

.. my 2 cents

TradeitLikeitIs

I am deeply respectful of the fact the market could keep climbing.

I purposely looked at an $INDU chart last night only up until 1998. It looked like a straight-up hockey stick, and I said to myself then "this is insane - it cannot go higher". And it just kept blasting higher.

I remember well in March 1995 when the Dow crossed 5,000 (!) thinking this was the top. So I am the first to admit seeing tops where none exist. Over the years, I have grown much more humble about the market's strength. Over the long haul, bulls absolutely rule the day.

As I said, I just take it a day at a time, and I'm very diligent about setting stops and following a few other simple rules.

8 DAY UP 1 DAY DOWN

THIS IS GETTING TOO EASY FOR BULLS.

NOTHING GOES DOWN IN THIS MARKET

Tim

I respect what you are saying.

In fact to be honest - I have always been a bear at heart.

I see all these stocks and bonds as worthless pieces of paper - merely created to be speculated upon - its all overpriced - so far from reality that it borders on the insane.

But the fact is - they can't let this house of cards collapse - they have to keep it going - so they must encouraged one bubble after another.

I see another stock bubble coming - probably larger than the last one because it will include all countries - I think we are just getting started.

Also the Fed will just give up fighting inflation.

This will probably continue until the global economy is fully integrated early next decade.

After that - the party is over and there will probably be a slow gruelling slide down for many many years as the fantasy unwinds and real staglation sets in.

But prior to this massive unwinding they need everything - Real Estate, Stocks etc.. to be as high priced as possible - because they know whats coming.

So I have adjusted my trading to be just that - "trading" - and hung up my bear costume - and try to remain market neutral - buying dips - selling pops - and playing the mo whereever it comes.

good trading

4+ years without a significant pullback...

as always...it could go higher but something to think about...

IBD/TIPP number coming in lower than 50 does not bode well either....!

45.5 overall number

take that perma bear nice rally monkey in all indices. screw the shorts.

Solar stock JASO is awefully cheap compared to its peers!!!

JASO is trading @ 21.26 at this moment.

I think it deserves to be trading at $40 to catch up to its peers like FSLR, SPWR, and TSL.

I believe alternative energy will be the new leaders of the next mega bull market.

"take that perma bear nice rally monkey in all indices. screw the shorts"

Mindless.. why don't you post something useful.

Here's something useful:

Today's close is a lower risk short than yesterday.

Today's close is a higher risk buy than yesterdays.

- why?

(1) Everyone was shorting yesterday's bad news. You cover bad news which was expected.

(2) TRIN is low today.

(3) Follow the volumes in the Short ETF's. Everyone day there is some negative news - everyone runs out and buys these funds. And others Hedge by buying them.

The next morning if the market stops falling they all have to close out and go the other way.

People bought today - not because they wanted to - but because they had to. So you sell to them (short or otherwise).

It was probably a pump for GE's results.

TradeitLileitIs

I suppose one way to be bearish while being bullish.....commodities are having their own big rally. My BAS is breaking out. I've been watching for some time and I've been it it since end of February. I also have some HERO.

The coal stocks picked up a bid last week. I have SSL and ANR.

I also picked up, though I would not call it well researched, some CSIQ.

However, bullish commodity stocks are not good for the economy as a whole. Weak dollar is likely driving some of it.

I'm still surprised by MTG's strength today; but have nascent TA skills enough to see that it had broad support at where I closed my put position a few days ago.

I know I am probably not welcome as I have been right unlike most who visit her but I won't advertise or make negative comments. I have only come here to see the professional charts and professional work of Tim Knight. I have been in the Bullish camp and recently said in comments that the bears could get .75% here tomorrow and then the Bulls will take off. I don't know why people want to keep throwing away money in a Bull Market ??? Now , yes the INFLATION numbers will be bad and they will sell it off a coupel of days with expirations but what if the Gov't gives us a sirprise down inflation number and we go to new highs tomorrow ...todays volume was heavier and the QQQQ's look to breakout to new highs. No advertising and hopefully Tim will be fair knowing that my opinion is valued by some and right more than not . Good luck AEIS has been our favorite in here but VLO and QLD sure did help us today

TTT

9 out of 10 days up. no way.

tomorrow we go down 150 points for sure.

does'nt volume play a huge role in a true head and shoulders pattern? and if so why dont you include volume in your charts?

a hard lesson i learned also is most shorts will get run in on the first neckline break, too obvious.

jmo tho,

But we are in a global Bull market. suck it bears and you hedgie promotor tomtheasstickler.

Good timing on NZD and thanks for the comments.

Well, I have been short NZD for a while now and have not closed the position yet. (Talk about stop loss!) But I do think it is due for a correction (atleast) based on that it has gone up on a weekly basis for the last six weeks. Currently it seems to sit at the top of the 200day regression channel. April 24th would be an interesting day..though I do think the ascent will last for about 52 weeks (mi d June) as the descent lasted for the same time (another 2 cents up?)

Post a Comment