Eight is Enough

Well, the octet of upswings in the market met a welcome halt today. Between the real estate market going down the toilet and the Fed gritting their teeth and confessing that the economy is starting to weaken, the market got the kind of one-two punch in the face it needed.

One catalyst for the drop in late February was the carry-forward trade. The NZD/USD nicely captured this (shown in green). As you can see, this FX has been pushing higher and higher (in spite of staying obediently below the broken trendline). A weakening here would portend good fortune.

Much of the indices resemble the NASDAQ 100 ($NDX), shown below - - basically, a slip from the huge upswing we've seen over the past six weeks (which I consider a retracement that will precede a much bigger drop).

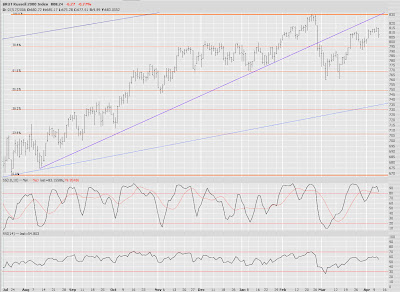

My favorite index puts - the Russell 2000 - had a pretty good day. I've adjusted the stop to 816.13 on these.

And here's the S&P 500 ($SPX). Check out the RSI and Slow Stochastic indicators.

Gold & Silver ($XAU) seems to have reached the top of its descending channel. I've got a big block of puts on this index now too.

One of the most resilient indexes, the American Stock Exchange Major Market Index ($XMI), may have double-topped. I hope so, at least. God can't hate me that much.

A high-risk bullish play might be found with - believe it or not - some of the battered sub-prime lenders. Check out Fremont (FMT). The monster volume and triple bottom might mean a nice bounce higher. Of course, you could also wake up one morning and find one of these companies has declared bankruptcy, a la NEW. That's why I'm not going to touch it myself.

General Growth Properties (GGP) finally took a tumble on some very sizable volume. Lots of room left before it hits that trendline.

Tired old has-been Microsoft (MSFT) seems to have a nice H&S pattern.

NutriSystem (NTRI), favorite stock of departed commenter hurricane5, is again in my portfolio. No surprise here, folks - I've got puts on it. Another nice H&S pattern, in my opinion.

PSB continues to shape up nicely. I'm jumping the gun a bit on the pattern, but as long as it's shaping up as roughly drawn here, I'm a happy fella.

Reynolds (RAI) is finally started to sink. It's about flippin' time.

Someone commented that getting a long series of modestly down days would be better than one whammo day like we had on February 27th. I'm inclined to agree. But cruel fortune doesn't care. We simply have to take it a day at a time.