Vox Populi

All right, the votes are in!

I appreciate so many people voting - well over 600 took part in the first "Technical Analysis with Tim Knight" poll, and the results are illuminating.

The first question was to address whether or not anonymous posters should be allowed to comment on this blog. I've flip-flopped on this decision (alone) many times. Sometimes I open it up to anonymous posters, since it increases the activity of the comments section and makes it easy for everyone to post. But then, once a few bad apples spoil things for everyone else with abuse and pointless put-downs, I decide to shut them off again.

So I decided to take this issue to the voting public. Watching the results was like watching a horse race. It was neck and neck for a long time, then "Ban Anonymous" starting to take hold. In the end, the majority voted to eliminate anonymous posters. I guess the verbal fistfights got to be just too much. So.......you have to be a registered user to post here. That definitely means the comments section will be a lot less active, but it will by the same token be a lot more civil.

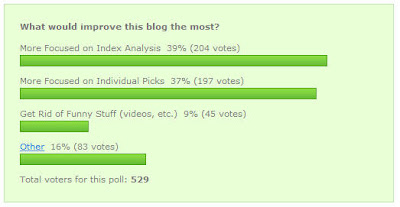

The next question I asked was how to improve the blog - - unfortunately, I only gave three choices: more index analysis, more stock analysis, or a reduction in the comedy. I didn't include a forth choice, "Everything is Fine", which apparently a lot of people would have checked had they been given the chance.

Those that clicked Other entered nearly one hundred specific suggestions, most of which were along the lines of "Leave it just the way it is." So - - will do!

Finally, out of curiosity, I wanted to see if the readers of this blog tended to be bulls, bears, or simply rational non-animals. It seems that most people claim to be agnostic, neither bullish nor bearish. I guess this is similar to asking whether a person is liberal or conservative, and they answer "economically conservative and socially liberal." It's a nice, safe middle ground. So be it.

In spite of the Dow's strong run today (and its continued attempts to crack 13,000 - - come on, can't you get it over with?!?!?) the Russell is still looking good on the short side.

And the Gold and Silver index continues to behave nicely within its descending channel.

I entered a new short today, CRR.

I don't have a position in CRS right now, but it looks like a potential short, since an otherwise beautiful bullish pattern isn't seeming to catch fire - - added to which, the volume has been slowly dying down for over a year.

I like the looks of MicroStrategy (MSTR) for a short position too.

...same story with MWP. As you can see, I'm using a trip of moving averages to help drive home the waning momentum.

As for ONT, the stock I keep mentioning as a long - - it continues to look good, and on sensational volume. Remember my cautionary tale from yesterday, though.

Lastly, my X puts finally started pushing up in price. It's about time.

Everyone is obsessed with 13,000. As I said, I (strangely) want to cross it. "13k and out of the way", so to speak. I imagine once this barrier is crossed, people will check that off their list and start selling into it.

Oh, and.......

49 comments:

Agreed, I too want the DJIA and the S&P to get break those old highs. I'm tired of hearing about the sentiment. Once those marks are broken, we will then have a much better idea if this rally has any legs left in it. A nice hard fall is just as exciting as the nice stair step action we've had. In either case, it's worth a lot of money. Last thing I want to see is sideways market.

13k and out of the way.

Very catchy, and probably some truth to it. Thanks for doing the poll. Anything to cut down on the grafitti.

After hour, AMZN is crazy up. Tomorrow might be a bull day again.

I think if Aussie, European, and Asia especially China markets push to history high again and again, US market might not be down. For example, Google almost got 50% business from overseas.

I feel short is tough but I do think the market needs a pause.

Let's us after 13000.

jakey lawnboy gayland,

not in that sense it was used. see, your problem is not words, but correct usage, beleive it or not, not all words can be used in any sentence, theres such a thing as structure, but thats a little beyond you yet.

and thats all the reply from that, one word is all you could find? how about defending yourself, oh yeah you cant, just admit you were wrong and move on, it's ok lawnboy, the world needs ditch diggers

That's not a perfect little cup and handle on IWM ...from your book !

TTT

jakey lawnboy gayland said"

(And don't worry -- I'll be here when you get to that step that asks forgiveness of those whom you've wronged.)

is that a reference to your twelve step program jakey? man when i said you needed to go to an AA meeting earlier that was just a jab. wow, pretty damn intuitive, ( that means- perceptive- jake)

anyway go back to flogging your bologna or whatever you do in lawnland.

p.s. - I tried to write slowly jake, so you can read it.

Quality over Quantity ALWAYS!!

I'm neither a bull nor a bear. On the other hand, I have far too much cash on the side to be a bull.

Maybe I'm an agnostic with fur and claws.

ONT looks like a climax top to me, except for the volume on the last day, could be short covering tho, have to wait and see if it'll break new highs or break down

to Tim & the bears,

I really feel that there is something big out there. Big-to-the-upside-BIG...like, once-we-break-13K-we-accelerate-up-BIG!!

like there's more than one 1/2-a-trillion-dollar-LBO waiting in the wings BIG BIG BIG

If you're short, you're liable to get your head handed to ya.

Gemmastar, there's not a thing wrong with holding cash. It's an accepted asset class. No one HAS to be in the market all the way all the time. Stepping aside is sometimes the right thing to do.

While I certainly understand the liquidity issue, and I know that has been fueling the market, I think of the events that will serve as a hand and pull the plug sweeping the 'little people' (meaning most of us in the market) down the drain. Sure, liquidity is a legitimate driver. But IMV (not that the market or anybody else should care) it's "ether". It's netherworld stuff. It's air in the balloon, and the latex looks a bit cracked to me.

EVERYTHING hinges on the consumer. The minute the collective knees of the American consumer buckle, then there will be global panic. That's how strong the dependency is. Yeah, I've read some opinions that the newly minted middle class of these nations will pony up, but the American consumer has decades of experience on how to live beyond one's means--so don't look for an easy backfill. IF the Am. consumer stays strong then the dollar can stay strong; then the Asian markets will not tank. If the Am. consumer buckles, the dollar tanks and the Asian markets will tank. The poor American consumer is on the world's stage. Nikei is down as I write.

BTW, I paid $3.05 for premium gas. $50 to fill up. We have some challenging times ahead. Hold on to your wallets and don't let any (bulls or bears) goad you into imprudent action.

You bulls crack me up with your "I want the DOW to go up to 13k". Nothing like a bunch of bears in denial.

Seems I recall hearing that same rhetoric at 11K & 12K.

TRADEITLIKEITIS...where are you ?

Tim,

It is refreshing to see that there are not eighty nine freakin comments to weed through. Traffic is good but it was becoming a chore.

I got on a plane to further my education on becoming a professional trader and was pleased to find out that you are a surprise guest speaker. I thought I was going to have to fly to Chicago to get my book autographed. It's the only book I brought!

"I got on a plane to further my education on becoming a professional trader and was pleased to find out that you are a surprise guest speaker."

Indeed I am! In Seattle. See ya there.

Tim, as a student of the market and one that watches it closely/daily, I cant figure out how you could be bearish during this entire rally? In a most basic sense, draw a trendline connecting bottoms and do the math. This is a big move, to look back as say one was bearish is a big mistake. Is a market bearish cause it has gone up a lot?? Wow.

Interesting day for the markets today. Dow was up and that thanks to IBM and DUPONT but breath was negative on the NYSE and the S&P 500 was down fractionally on higher volume (distribution day). Commodities and commodity stocks the leaders of this bull market were weak across the board while the dogs were barking (for the definition of the word dogs please look under semiconductors). The question is can the semis lead higher without commodity stocks participating. I seriously doubt it. Also momentum indicators such as stochastics and RSI have turned down. Stochastics has been overbought since April 4. If a pull back were to happen the conditions for it are perfect right now.

Shorting setups i am looking for ctsh, shw and mbt.

Tom the trader wonders if IWM is a perfect cup and handle. It is either that or a double top.

"Tim, as a student of the market and one that watches it closely/daily, I cant figure out how you could be bearish during this entire rally?"

Glad you've got the market all figured out, tommy t. Congrats.

Tommy T,

Have you been 100% during this uptrend. You have probably thought about shorting it many times and lost money. Great analysis after the fact kiddo.

I thought a pullback was needed, back in January...

But I think this sideways choppiness is the only pause that will happen.

While its NICE to say "I can't wait for 13k", I would almost think that 13k will just draw out more firepower to the bulls...

Look at the news, even bad news is good news. (Tim, I think you said the exact same words in one post)

I just think at this time, we have to put aside our fundamental ideologies, and maybe make some cash until the "right time".

Watch this sucker fall as soon as I press the 'submit' button on my brokerage account...

Plumber sez, stumblingly:

"it's ok lawnboy, the world needs ditch diggers."

Well then, dear boy, I suggest you get on with it.

_____________

Plumber exclaims:

...

ONT looks like a climax top to me, except for the volume on the last day, could be short covering tho, have to wait and see if it'll break new highs or break down.

...

We await your further analysis with bated breath, and nervous, if relieved, gratitude.

tim, now a survey for you. what would YOU like this blog to look like? what kind of posts would you like from us? would you like us to give ideas of what we are thinking about being a part of and you analyze them, do you want us to ask you TA questions, do you want us to talk about success/failures? in a perfect world, what does TA w/ TK look like?

thanx!

Oneway:

like there's more than one 1/2-a-trillion-dollar-LBO waiting in the wings BIG BIG BIG

More than one half trillion dollar deal? What happens after Microsoft gets taken private?

Someone rolls up the airline and radio industry into a Super Giganto Transformer Robot, like Megalon?

Or are you intimating that KKR is going to make a play for the Federal Reserve? Because I would consider that bullish for the near future...

Tim, I'm sorry to see you do away with the anonymous posts. I'm not sure how accurate your democracy is. I have to confess to voting twice. :)

Best comment I read was to include more fib regression lines.

The upside is that I got motivated to put my picture up by seeing all the pics here and lack of anon. How do I look?

It pains me to see the bears suffering. I lost a good chunk of my shirt last fall and this winter/spring on the short side. Had to take a major trading hiatus to break the spell.

Am back now consistently profitable on the long side. Am very wary though and watching positions like a hawk, as I'm still expecting a major downturn any day now...now...now...now...

I guess you can take the bear out of the woods, but you can't take the woods out of the bear - ha ha. So I guess I'm converting from an inveterate bear to one of those go with the flow types who "won" the poll.

BTW, count me in with all those who kie it just the way it is, nothing needs to change.

I'm glad the anons have been dealt with. Thanks again - I certainly like it the way it is.

thanks again

is that all you can muster jakey lawnboy gayland, repeat what i said and then pretend it was an original thought of yours? i'm sure the last original thought you had came out your ass.

anyway,you wouldn't know technical analysis if it banged on your tar-paper shack door, sat on your imitation pleather couch, and shared your nightly meal of ramen noodles and vienna sausage.

at least try to post something original jakey-LBGL( thats an acronym for lawnboy gayland, i know you love acronyms so much, with your secret squirrel code and all,)

and hey, the ,"i'm rubber and your glue" thing, went out in grammer school. try to go back to googling something interesting for you to say.

jakegint, AKA-jake-LBGL say's excitedly,

"We await your further analysis with bated breath, and nervous, if relieved, gratitude."

i'm sure your awaiting quite a few things with bated breath, or in your case, "BAITED breath". let's venture a few guesses shall we?

1. a toothbrush for starters

2. just one more "swig" of the old crow whiskey before work,

3. one more spam sandwhich

4. brokeback mountain 2-the sequel

5. your mail order bride to arrive

6. to find out who really shot JR

7. your ranger rick super secret squirrel code decoder ring to arrive in the mail

8. for your "mr. right" to come along

9. your portfolio to finally go green

10. calgon to "take you away"

and finaly, drum roll please,....

..A single, original, coherent, intelligent, articulate, lucid, expressive thought to call your own.

maybe one day jakey, keep your chins up..

Oh man, permabear Doug Kass must be seriously hurt. Ouch!

Leisa, thanks for the reminder that cash is an asset class.

Now that your put options are worth 0, here's what to do now: buy JSDA and solar stocks!

www.beanie11111.blogspot.com

JSDA about to fly!!!!!

no time left.

bottomed!

After no posting for many months - Im still around and still a bear - a big bear. I just cant force myself to bet on the DJA going up, even though its been so bullish for many months. Does anyone else feel the same?

By the way, whats the big deal about people not posting unless they are anonymous? You only have to create any old nickname and password, whats the problem with that? I really cant understand it, but on the other hand, its got so bitchy from the bulls - we only want to hear from that have something constructive to say and not just scoff as us. AFTER ALL TIMS BLOG IS PRIMARILY BEAR ORIENTATED ie he offers technical advice and suggestions on short positions based on chart analysis with some long positions included if the charts strongly suggest that.

another up day surprise. who would have thought the market is up big again. bears getting clobbered in amzn +12.55

jakegint , breathing heavily, say's

Plumber exclaims:

...

ONT looks like a climax top to me, except for the volume on the last day, could be short covering tho, have to wait and see if it'll break new highs or break down.

...

We await your further analysis with bated breath, and nervous, if relieved, gratitude.

10:36 PM

OK, let me break it down for you jakey LBGL, :

From breakout mid march to early April, @ .45 cent gain is real close to prior breakout of Dec. 05 to Jan. 06. In TA thats known as a "measured move". Then the three day run up is known as a "climax run". Notice the huge volume on the run-up and then the largest volume day on the top, which closed at or near the day's low? Thats known as a reversal spike or ,get this, a climax top. Then the big volume on the downslide, thats a sell-off. And guess what? some brokerages allow short selling of any priced stock, so they short it on the way down, hence the bounce when they cover. [If you don't understand short selling, you might be on the wrong blog] Anyway, confirmation of this being a climax top will come as I stated earlier, " if it fails to break the recent high, volume dries up, it reverses and breaks below the low of the bounce, or falls into a trading range. There are other rules and scenarios but I won't confuse you with those right now.

A pattern is only an estimated guess until it's confirmed. The idea is to be on the right side of the trade when that happens. Its called r i s k [ say it slowly jakey]. But I would'nt expect you to get it anyway

See jakey lawnboy gayland, part of TA is recognizing the patterns, anticipating the move and profiting from it. There is risk invovled in trading, you know that don't you?

It's ok if alot of this is over your head, just keep copying what others say and pretend you know what you're doing.

.

And Leisa, I still don't care if the grammar is correct, It's from a lack of effort or desire to impress people here I guess.Thanks tho,

doesn't look any more civil or noteworthy to me.

TTT HEDGEFUND Has been 100% on target and the CUP and Handle that Tim taught me in the book worked out perfectly. That is the most bullish of patterns and we certainly got it !!!!

TTT

why you guys gettin into so much detail with TA anyways? You gonna get yourself worked up into analysis paralysis. Tim is pretty good with TA and he's gettin rimrotted by the bulls.

Cramer was right. He doesn't like TA. It should be a side order rather than a main dish.

Once again, solar stocks are en fuego!

They will lead the next mega bull market.

TSL

FSLR

STP

SPWR

Some thing I posted a couple of days back, not much as changed since then, so just copy pasting it again.

I trade the ES primarily, and a "certifiable" bull, but right now I cannot find a reason (set up) to buy.

Top calling sucks but hard to resist it, So here goes, 13035 for the DOW and 1500-03 for the SnP500. That said, Either we are at a top or as someone mentioned we are just at the beginning of a New bull rally, even if it is the beginning of a new Rally, there is going to be a considerable down side before an meaningful new high/s. The Question here is can the bulls take a 10+% hit (of the total Index value) and yet be laughing all the way to the bank?

A Hit is going to come , that is an almost certainty, Bull or Bear phase will be determined after that.

As of now there is absolutely no evidence to suggest building of short positions , maybe our eagerness to catch the top ? A sin I have often committed (to my folly) in the past.

To the Bulls, what is the stop for longs, and is there a target?

My Call - the bears shall be mauling the bulls before May is over.

holy cow!! Shorts are covering enmasse.

beanie11111 said;

"Cramer was right. He doesn't like TA. It should be a side order rather than a main dish."

I agree completely, TA needs to be used along with fundamentals to try and find the right buy and sell points. Occasionaly tho, you can play the fear & greed , crowd factor, whatever you want to call it solely with technical analysis.

I prefer TA because i think the chart is telling long before the fundamentals show the truth. Not always but enough.

Also, when the markets in a bull run, most fools can pick stocks a ride them up, "a rising tide lifts all boats" but when the tide changes, alot of people are gonna get caught high and dry. Thats where TA helps. You've told us the solar stocks are going up, all I ask is tell us when you sell or when the top is in for them. Cause the stock usually drops long before the fundamentals.

I like the solar stock group but I think it's a trade, not a long term, due to the fact they're a long way from profits or "fundamentals". We're in the greed stage of them right now.

only my redneck opinion tho,

Humble1 said...

"doesn't look any more civil or noteworthy to me."

Maybe not civil, but certainly noteworthy...

civility is overated anyway..

beanie11111 said;

"Cramer was right. He doesn't like TA. It should be a side order rather than a main dish."

TA works just fine -IF- you have spent time learning how to use it. If you have not, then why would it work for you or Cramer? Why would you think you understand how it works or does not work? It's always the people that don't know enough that come up with this sort of thing.

New equity...who's talking about being 100% long the entire rally??? Ha, we are talking about constantly looking for bear ideas....thats a good one new equity...If you are new equity, I hope you are reading other sources for ideas.

Post a Comment