A "Relief" of a Rally

First, a tip of the hat to fellow blogger Charles Kirk for mentioning this blog a couple of weeks back in addition to pointing out this interesting article. The thrust of the article is that we're only about a third of the way through the secular bear market which began in 2000. It's fascinating stuff.

I've looked at hundreds of charts (as usual) today, and in spite of all the hand-wringing yesterday, my belief is that the bulls have pretty much shot their wad as of today. It's been very rough for us bears of late, but I think we may be at a turning point.

My first indication was this morning. Even though the market was up nearly 50 points (again.....) I noticed just about all my portfolios were showing nice profits. Part of this was due to the weakness in oil, but the fact is that the rally was losing its breadth. The only number that matters, after all, is the Profit/Loss column each day, and when that's green, I don't really care what the market is doing. The fact that the market's surge withered away to a 7 point gain today was obviously a relief.

Below is the minute-by-minute chart of the Dow 30 over the past sixty days. I've highlighted the "higher highs" that have been happening for most of that time, connecting them with arrows. My sense is that this is a high-water mark. A very strong Friday tomorrow would absolutely flabbergast me. (Could happen - never say never!)

Oil is still teasing us with a head and shoulders pattern in-the-making. Of course, until that neckline is broken, which may or may not happen, this pattern doesn't mean squat. I'm still short a lot of oil/oil service positions, so I'm jumping the gun, I confess. It's got to push through the area I've highlighted in yellow, and then it's going to get the crap kicked out of it.

I'm only going to post one stock chart today - SHLD. This has all the markings of a beautiful cup with handle pattern that is failing. A failed bullish pattern makes a fantastic bearish pattern.

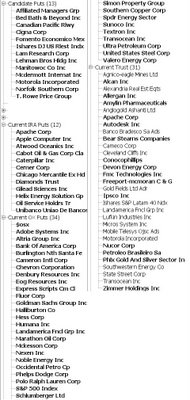

Below is a compilation of the items I am probably going to buy puts on as well as my current short/put positions. Not a long in the bunch.

Let's hope tomorrow is a good day to an otherwise crummy week!

72 comments:

Tim,

Whatz your opinion on RIMM?

Thanks

If you're looking for some interesting reading check out Liz Ann Sonders with Schwab. She does a great job of justifying why were heading for a recession. www.schwabinsights.com/2006_08/mktoutlook.html.

R41

(long time reader - 1rst time blogger)

FUDGE!!!!!!!!!!!!!!!! I am getting killed this week. I swung for the fences because the writing is on the wall (recession). All I have been saying to myself is "The market can stay irrational longer than I can stay solvent. Big Bill

LADIES AND GENTS: another great set up is occuring (downside of course!).

I did a scan search, and found SHLD (great pick Mr. K), but also check this one out:

CL

Thats right, those trusty Colgate guys, must be putting out crappy toothpaste because the stock looks prime for a fall.

I wouldn't hop into it just yet, its making a nice little ditty of a formation, I would say a good support level is around 58 bones.

Once 58 is breached, looks prime for a meltdown.

thats all folks. I couldn't find a good bull setup (because i think everything is overbought, naturally), but good puts are easy to find right now, however, how you manage your patience will dictate how much you profit or lose.

Everyone, including this market needs to shake itself good!! Come on people, this rally is a sucker's rally, that's why none of the indexes confirmed it with volume! We are at the END of an economic cycle, NOT the beginning!! This is that brief little rally that comes after the fed quits/pauses! Don't let it fool you. Go SHORT young man! October - Dec puts are BARGAINS!

See you on the other side!

Fast Eddy

I still am not liking the wedge formation on the Russel 2000, and the lack of participation given this "rally". Trannies have a long way to go, and are still below the 200 DMA. havent seen a sell off, or divergence in these areas from the markets in a long time as to what we are seeing now. ill post a chart on my blog.

mhmThere is much debating going on whether this rally is real or not. Of course its real but will it hold, will we break out to new highs. Most bulls in here agree that this is the next leg up to 11700, that any minor selloffs from here should be bought. Now I do not own any short positions, if i do i swingtrade in and out, however, I do own QID and SDS after this last run up. I think there is a bit more upside left but do not think it is sustainable. Some said that this rally was a given, i disagree this rally was not in the picture, no one could have predicted this move back to 11300+ on the dow and 2150+ on the nasdaq. Right now its tough to say where we are headed. I think tomorrow profit taking could be in the picture. Many are now showing support levels as 11250 on the DOW and 2100 on the NASDAQ, will that be a good time to go long? Or as we near those levels will the bulls give up and sell leaving the bears in a better position.

Trader 2006

Wow, a lot of nice compliements and comments tonight. I appreciate it. The comments section has sort of gone bananas, with almost 200 comments a day. I find it hard to read it, let alone reply.

One gent asked the difference between the bold and non-bold holdings. It's simple - the bold ones are options (e.g. put positions). Good question!

I'm really sorry I can't answer all the questions that come up; maybe one day I'll have a more complex and complete blog where people can post questions for me to answer, and they're really visible to me. Good luck to all on Friday...........we need some!

Besides a normal pullback (predictable to any twelve year old with an IQ larger than a soap dish), there is no other down side to this market ... especially the S&P 500. Any long term bearish chat is delusional and smacks of amateurism by those that seek to justify losing positions. Any kid bearish long term on this market ought to step aside and seek further education.

It's a bear-beque kids. Belly up and help yourself. ;-)

Well, the bull run is on, I doubt it will reach new heights, but I do see formation happening.

Let me whip out my crystal ball for a second:

Nasdaq: I see an inverse head and shoulders forming. I think the next leg down (finally), will take the naz to about 2100 (a support level based on intraday highs in Jul/Aug, and the lows in June).

Afterwards, this thing will continue to go up to about 2225ish (which was a huge support level from nov05 to may06)

THEN, things will fall apart. We could easily see the next three months being all up from here on in (thats how long it took for the naz to fall from 2225ish (the first time was 5/17), to the low in July).

That is when I think we'll start to see the bear market that we are expecting to occur.

the spx, however doesn't show anytype of weakness right now. Looking back at the charts show that teh low of the current bull cycle was the low in June of this year, and its been making higher lows since. (and now higher highs).

I would imagine it will top out at the high of around 1320ish the high in May, and I think that would be around the same time that the nasdaq would be completed its inverse head and shoulders.

Sorry guys the batteries in teh crystal ball are crappin' out, and thats all I can speculate right now (even though I hate playing off speculation anyways)

WHAT I AM playing right now is a short term fall (starting asap), and if things start finding support based on numbers above, then I'll probably sell more puts (I don't want to get rid of my puts that I bought a month ago, but I'll continue to sell puts for the next few months).

If of course, the supports don't hold, then ... look out below??

again, if you want a really good stock to play, look at the QQQQ's because you can see the formation MUCH more easier.

40 was a support for most of the time from Nov05 to May 05. You can see it has hit a resistance level right now at around 39. I can see this thing retract down to about 37.43. and then complete its inverse head and shoulders by going all the way up to 40.

Then, the this thing will fall to bits.

That would be a few months from now though.

The support/resistance lines are much crisper to draw out on teh QQQQ

All posts from this week should be bookmarked. See who is right and who is wrong.

Right now the bulls have the upperhand but that can change in the next 2 weeks. Of course there is no way of telling if were on the right track to 11700+. It seems after this week most bulls think we are. I still think we are stuck in a trading range and wont break out of it till the end of 2006. By then a clear direction will take place. I would say there is no winner yet.

BEARS 0-0 BULLS 0-0

Only way the bulls win is if new highs are taken out 11700++

Bears win when 10660 is taken out.

Bulls have a bit of a lead but that can change.

Trader 2006

stockshaker so 2100 is the new support?

When does 2100 not become the new support. How do we justify where the next support is after 2100 if the nasdaq falls further.

anon 9:48: that is a really iffy question, because I would like to say that the clear cut support on teh naz is 2100, but theres so much noise around 2075 to 2100, that I would even say 2075ish (the acutual price I would think is the low on 6/14, which is 2065). But 2100 was a pretty decent resistance for end of Jul and beginning of Aug. But I would probably wait for breaching of 2064, to be more conservative, and yes, that is a 36 point range, but with the volatility that is going on right now, I think you should trade much more conservative than before...

Anyways, a new support for the naz if things fall to sh*t? I would easily say 2025ish (low in Oct05, and again a pretty good support for the CLOSING low on Jul06)

If THAT gets breached, I would think that the naz will eventually fall to around 1900 (that was the low based on April05 lows.

But in order to get THAT low, I had to zoom out to a 3yr graph, so there certainly are intermediate lows in between 1900 and 2025, obviously), but I don't have the patience to start examining daily graphs for the past three years

If 2025 gets breached, I would probably just buy long term puts (I still am holding onto long term puts at the moment, but selling conservativly striked puts in the meantime - so that I don't miss profits if things don't hold at supports). If they DO hold at supports, I'll buy back the conservatively striked puts at a discount,and sell more agressively (at the money striked) puts, buy some time until resistances start slowing down this puppy.

Wow. sorry guys, I don't have any charts that i have annotated, but I hope you were able to follow that...

again, what i just said is completely my opinion, and all could easily become useless if none of the supports hold up.

HOWS THAT!?

all in my opinion though. IM no Pro.

Nancy Drake --- I think you are delusional! The market leaders that are responsibel for the bulk of earnings growth in the SP500 (i.e. ENERGY) is losing momentum. Please enlighten me as to what in your view is the catalyst that drives this market higher. I think it is you that needs to be 'educated' on a longer term history of the market ... i.e pre-1980 ... when commosdoties rule, financial instruments don't. No way we are breaking the former highs on the DOW30. Good luck to you in losing your money!

Trader Fred

Today is options expiration Friday. Lots of volume with probably not much price movement. You know the routine......gotta squeeze out the shorts. Next week should be a pull back. Look for where support is. Will there be a higher or lower low???? Trade accordingly.

Doug

Trader fred has a point, earnings and price wise.

lol We'll see if Nancy is still around next week when the bulls get eaten alive!

Seriously though, I may be an amateur, but I just don't see the market going higher. Low volume yesterday, and a nice doji to indicate transition. Though it could be a stopping point for the OE to let them off the train. But I think it is more than that, because unless there are a lot of seriously delusional bulls out there, I can't see anything to drive the market up next week. Unless I give credit to the conspiracy theories.

We're dropping next week, plain and simple. "How far?" is the real question. The next are: Does it set up for another rally for the bulls? Or will it be a nice warm cover for the bears on the way down to where the DOW should be?

Trade it as you see it, not as you believe it.

Folks,

I believe the last 4 day's volume are big in this time of the year. It is well above average. To point to volume and not price is a mistake. If you look at the rally from oct 04 to May of 06, you'll see that majority of the updays had no volume. Historically big volume usually occurrs at the bottom. Take it for what it's worth. Looks like we got another new high on the dow.

Trader II

im neither bear nor bull. i just try to agree with the market. i do agree with all the downside economics out there but if your a true technician, both the dow ind. and the s&p both just crossed the neckline of an inverted h&s pattern the last two days. could poss. back to test it . would be @ 11250 on the dow & 1282 on the s&p. of course all patterns have to be validated so we'll see. both would be quite a rally to the upside for retracement. as for market economics. its usually @ 3-6 mos ahead of the economy. but hey i dont know shit , pb has it all figured out with his "new" discovery of "liqiudity"

I was neutral going into today, being an expiration day and wanted to see if the momentum holds or if it was a case of possible manipulation. Consumer Confidence comes out well below estimates....CNBC cheerleaders don’t even blink. I just turned bearish! The big money firms used to get these reports prior to the public, not sure if that’s still in effect. Pushing up prices before a report like that to bail out makes sense to me. I’m looking for a helmet to wear when this market falls off the cliff.

Super Bull,

What else is left to prove? We been up 4 straight days and 360+ points for the dow. The Dow have been up 700+ points the last month!!!! Am i the only one that realize the dow is up over 700+ points the last 4 weeks!!!!! The money continues to come in. At best we'll get a small pullback next week and then we'll get the usual end of the month jam.

Trader II

during the last twelve months, there have been only 6 months where the last 2 days, followed by 3 days into the new month had actually seen gains that can be considered a significant move.

Also, down months are more likely to see EOM markup than months showing gains with three days left in the month. So EOM jam means that dow should be 11000 minimum to justify closing the month green, meaning key areas that should hold to confirm rally are not holding and all gains during last three days have been erased.

Also remember it is the end of August and not the 3rd Quarter this month.

Beoing my shut down plant, ford cutting 6000 salaried jobs, shutting down plants, gap revises down, dell problems, consumer confidence drops way more than expected, man i love it, lets buy more stock.

problem here is, theres a major problem, and a serious chance of some major downward stock movement the next two weeks. may not happen and im giving this rally a chance.

Hello and greetings to all....My first time posting.....lots of interesting ideas.....been in the markets for over 20 years.....

Just bot the Google 380 Sept calls for 13.40....target 35/40 ....drops to 9...double position.....drops to 6...sell for a loss....

:)

Watch CNBC...12:25....

"all the bad news is factored in" and stocks are way undervalued.

What a load of crap...... I'll remember to thank CNBC later this fall......

Market getting ready for end of day rally, end of week rally, etc.

NASD climbing all day. Should close green.

Trader II

Look at DELL - after a horrible report yesterday, it dropped as it should. But since morning, its been rising from its premarket low of 20.46 to 21.70+ now. Seems strange. But what't its max pain? 22.50! So will it close above 22, only to drop back to 20 on Monday? Should I short at 22 for a nice $2 gain? Maybe I should.

Is there an end to CERN going up? This stock stays in over-bought territory since the last 10 days.

Any comments?

- Jay Mac

PB,

You been calling for a correction or decline for 3 days straight. Aren't you tired of this? I guess eventually you'll get it right. Looks like the Qs are about to go green.

Trader II

Have the majority of the people on this board covered shorts???? Sentiment gauge....

MSFT is keeping the Nas above water...and helping MO keep the Dow up. I'm skeptical.

Sentiment Gauge??? I straddled the DOW going into this weeks PPI, CPI and have just now legged out of my Call position. Maybe N. Korea tests a missle over the weekend and I make it both ways. $$$$

Covered short???

Have you been reading this board the last few days. Majority of the shorts are adding here. We are rallying into the close and close at the highs of the week. Pull out the weekly chart for the spy, dia & QQQQ and you'll see that we'll get even higher prices next week.

Majority of the shorts are stuck holding the ball with fundamental reasoning while the longs have reaping all the profits.

Don't fight momo.

The Trader II

Die hard shorts never cover.

Just average up.

However I am getting sick of this market.

Tc

BSI87 Are buying QID? Im gonna be patient. Naz comes back to earth next week! if im wrong ill lose, that simple. goodluck to all!

Nasd intraday have the same 45% angle ascend. Don't fight it. Wait a few weeks.

Dell recovered a huge chunk of their loses.

Market GREEN!!!

The Trader II

Volume is next to nothing today. Traders got their prices where they wanted them for options expiry yesterday, then they all went home, knowing that the retail investors wouldn't be able to push the prices out of range.

I don't mind people being bullish, because it does look like we've re-established the bull market direction, but what I DO have a problem with is people coming here and saying "I told you so" about the recent rally. Nobody had a CLUE about this rally as of Friday last week (or even this past Monday), not even the perma-bulls.

What the bulls REALLY are after is to keep pumping this rally so they can sell their shares at a premium. They know this is the end of the line, so they keep pumping, hoping to unload their shares to "newly-converted bulls."

Ain't gonna happen. The bears will ultimately win this one if they keep adding to positions here, as almost everything is overbought.

-Tony

I just added SPY puts.... I suspect there will be a pullback...followed by another rally into late next week...and that should be all.

Tony --- haven't you been calling for a decline since, like forever?

When will you learn? You can only need to buy buy buy! (puts that is)

Trader II

Does anyone know if IWM.... costs anything additional? I think it is ishares....???Thx

Tc --- you my man!!! Hard core bear!! This market is fubar'd --- what an awesome time to short!

Trader Fred

PB,

I have no problem with you being a loser Bull. I'm not a bull nor a bear. I'm a trader and been reading some of Tim's great work. I do have a problem with some of you advising others to add or average up on their position with no reasoning besides the "fundamental" picture. As a trader, the "fundamental" picture is nothing but HOPES & DREAMS in the market.

Some of you said there was nothing to indicate that we'll get this rally in the charts. I beg to differ with that statement. There was a nice double bottom entry in mid July. We got a false breakout in early August to the upside where Tim was stopped out. But during the pullback back, we merely backtest the broken downtrend and also the 50 dma twice. Both held up. Like they said, if it ain't going down it's probably going up. The path of least resistance is up.

The Trader II

Another options expiry play for y'all. YHOO - they have to close it near $30 today. Look at the pumping going on. I'm looking to short it at or near $30 today and watch it drop back to 26 next week, for a good $4 profit.

I'm also trying to catch these peaks at end of today: QCOM, DELL and SIRF.

i thought it was a just a trader blog. i didn't know you had to stay bearish when the market is going against you.

if anyone knows a good blog for bull and bear trading please let me know.

MED

Tim

Few days back you mentioned MOT as a one of the possible short sell candidates based on technical reasons. But isn't it broke the earnings flag pattern(reference: encyclopedia of chart patterns)with price target of 26

Whats your take here when two technical patterns are conflicting? Which one should I believe? Would be thankful if you could let me know.

Today is the last day of this faux rally.

hmmm... wow, you guys are really calling each other out.

don't you think news/economy data, that WE think is going to cause the downfall, is already priced into the market?

do you think the bulls are stupid, that they don't konw the state of the economy as well?

us bears aren't the only ones who read news, thats why if its a bull cycle, its because its meant to be a bull cycle right now.

price reflects all...

but i still agree wtih everyone, the rallyis completely overbought, and a short term retracement is definatly in the near horizon.

But then, its all going up from there. The TA is very clear in that regard.

Anon said:

"Today is the last day of this faux rally."

Wait...I thought this market was "over-bought" all this week. Is it over-bought yet? :-p

Keep making excuses people. Funny, but the Bears are starting to sound like those mindless perma-Bulls on CNBC.

;-)

Eddie,

You nailed it. Forget the news, just listen to the technicals and use stops.

Thank god there's a few cool heads here.

Dell being bought into the close. Climbing a wall of worries.

short BRCM at 30.01

I think it's funny that the perma-bulls here continue to think they know what's going to happen with the market. And they think they're smart enough to have been able to predict that this rally was coming. Yeah, right.

Bottom line is that when the market sentiment dropped to the point where nearly EVERYONE was short, then the PPT jumped into action and floated this market up. Period. Short covering, technical traders, and panic buying continued to drive it up. Add options expiry to the mix and you wind up with what we saw this week.

The talking heads can use the "soft" PPI and CPI numbers as ammunition, but the simple fact of the matter is that consumer prices paid today are MUCH higher than 2-4% or whatever they claim as being the YoY figure. As someone else said, even everyday items like milk and bread have gone up 25% alone.

So, yeah, a 0.2% monthly increase instead of a 0.3% expected increase should make everyone warm and fuzzy about the economic outlook.

Riiiiiight.

(Hint: It's not fundamentals, it's not raised company guidance, it's just manipulation, pure and simple)

short DELL at 22.30, YHOO at 29.95, SIRF at 22.25, QCOM at 37.45.

BRCM was looking too suspicious closing right at 30 with options expiration.

I have a tight stop on this. Will get out of this on monday

"hort covering, technical traders, and panic buying continued to drive it up."

What have i been saying. I'm a trader, a technical trader.

The Trader II

I've been saying day. We are going to rally in the afternoon and close green. There is real buying here. No manipulation, no scam..just pure buying.

The Trader II

Trader II,

Can you please enlighten us with what you have been buying and on what basis?

BTW: good luck to all those who shorted today! you will need some

- Jay Mac

bulls are in complete control. next week is going to be spectacular.

last major index has broken through downtrend ... russell 2k ... iwm

maybe more upside next week?

Trader II has just been pumping aimlessly. Of course, he magically appeared AFTER the start of the rally. If he would have said ANYTHING even remotely bullish on Friday or Monday, then I would give him some credit. But to show up after Tuesday/Wednesday's action and call a bull run is just plain ridiculous.

Here's something Trader II said:

"There is real buying here. No manipulation, no scam..just pure buying."

Oh, I see. So what you're saying is that YOU'RE buying here???

Or exactly WHAT are you saying? Besides spouting more nonsense about what you SEE on the charts.

Anyone can simply "report" what he reads off the current chart. We don't need reports of the CURRENT trading day here, we need technical predictions for the NEXT trading day.

-Tony

yes, can we hope the same next week. Lets have another 5% rise in the indices.

oh! why just 5%, may be 10% next week, and then 20% the week following and so on.

"On the week, the Dow is looking at a weekly gain of about 2.4% while the S&P 500 is up around 2.6%. But it's the technology-rich Nasdaq Composite that's seen the most buying, surging 4.9% on the week, as investors snapped up beaten-down tech stocks." -- MarketWatch.com

Largest point gain in a week for the Naz since 2002.

What if we had a bear market and nobody came?

;-)

To the perma bulls on the board: explain how the market will continue to go up... with slowing growth.......globally.

Companies will guide down ....and that will cause serious multiple contraction......

All it really takes for the market to go up is lots of money......however at some point fundamentals, data, news coincide with market actions.

I say please keep being complacent.... this has happened before- history repeats itself especially when you are dealing with cycles.

Costas, re: shorting before the weekend

One thing I have noticed is that bsi knows what the hell he is talking about. I also do not get the feeling he is bear or bull-he just trades what he sees. He is trading based on indicators, not a four day rally.

Good posts, bsi. I am very new to trading and am learning a ton from you. thanx

-Jana

"Largest point gain in a week for the Naz since 2002."

And nobody finds this to be unusual or unpredictable at all????

Pray tell, exactly what were the catalysts for such a huge run in the Naz??

Dell beat earnings!! Oh, yeah, that wasn't it.

AAPL crushed earnings!! Oh, no, that wasn't it.

Oh, that's right. CPI was 0.2%. I almost forgot.

It's not as though we've seen an 80% decline in the Nasdaq like we did from 2000-2002, which would act as a catalyst for a rally at the bottom.

This action is completely ridiculous and even the bulls have to admit that a 5% rise in ONE WEEK is absurdly out of place.

Tony,

You can go back and see my post on Tuesday Morning. I was the one that replied to the troubled Annon about exiting his losses with stops. Also note thru out the day i was telling folks to have tight stops on this leg up. I've been reading this blog for some time and don't usually write. But when i read about the troubled individual that asked for help, all you bears told him to hang on, average up, the top is near & etc. As a trader, i can say it was the wrong advise. If that individual have listen to people like you, he/she would probably lost another 25-50% of their put values. Hope don't make you money in this market.

We are heading higher next week and probably straight up to 11,700 til the end of the month. FYI, 11,700 is only 300 points away, not very far fetch now is it???? And yes, housing is bursting, high inflation, yada yada yada...old news.

The Trader II

man, wasn't that bad timing for going short on BRCM. They just released some PR news saying that they received delisting notice from Nasdaq. This will drive the stock higher on monday I guess :-(

I will stopped out probably in the pre-market itself.

Anybody else buy those Aug 600 OEX calls for .75 2 days ago.Hope so,they closed at $1.50. 100% return for very minimal risk.

What a day, wish i could have posted during market hours but too busy, anyway shorted AMZN for a huge .12 haha and MRVL for a huge 6 cents those were my daytrades. Besides that this market is weird, not because its doing what its doing but just look at DELL today, down over $2.00 only to reverse and trade down only 50-60 cents. AMD down over $1.50 to erase nearly every loss. Then good old BRCM, hmmmmmm back to 30+. YAHOO gaining again today. Im looking at DELL/AMZN and BRCM as shorts for Monday. DELL does not deserve a $22 stock price. Maybe $18 but not $22. Especially with the SEC probe.

CNBC is starting to HYPE once again, talking about how the dow is shy of 6 year highs etc etc etc. Still waiting ever so patiently for that little box they put in the center of the television showing how far off the DOW is from fresh highs. Looking foward to that one.

I think if we rally again next week i will certainly believe 11700+ is about 75-90% possible. If we do touch fresh highs how high we go is anyones guess. However im sure the next drop will not be a pretty one. Next drop could EASILY take us below 10660 on the dow and 2000 on the nasdaq without a problem.

Ill just sit back, laugh and watch cnbc hype up 6 year highs. Then laugh again in 2-3 months when the markets are falling.

Trader 2006

Folks,

I'm done here. Apparently there's another moron posting as me (trader II) and this seems like a joke to some of you.

Trader II

Post a Comment