Yeah, We Do.........

I've been mixed up with computers a long time - - since 1979, actually. And I've been involved in electronic communities since 1981. Yes, you read right. I've been doing this a while. And I've learned a few things along the way.

One thing I've learned is that there tends to be an inverse correlation between how a person presents themselves (when they can hide behind a facade) and how they really are. This applies particularly to personal appearance. A shining example of this appeared in last Sunday's New York Times, which profiled a number of serious electronic gamers with their avatars. Here's a particularly painful, poignant example:

So the enormous mass of protoplasm on the left is the human. And the svelte, strong, serious warrior on the right is his representation of himself in the virtual world of Everquest.

Now, if you read this blog at all regularly, you really have no reason not to do the free sign-up for BlogLog, since it's a kick to see who your fellow readers are (savvy, witty folks, by and large; with at least enough good sense to swing by here once a day). But I am highly confident that no one reading my blog looks like this.

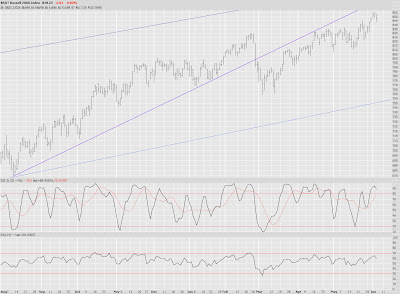

My caution yesterday was very well founded. In fact, it was spot-on. The market opened. It farted around a bit, then it fell hard. And I closed out my DIA and RUT puts at huge profits.

Then I bought calls. But........because I'm an idiot......I sold them shortly thereafter for breakeven. Then they spent the day going up 20%, so that was about $8,000 down the toilet. Like I said: an idiot.

But tomorrow is - at last - the big day. That's right - it's Blackstone day. Apparently the demand for shares in BX is about seven-fold oversubscribed. Nothing would be more poetic than the market taking a fall tomorrow. As for BX, I guess it's almost certainly going to close well above its offering price. I guess. But there's something about this offering that I think is rather pivotal in the world of investor psychology.

Anyhoo, my intuition is that tomorrow is that we're going to resume the fall. Perhaps even taking out Wednesday's lows.

One of my favorite real estate shorts now is Kilroy (KRC). If this stock can break its neckline, this is a honey of a pattern. Quite large.

If the market is on the weak side after the opening bell tomorrow, I think some 3M (MMM) puts are probably one of the best places to take advantage of any downside action.

I've mentioned Micron (MU) as a long a number of times. This is a great little pattern, with a volume swell to boot.

It's been quite a week. Let's see how Blackstone day treats us. See you after the close. Oh, and this is me. For real.