Give It Up!

“To the last, I grapple with thee; From Hell's heart, I stab at thee; For hate's sake, I spit my last breath at thee” - Melville

Well, bulls, you had all week to try to make your new high, but it didn't happen. In spite of having the entire world on your side, as well as CNBC, you couldn't pull it off. I saw some articles torture the data so they could try to make news out of the week. For instance, I read that the high price on Wednesday exceeded the closing price from January 14, 2000. And they tried to spin that as a "new lifetime high." Who cares? Give it up!

Before going into stocks, let's take a peek at our beloved OIH. I wasn't too happy with today's action. My 131.07 contingent order didn't get taken out, but I'd prefer seeing the price fall away from the retracement. We're still in play, however, and so long as we don't violate our stop, we remain positioned in puts galore.

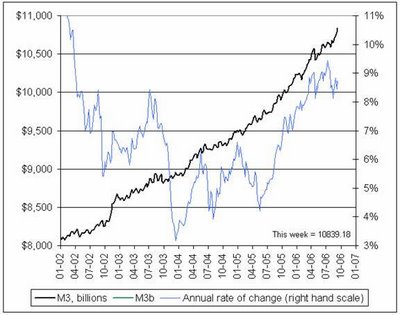

The Federal Government started hiding the M3 figure earlier this year, but some intrepid souls have been able to compute it in any case. The graph below illustrates how the Feds have poured cash into the economy to keep things floating. They're eventually going to run out of this fuel, you realize. This house of cards can't stay propped up forever.

I've got puts on QQQQ and $NDX. Today was a nice bearish engulfing pattern. In mid-July we had a different (bullish) candlestick, the hammer, which proved quite prescient.

The Dow, which is what everyone has been watching, fell 40 points today. It came within 9 points of its all time high at one point. Hey, bulls! Psych! All the same, there's no doubt the past few years have been good to them in general. Notice the huge push up in 2003 and the less pronounced push up since then.

I am trusting Mr. T to keep the markets down on the Russell 2000. The most recent horizontal line drawn is my line in the sand. We want to see prices fail below this line to affirm the death of the bull market.

Meanwhile, the $XMI, which had the most bullish of all the index patterns, seems to be pooping out.

Now for some specific stocks on which I own puts and obviously feel good about from a bearish perspective. Cummins (CMI):

Capital One Financial (COF):

Monsanto (MON):

Panera Bread (PNRA), which a blog reader said was too dangerous to short. Well, so far, so good.

And old favorite Sears (SHLD). I mean, come on, people. It's Sears. Have you walked around a Sears lately? Not unless you're shopping for a lawnmower or mattress. What a hole!

See you next week. Victory, come visit us in October!