Thank You, Commodities!

It was a sweet trading day. Gold and oil, mentioned as shorts here many times, got completely trashed. Looks like there may be plenty more trashing to come. Here's the latest chart on OIH, which has plainly broken its neckline, along with some possible support levels on the way down.

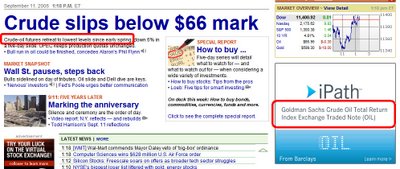

Funny enough, since oil peaked in the first half of May, there was a scramble to generate financial instruments based on this once-again hot commodity. Some web ads can be awfully ironic.

Here's the $XAU, which got nuked. I see a lot more potential downside here. Today was an extraordinary gap down.

The S&P 500 ($SPX) has until recently made a series of higher highs, which is what a bull market is made of. I think the trend may have changed. I've illustrated the "chain" of higher highs and what I think might be the first link in a new chain of lower highs, which is what a bear market is made of.

The $OEX, bless its heart, broke under its trendline, and it's struggling to mount it again. I think it will fail. Which means we here will succeed.

Here's a lovely example of the power of trendlines. ATW broke under its trendline. It struggled mightily (as the $OEX is now) to get back up. It kissed the trendline. Then - - sayonara, cowboy.

Genentech (DNA) gives us a great example of a failed pattern. This was a gorgeous saucer shaping up. Even I mentioned it as a bullish pick (gack, gack, cough). Today changed the picture. No more saucer.

Although I have no position in GRMN, this might be a nice head & shoulders pattern which is nearly completed.

The same applies to HYDL.

This market is a lot more fun these days. Hopefully there won't be a "gee, no attack on 9/11 anniversary" rally tomorrow. The bulls will buy based on just about any premise. Anyway, see you here on Tuesday.

102 comments:

Yes, where else is money going to go but into stocks? Bonds are expensive, and real estate is weakening. The Fed always hikes until something goes wrong, so were it not for the popping of the housing and commodity bubbles rates would have continued higher pushing the economy into recession. Growth will slow but it probably won't go negative.

Real estate rose sharply as stocks fell from 2001-03. Stocks will rise as liquidity exits commodity plays.

holy crap. did my account just explode? I don't get it.

I had shorts on PD, FTO, NUE, and TS - and they all just bottomed out!

TS and NUE just broke a really nice triangle pattern. So if you want to still jump on board, looks good.

but after today's action, I just had to sit down for a moment and try to understand what just happened.

happy trading everyone! and I hope there's plenty more to go...

not all good though. I had to get out of my housing stocks (MTH), because it jumped above resistance. I don't know whats going on with that (or the other homebuilders), but it seems sideways/bullish for the short term...

once its figures out which way its SUPPOSED TO GO (down of course), it would be prime. Its hugging a really strong support level/52wk low

Once it has good volume on a breakdown ... TIMBER (no pun intended)!

JOE had a fantastic jump today. Very hard to explain though since its a real estate development/trust sort of type of company

JOE can really be um, testy, shall we say. I made some good money on it May-June...figured it was going down to the 30s because it still has a nosebleed PE, while all the others continued to tank. That obviously didn't work out. I think it is so sold short it may take months to work out. Very violent moves, often times the opposite of the market in general. Since end of July he's been making higher highs and higher lows...no more JOE for me.

Funny how all the indexes closed slightly up today, yet the NYA was down -$32.47! Every other stock blog I scan (about 20) is majorly bullish....FWIW.

I have OCT puts on the following:

CAM

HLX

LLL

MRO

NOV

UNP

Happy trading all.

Lee

"If I - the bear of bears - the Cassandra of Cassandras - start hunting for something to buy, you know that the market's about to fall. And so it has. "

-----------------------------------

Almost, Tim. The commodity-related stocks have fallen. Other sectors are showing potential signs of life and the major indices closed UP (albeit only slightly) today on higher volume. Select retail and tech stocks are starting to look interesting-- at least for the near-term.

RE HYDL....NSS would have looked like a nice candidate as well...until the buy announcement! These stocks are down from April highs. MVK was scooped up, and now NSS.

If people follow the law and don't leak information, a buyout isn't going to be reflected in the chart, so that's a risk we have to take every day with every stock.

just like to point out the always bullish posters here ... sanjay sola, trader II, downosedive, super bull (what else)

These guys live in fantasy land and probably wish to suck Bernanke's kok. I mean really, do you expect the market to just pick new leadership here and not even pause let alone break down badly?

WTF do you think carried these markets higher the last five years? Wasn't tech! Resources are correcting badly, we are back to June lows. Housing stocks are in the toilet and the financials are just starting their nice decline. This is it fellas. The time has come to go short! You really think your QQQQ's will hold this market up?

Trader Fred

sanjay sola --- go ahead then, BUY AWAY!!! but pls take a look at the Asian markets overnight ... i think they missed your post!

And then the Nikkei came back....

down with terrorism and bulls.

Tim, agreed. I had looks at OS, HYDL, LSS and NSS over Friday and Monday with the intention of shorting. I ultimately decided not to given what I knew about the overall attractiveness of each of these players. I felt that the individual stock risk was too great.

Glad to see a lilt in your posts!

sanjay (and Tim)-- mcclellan's are almost dead neutral, not oversold or overbought on a short-term basis. As for the lower highs-- the $SPX has a series of higher highs and higher lows over the past two months as it attempts to climb back to the May high. Too soon to declare last week's high a "lower high" than the May peak until or unless the uptrend from the June low is broken. Cheers.

Trader Fred - oh dear, no no no, please Im not a bull in the sense that I agree with all the educated bearish analysis on this website. BUT......the fact is noone else is listening and the DJA just keeps on retaining its strength. To that end, Im in despair to the point of continually predicting an uptrend, because sentiment rules over technicalities and indeed reality itself. As long as this continues to be the case the market indices will not fall. With all the bad news that has come out and continues to come out, surely the question is.....just what will it take to turn sentiment away from buying and in to sustained selling? Beats me. A reality check, just aint doing the trick right now and there is no reason to suppose that is going to change in future. Id sure LOVE the DJA to collapse, but I cant continue to hope for that and ignore what is actually happening in reality. Keep posting those bearish thoughts !!

qqqq's weekly continues with rising flag, with more volume an down weeks, still bearish sign, but not confirmed until breakdown or breakout, with my signals just showing overbought on this chart, see how long it can hold.

people here seem to forget this is an T&A blog,(bearish, but still technical none the less) you should trade accordingly instead of attacking each others point of view, disagreement is good, someone has to buy or sell you stocks,options etc. , without difference of opinion there would be no markets,!! same thing makes a horse race, DIFFERENCE OF OPINION!!

this effin' sucks ... when will we get an honest to goodness bear market? With resource stocks falling apart the market still manages to hang in there. I give up! I won't buy because every bone in my body is against it, but being short is costing me dear! Wake me up when things turn for the worse (or better)

Trader Fred.

P.S. sorry for my rant on the bulls, but you guys are one idiotic bunch -- except downosedive, he's a cool brit!

Hope you got long BOOM. Big news today. Up 7% premarket.

to finish up on the qqqq's , the daily charts continue to show upside momentum, a break of 39.25-39.50 with volume could be big with no recent resistance above til @ 40.50- 41.00. , not saying its going there, just making observations, (so settle down freddy) , i do see upward movement on the dailys , but bearish on the weeklys, (need this to breakdown for my puts,) this report on fri will force move one way or the other short term at least, weekly rising flag going on 4 weeks now, move could be anytime,in next few weeks,

Hi guys,

Sandisk SNDK looks ready to breakdown hard...... the chart tried to rally past its trendline twice yesterday then closed near even...... It is now below its uptrend line......

Looks good down to the next fibonacci level 52-51 area......

Cheers

Remember yesterday we had a couple of hours of red followed by green, I hope today we get a hard sell-off by the close. A few blogs I read said to buy on dips due the TRIN and where it sits today.

Looks like another bad day for the Bears.

Feel like buying some shorts but think of holding off ahead of the inflation data due out on Friday.

Trader 2006.

oh, do I ever need a reversal day today!!!

TF --- yes, totally fucked!

By Scott Malone

BOSTON, Sept 7 (Reuters) - The cooling housing market and a softening of capital spending will bring a slowdown in U.S. manufacturing activity next year, according to a study released by an industry trade group on Thursday.

The Manufacturers Alliance/MAPI forecast that U.S. industrial production will rise 2.5 percent in 2007, off this year's projected 5 percent growth. Excluding high-tech items like computers and semiconductors, industrial output will rise 1.5 percent next year, following this year's 4 percent growth, the group said.

"The housing market has turned, it's going to be down this year and even down more sharply next year," Dan Meckstroth, chief economist of the Arlington, Virginia-based trade group, told Reuters.

"So we don't have the home equity generator that was there in the past, and without that home-equity generation, that's going to constrain consumer spending," he said.

Rising home prices have prompted some U.S. consumers to take out second mortgages, using the loans to fund other purchases.

Meckstroth said capital spending by corporations could also cool next year, following a spurt of investment in new diesel engines ahead of new U.S. emissions regulations set for 2007 and a surge in manufacturing along the U.S. Gulf Coast after 2005's devastating Hurricane Katrina.

The group predicted that production of housing, household appliances, motor vehicles, steel, construction machinery, and engines and turbines would decline next year. That could take a toll on home builders such as D.R. Horton Inc. (DHI.N: Quote, Profile, Research), appliance makers like Whirlpool Corp. (WHR.N: Quote, Profile, Research), and heavy equipment makers like Caterpillar Inc. (CAT.N: Quote, Profile, Research)

"We do expect a recession," Meckstroth said. "It's just a question of when."

Im hoping for a huge reversal today, but I dont think were going to get it.

Trader 2006.

It's clear to me everyone got WAY too bearish in July.

I can give you many reasons we should have a sizable move down...but what does it matter.

This market just F'ing WILL NOT GO DOWN.

JOE (St Joe Land) is up 10 points since yesterday's low. WCI, a bk in waiting, is also being very strong.

Hey right on Trader Fred! Heck this is the craziest DJA, when oh when will this madness end?????

Well, it looks like they are really intent on tightening the noose around the bears necks for this EXPIRATION week.Mine included.I'm the genius with the OEX 610 puts.Everytime I leave and come back for a look, five minutes later everything is stronger.The NASDQ,the SOX,the Transports,the S&P.etc.I guess oil holding at 65/66 isn't exactly bad news either.Blah Blah.Just ranting in frustration.Hope Trader Fred is right about Friday."Hope" springs eternal. Good luck to all!!

Denver

AAPl is REAL going to $100, it has been strong every single year for its whole existance during sept to dec time. Why should this year be any different. Strong buy on AAPL, another 40% run up for the remainder of the year.

Oil down 24 cents, Dow up 59.....but when oil goes up by a simila amount, does the Dow fall by a similar amount? Heck no, it goes up. All the commentry trying to justify the indices movements is just hot air. If the market turns those same reasons will be given to jusify its fall. But its looking an increasingly big IF, IF, IF

Un-fukkin real! will da' bulls EVER give up? I mean the ship is sinking and what do they do? BUY! I've never seen anything like it!

GIVE ME MY MONEY BACK, BULLZ!

TF

I hear you downosedive ... everything is working in the bulls favour ... I give up!

Trader Fred

I will say this, the next drop in this market will most likely happen in mid oct-nov time and I think it will be a june-july repeat. I dont see the market going straight up for the next 4 months. Its going to pull back at LEAST 5% from around this area before it moves up again.

Again I agree with what some of you are saying, how it just continues to go higher for no reason at all, oil is still high. I could see if it were trading at 35-40 but its still trading in the mid 60's.

There is really no other catalyst to push this market higher.

Trader 2006.

sanjay i was thinking of buying some more QID around ndx 1600-1610 area.

AS FOR TOL

HAHAHHAHAHA, pathetic, that stock will be in the teens in the next 8-12 months.

Trader 2006.

I think the world will stop revolving if the markets fall, THAT is why everyone (execept us) is buying. So there you have it, WE, da' BEARZ are the mortal enemies of the world. So let's be nice and start buying!

AAPLBULL, do u think the iDildo will do the trick for AAPL $100?

Get the f*** out of this site. This ain't no place for any damn bull.

This market test bears nerve!!

die AAPL, RIMM, SNDK

no you silly! It's the iDildo and the free BJ by Steve (blow) Jobs! That will get us to $169 (by year 2074)

Goldman, USB and Amtech analysts can't be all wrong here. 1 million macbook sales this q should do it and that is what the channal checks are indiction. Bears better cover under $80. Release of iDildo can only help! Steve will get eps number to exceed expectation by a mile even though it means a blow job. ROTFLMAO.

Data not showing up on the Proshares!!

Trader 2006.

News flash the S&P and DOW have regained their uptrend lines....HOWEVER.....they will not close above today.....

I think this is a really good place to short.

SPY, DIA and SNDK

AAPLBULL, yes please do rely on the analists. Also I suggest to put all your money on AAPL. The Analists will rob your money and screw you analy also :-)

I'm going long, screw the rest of ya'!

- my portfolio is crying!

Today my Small Cap Swing indicator moved to a LONG

signal, at least from an intra-day perspective. I warned

yesterday that a switch to LONG could happen anytime.

To be a verified LONG it must remain LONG at the close.

Here are the recent values of the latest swing signals.

. . . . . .Small

. . . . . . Cap . . . . . . . . Russell

. . . . . .Swing . . . . . . . . .2000

Date . . . Ind . .Signal . . % Chg

08/28 . . +05 . .LONG . . +1.1%

08/29 . . +23 . .LONG . . +1.2%

08/30 . . +39 . .LONG . . +0.8%

08/31 . . +48 . .LONG . . +0.0%

09/01 . . +52 . .LONG . . +0.1%

09/05 . . +62 . .LONG . . +0.8%

09/06 . . -19 . .SHORT. ..-2.1%

09/07 . . -43 . .SHORT. ..-0.8%

09/08 . . -61 . .SHORT. ..+0.3%

09/11 . . -72 . .SHORT. ..-0.1%

09/12 . . +08 . .LONG . . +1.3% . Intraday @ 12:00noon ET

Normal LONG target: . . +65 to +75 (max: +95)

Normal SHORT target: . -65 to -75 (max: -107)

My personal bias is that this LONG swing will be short-lived, much like the latest few swings (4-5 days). It could switch back to SHORT as early as Friday.

WHY THE F#$# DID I SELL RTH!!!!!!!!!!

I had it at $91.00 now its at $97.23 in 3 weeks. WTFFFFFFFFFFFFFFFFFFFF

Wish I had more patience.

Hope this MARKET TANKSSSSSS

Trader 2006.

LOL! I relied on goldman's upgrade at $60 and brought in. Now 80 days later, it is @$73. They have not done me wrong so far. I will wait for goldman's downgrade to sell.

Oh, wait maybe I should listen to anonymous poster on a blog.

GM is at $33! Man they make some good cars!

Ford at $9!!! --- short, short, short!

Anonymous said...

I'm going long, screw the rest of ya'!

- my portfolio is crying!

9:03 AM

thats when you lose money.

Im playing one side and thats the short side. I will wait very patiently, even if I have to wait 1 or 2 months. I have seen this too many times before. I sold my RTH extremely early because I was not patient. Im going to stay on the short side and wait till we have that nice 500-800 point slide in the dow. And 150 point selloff in the nasdaq.

Trader 2006.

AAPLBULL, lets wait for couple of hours and observe what happens to the AAPL stock

anonymous, regardless what you bears think these markets just refuse to go down. What could happen in couple of hours.

Sandisk SNDK is off its highs....looks like it wants to break down.

Looks like a good setup

Okay, I have a change of heart. I just sold my yummy AAPL @73.2. Now may I get permission to post here? LOL!

AAPL could close in the red today. Just taking a WILD GUESS.

Trader 2006.

Tim......Hats off for some excellent charts!!

.....I notice here on this blog a lot of trading being conducted WITHOUT a SPECIFIC REASON ...dare I say mostly on emotion and hope...I am afraid to say that this leads to ongoing losses for most of us.....

(I will admit though that this is exactly what I did in my younger days....:))

Anyways....sold all my Google Sept.380 calls(GOPIP) at 11.90.....

I still own the common for a target of 420+ in the next 3/4 weeks....

My best to all of you...and thanks again, Tim.

"AAPL could close in the red today. Just taking a WILD GUESS.

Trader 2006. "

How red? a tiny bit red or crimson red?

AAPL IS REDDDDD

TOLD YOU

TRADER 2006.

AAPL is trading all over the place. Guess the new products arent as hot as many thought they would be.

Trader 2006.

"AAPL IS REDDDDD

TOLD YOU

TRADER 2006"

But I asked you how much red......don't wait for it happpens

SANDISK GOING RED......

What the heck is going on with the Retailers?????????

I didnt wait:

Anonymous said...

AAPL could close in the red today. Just taking a WILD GUESS.

Trader 2006.

9:37 AM

Wrote that at 12:37pm when AAPL was trading up about 50 cents.

XHB up to $32.86, i might be extremely bearish on the homebuilders but next time XHB dips below $29 Im buying it just for a TRADE.

Next time RTH dips to $90 I buying it FOR A TRADE.

Trader 2006.

TOL up 1.24

WMT up over 90 cents

BBY up over $3.00.

Come on,..

Trader 2006.

AAPL falling hard - down below 72 now. How far will it go, any forecasts?

AAPL close $73+ just watch

Trader Fred, I down about 9000 dollars at this quarters expiry. I cant just write this off. I still intend to short again to try and recoup some of this, but goodness knows when. Im just blown away with the DJA - 800 up from its last low and still going strong, unbelievable

PXJ, its an oil ETF, trades like OIH, Im starting to get bullish on PXJ, think if it dips to around 17.25-$17.50, could be a strong buy.

Trader 2006.

The HGX homebuilders index is now up 3.6% for the day.

Yeah...that real estate problem is all over now. Buy up!

but seriously...we are (unbelievably) going to get another chance to make a killing shorting these things....

Thank you God.

10:48am

Agree. Its not over, Homebuilders will fall another 25% or so in the next 6-12 months

trader 2006.

What is the fuel for the homebuilders shooting for the moon?

Why the charge up these last few days? Does anyone know?

Who is buying after the influx of earnings warnings?

The homebuilders here in Florida are knocking $100 grand off home prices to get rid of spec homes in my neighborhood. There are 10,000 homes on the market in my county alone.

Who in the world thinks these are good, stong buys?

- Jana

WTF WTF WTF ...

All this mother f***ing hype and we get this ....

......................

SAN FRANCISCO (Reuters) - Apple Computer Inc. (NASDAQ:AAPL - News) on Tuesday unveiled a number of new iPods, including one with the most capacity to date, and said new versions of the popular digital music players would sport video games such as Pac-Man and Tetris.

Speaking at an event in San Francisco where the company was expected to introduce a movie download service, Chief Executive Steve Jobs said the new 80 gigabyte Ipod would cost $349. The company also introduced a new, thinner iPod Nano available in five colors with 24 hours battery life.

......................

damn those AAPL puts are expensive.

there is program out there that knows EXACTLY when I cover my shorts, and then drives prices lower! WTF!!!!

Trader Fred

Trader Fred, and that program tries to rob all the retail investors. I think those bastards should be screwed

Hey Tim..I've got an idea for a new market indicator. It seems like the more posts the comment thread gets, the closer we may be to a top (albiet perhaps a temporary one). Could you arrange this indicator on a daily chart overlay on the S&P??

Thanks,

Jim

eddiefl -- you are a bull, so why am i not surprised by your post?

How about the poor suckers who will have rates adjust upwards on them? Without any wage gains, something has to give!

Also, why does the market rally when oil goes lower, but does nothing when oil climbs? This market is one-way only and it's all in the bulls favour!

DIE MF BULLS, DIE!!!

-TF

the trade deficit is higher than expected, so what does the USD do?

FUKKIN' RALLY!!!

I think the market was flooded today with a BUY USA order!!!

F*&K BULL

Die BULL

What an insane market

POS

now where the fuck are you APPLBULL!! in the toilet :-)

AAPL is going to $200!

Man, this post sure has turned into a war zone! Hezbollah would be proud!

Anyways, must be near a real top, as all the BEARZ are freakin' out!

This is really Pathetic. Markets RALLLY FOR WHAT REASON. Im not worried because when we get the 2-3 day 200 point selloff you will wish you short these levels. Friday will be interesting. Either we rally or fall hard 1% or more.

I hope we get data showing the highest inflation in a decade so this dow can drop back to where it belongs. Well under 11k.

Trader 2006.

pb I want to short here as well but im waiting for fri.

Trader 2006.

if QQQQ is a buy when commodities break down, what made them a buy in MAR, APR when they were hitting all time highs?

Confused as a MF.

CSCO knocking on 22.50

go CSCO!!!

i'm sorry.....wthf is going on with aapl.....shot up $1.5 from the low....did they introduce another product?

eddiefl - your comments about a shift from real estate to shares, well well being playing a part in this rally. Money will chase money and right now the market is the hottest up action going on. The trouble is with joining in, it could just as well reverse if the speculators feel the uptrend is at its top. As to trading small, well yes of course you are right. But hindsight is a wonderful thing. I chased the shorts because thats what I believed. Im afraid when it comes to indices Tim has been just as confused and misguided as the rest of us, Ive yet to find a guru who gets it right - a major uptrend has been missed by all the bears. Your prediction of sideways to up for the rest of the year could well be right. Statistically a rise in the Dow at year end is only s 15% chance - well heck, it looks like that may well happen. Jeeze Im just shaking my head in disbelief

sanjay, what are u shorting?

I wasn't foolish enough to sit back i rode the bull folks, I fliped and entered spreads and flipped the CME into a call and many other for a huge profitable day.

I'm ready to exit near 3:55 and go to dinner.

I don't freeze in the headlights

I hide in the bush and smacked'em right upside the head.

Well the 40 pt.pullback yesterday morning turned out to be like bait on the order of a nice juicy steak with a cerrated blade hidden inside.Bears went for it hook,line & sinker.Did anyone's charts or analysis tell them that this was going to happen today.Apparently not.With all the magnificent possibilities to make money out there,What is with all the talk of trying to scalp a couple of pennies profit on Apple puts?I just looked at a 52week chart of APPL and this looks like more of an area of support than a point from which it would sell off.Lets face it fellow bears,unless this market sells off a minimum of 200 pts back to 11,300 by Fri,or lets say by Wed. of next week,we've been slaughtered and burned at the stake.

Cheers Mates

Check out BBY trading. It gaped down near $2 to bait in the shorts, then it just reversed right away and had not look back for $6.... who would want to be shor in this market?

ok so you are back with your iDildo.

What say you? why don't buy some AAPL here, some analist will upgrade it tomorrow, why not buy it today?

Ther is one blogsite that has been predicting exactly what we are seeing for the last 3 months and predicts 1400 on the S&P for the end of the year. Thats at least 800 DJIA points.If you want to check it out just for fun and comparison,the site is:

WWW.CARLFUTIA.BLOGSPOT.COM

eddiefl - wise words indeed - your real estate comments (Ive also posted before saying your real estate wont collapse, because people reajust, they find a way to cope with the only real casualties being those that screwed up their finances anyway and those that speculated 100%) and your comments about me, you and everyone else - these are indeed wise words and othersd would do well to heed them. Im touched by your comment, food for thought indeed!!

interest rates back to 0, is that the only way to keep this economy rolling.

Trader 2006

I remember last time we started entering into multi year highs on the indices, everyone was so positive then out of no where we got a HUGE decline, what makes this time any different, yes we may see new highs on the s&p and dow but it wont last. There is no catalyst to keep this momentum going. Oil could be the excuse for now but who knows where that heads in 3 months.

They will buy up this market up as much as they can but when its ready for the sell-off it will longer and worse than the one in June and July.

Back in June and July everyone was calling 10,000 here 10500 there. It never happened, we bounced and that was it. Now im hearing 1400 on the s&p, 12,000 on the dow, 12500 on the dow etc. With that being said we may touch the 12,000 level but it wont last.

Trader 2006.

USO is down 8 DAYS IN A ROW....

11-Sep-06 60.18 60.85 59.62 60.03 1,593,200 60.03

8-Sep-06 62.04 62.12 60.83 60.90 1,368,800 60.90

7-Sep-06 62.33 62.41 61.53 61.89 956,300 61.89

6-Sep-06 62.68 63.39 62.17 62.20 1,007,600 62.20

5-Sep-06 63.37 63.55 62.86 63.31 740,600 63.31

1-Sep-06 64.75 64.80 63.54 63.75 591,600 63.75

31-Aug-06 64.30 64.81 63.83 64.80 721,600 64.80

30-Aug-06 64.33 64.85 63.20 64.85 1,133,000 64.85

Trader 2006

I don't know WHAT to think anymore. My head is literally spinning!

really..

A lot of these oil service stocks are growing earnings at 20%+/year and trading at p/e ratios well under 10. Example: PDC

I guess that pesky energy shortage thing is all fixed now? No need to be drilling or exploring going forward? Did I miss the headline?

Okay,here's the deal. If you are still a "BEAR" here,thats fine.But if we actually go all the way to 12,000 from here, and then pull back to 11,700 or so,AT NO TIME DO YOU GET TO SAY - "SEE ,I TOLD YOU SO". Because that means you just missed the 800 pt. rally we just had.When you're wrong,YOU'RE WRONG !

Woo woo!!

The "gain train" is back in action. All major indices way up today. Hilarious.

Way too funny. I said it before, it's 1995 all over again. I'm not even gonna TRY to guess where we go from here. But my initial impression is that it's "up".

Trader 2006: You keep saying "I'm not worried." Well, in my opinion, you SHOULD be worried if you're still short. Unless you've picked the exact sectors that are weak right now (even I'm not sure which ones those are, besides commodities), you've got to be deep in the red. I lost my bearish disposition quite a while ago and haven't been short on anything for weeks. Granted, I haven't really been long, either, but at least I'm admitting that the market is acting funny and I'm not going to touch it without seeing some clear direction. And the clearest direction I can see (the path of least resistance) is definitely UP.

-Tony

You can pick up nickles without getting hit by the train. You may never get direction.

You can't make the market do what you want it to do.

BTW, institutional selling has actually been increasing lately. Unfortunately for the bears, the BUYING has also been increasing, actually at a faster rate.

Clearly, nobody is concerned about the outlook of the stock market right now. I would imagine the VIX has dropped back to the 12 range, but I haven't checked.

(Ok, I just checked, it's actually BELOW 12.)

-Tony

Tony, Im going to say it again. Im not worried. Just like every bear was calling for 10,000-10,500, it never happened. I was actually long many stocks around DOW 10750-11,000 but I closed most of them out and went short around DOW 11250.

Trader 2006.

When we hit 12,000, let me know if you're still not worried.

I guess if you can take the pain, and believe in a market collapse beyond the short term, then your strategy MIGHT pay off.

But then again, it might not. How far are you willing to go against the grain? There are many, many powerful forces at work in the bulls' favor right now. Lots of big money that just does not want to see the markets collapse.

For all I know, they may not be able to prevent it. But I would be willing to bet that they'll try like hell.

Good luck out there. My luck has run out a few times, so I'm standing aside for the time being.

-Tony

Tony

I dont need the markets to drop to 10,800 or 11,000, if the markets have a slight pull back of around 2-3% from where they closed today ill be fine. If they do fall about 2-3% ill sell some positions off and most likely sit in cash until the market finds a direction. Havent seen to much volatility like we did in July, however it could be back as early as tomorrow. Ill be happy to see a slight pullback tomorrow. If we rally then we rally, however im paying attention to friday. Friday could actually take the dow and s&p close to new highs for the year, thats if the economy shows little or no inflation at all.

Trader 2006.

Post a Comment