Long entries like yesterday's take a lot of time, so I'm going to make it shorter today. I must say, it was heartening to see this headline at the top of Marketwatch:

So why not get yourself a t-shirt, mug, or mouse pad to celebrate, eh?

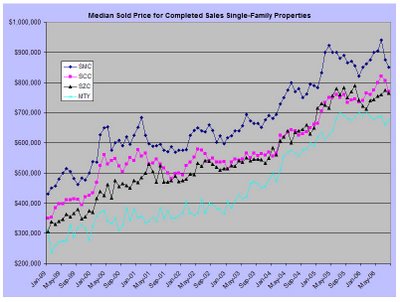

This is anecdotal, but here in the Silicon Valley, the sky-high home prices are starting to look awfully toppy. I personally tried to sell my second home (a 1400 sq. ft. basic house on a 6000 s.f. lot) for $1.4 million. Guess what? No takers! What a surprise, eh?

This graph has been shown here umpteen times, but oil has been so good to me, I just have to keep showing it. It could do great things for us. But it needs to stay weak!

Lastly, here are positions from two of my accounts (I manage four accounts personally). All of 'em puts or shorts, of course!

Let's go for a three-peat tomorrow, OK?

Thursday, September 07, 2006

Subscribe to:

Post Comments (Atom)

61 comments:

No Tim, afraid not, there will be a rebound tomorrow. We are still in bull mode for the main indices (unfortunately). I cant speak for individual shares - they may well go in the reverse direction. But for me there is only one measure to gamble on - the good 'ol' DJA. We all know the Fed wont increase rates this month - 2 days sell off used that and the current data in order to take a little profit. Thats all. Tomorrow the cry will be 'bargain hunting'!!

Tim, TLC has show last weekend about home improvement "flip that house", fixing ..changing...adding could add 25% to home value, but that's about half the price of yours

Flip

"No Tim, afraid not, there will be a rebound tomorrow. ""

Fortune teller ?

I agree the real selling has not begun yet. I think we may see a minor up day tomorrow, nothing major, however after the bell NSM had a bad report which is taking the Semis down again, you know the sector that leads the market up.

Today I sold some of my QID, Still hold a position. Also own SDS, not selling until 71++ Waiting for NDX 100 to touch 1605-1615 area to buy more shares of QID. However, I usually cant wait and will probably add a position before that. Dont want to totally miss out on the next huge decline.

Trader 2006.

as far as the apple shorters, good luck, as for that, ross perot said it best " i've never been run over by a truck i saw comin three blocks away."

The consensus is a soft-landing. But soft-landings are chance occurences. Once this ball starts rolling downhill, good luck stopping it.

Look what it took to get us there. 40 year low interest rates - all that fuel has been used up and on top of that, the flow has also been restricted. So how could there not be an affect on the economy. Please enlighten me dear bulls!

trader Fred

Downosedive -

At least your crystal ball looks both up and down.

R41

I guess it's 100 bucks for AAPL then, eh plunger? 'cause those i-pods are so vital to the economy!

i did'nt say it was going up, nor did i name a price did i, captain anonymous, just said if its so freakin obvious to anyone its going down, look out,

(or maybe you never heard of a short sqeeze )

VLO , SNDK... yahhooooooo!!!

another 100points down would be nice, before October rally.

DOW

Not enough volume the last two days to make a call either way. Still way too choppy - with little coviction. When are those damn sellers gonna get back from their summer vacation already!! They must be sunburned as all hell by now!

BTW ... Plunger, I quoted Perot LAST night ...

sorry didnt see it duggy

... no plunger, I thought what was obvious was that AAPL is going up!

easy boy!

rising flag on the qqqq,s weekly charts, bearish, but not sure how long flag will last, but it is at bottom of flag now so tommorrow could be up day or could get downside break, have to wait and see, need volume to push this

Just gotta say this one more time. Inverted yield curve (45bps diff. between mm to 10 yr)

Six of the past 7 curve inversions have led to a recession.

Very low probability that we will escape a recession this time around given the monumental housing bubble.

Cheers BEARZ!!!

-Trader Fred

P.S. still a lot of anonymlous bloggers not signing their posts!

Hi Tim,

Check this blog every trading day in the past 6 months. Really enjoy your constant bear view on stock market :)

I am bull becasue it is much easier to make money on rally mode. But traders need bear view to banlance their thinking.

Danny

I chuckle when I see references to AAPL going up. The pattern is so obivious that it is about to do a clif dive, yet everyone is expecting $100 by Xmas.

Check out AAPL GTW charts in year 2000! That is your road map to the day. I promised myself to load up on AAPL puts if we are up today! Sure the pattern can fail. But the risk/reward is highly skewed towards short here.

BTW,when Bob P on CNBC said:" we just had the best AUG since the year Two Thousand" on Tuesday, I took notes and added to my shorts at closing bell.

Have fun, I know I will.

J

damn!! those AAPL puts are so expensive. I am planning to buy AAPL Jan 07 puts since a month now, but those puts don't come down at all.

Im hoping for an up day tomorrow so i can load up on QID under 66.

Trader 2006.

sanjay:

breaking the lower trend line with rising wedget is the signal to sell, sure it may come up from down under and kiss the lower trend line, then again, it could just flush down from here....

when does the markets NOT in a confirmed rally mode according to IBD, lol.......

good luck on your long positions, as for me I'd rather stay short, it is sept baby.......going to be beary fun.......

- J

Hummm, now its looking like an either way - the futures are now zero, indicating noone knows what is going to happen. I still reckon an up day, but by how much is anyones guess. More to the point, where after that? Most of you are so reassuringly bearish, Im almost tempted to close those retched longs and run with my shorts - - I only have a few days of the contract left...ekkk

Congrats everyone as we have all come to witness the beginning of a horrifying cliff dive for the markets.

HURRAY! --- the markets are fubard, the real selling is to start real soon ... add to shorts on any rally!

Get Shorty!

duggy, not a lot of volume true, but still above three month average for last two days on s&p, naz and dow. not great but reassuring to see higher vol on distribution days. think we'll see a few small up days, real indecision, then hopefully failure of some major support WITH volume. as far as the " cliff diving" i dont see it.

anyone know a good site to follow futures in the mornings?

Goldman can not bring themselves to put a strong buy on AAPL, yet still want to pump a little, so they added to their americas conviction buy (ie bagholder addmision) list. We have a gap up in AAPL, let's see if we crap from here....

Cheers,

-J

re:AAPL

Here's your chance to short. They gapped it up at the open. Buy to cover above the 73.80 area.

Do your own homework.

bsi87

re: globex futures

http://www.cme.com/trading/dta/del/globex.html

re:AAPL

Looks like anything above 73.13 is a gimmee.

bsi87

re:APPL

burning a lotta fuel, 5 million plus, and it's not holding the opening price.

ZZZZZZZ.

bsi87

re:APPL

If it trades below the open AND the previous close, I doubt that traders are gonna want to hold long into the weekend. (OOPS, it just traded below the close)

re: bonds

Suspicious rally. Might have to short some but more likely next week.

re: gold

Starting to look interesting...again from the long side.

bsi87

re:

AAPL

collecting lotto tickets here slowly at 0.5/each for oct 57.5 puts. just as goldman has it on americas conviction buy list.....it is on my conviction earnings' warning list....... this or next q is the inflection point for aapl and ipod.... I am puting my money where my mouth is....

without ipod aapl would have been no different from gtw.....the hype of computer and notebook sales is going to hold aapl at 3.5X sale is laughable.....

AAPL

collecting lotto tickets here slowly at 0.5/each for oct 57.5 puts. just as goldman has it on americas conviction buy list.....it is on my conviction earnings' warning list....... this or next q is the inflection point for aapl and ipod.... I am puting my money where my mouth is....

without ipod aapl would have been no different from gtw.....the hype of computer and notebook sales is going to hold aapl at 3.5X sale is laughable.....

-J

AAPL

wow QAA VY 7558 vol @ 0.45 right after my last post. I got a few filled as while. the trade is on man........

-J

Tim - Like your blog

Look at these charts. Nearly every major equity index has broken down out of a rising bearish wedge. If you know the history of the bearish wedge, then you should know that we are looking at 5-7 days minimum decline. How you can say the indexes are at "support" is beyond me.

Whoops - here is the link:

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID1826437&cmd=show&disp=o

anybody have an opinion on bidu?

damn thing won't breakdown.

re:SLV

putting a buy limit order in at 119.43. There was a low put in a few days ago at 118.53 so my sell stop will be slightly below that. Risk will be about a buck per share.

re:AAPL

broke down out of a very ST ascending triangle with resistance at 73.48-73.58 area (below the 73.80 previous top). Measures down to 71.50. That'll make 'em puke.

bsi87

bsi87

re:OIH

bought some on retracement from yesterday. 136.60 high, 133.33 low

1.63 difference, limit order at 134.96.

bsi87

Mkts are oversold on the hourly charts. At this time, I'd look to short the Russell 2000 around 725, the DJIA 11,475, and SPX around 1312.

It'd be sort of a ST double top. A reversal around those averages would be a clincher.

JMO, no positions in the indices.

bsi87

carlfutia.com has some interesting points on gold/silver.

R41

AAPL

closing at $70 today...

-J

On 9/06/06 my Small Cap Swing Indicator moved to a

SHORT signal when the market gapped down.

Here are the recent values of the latest swing signals.

. . . . . .Small

. . . . . . Cap . . . . . . . . Russell

. . . . . .Swing . . . . . . . . .2000

Date . . . Ind . .Signal . . % Chg

08/28 . . +05 . .LONG . . +1.1%

08/29 . . +23 . .LONG . . +1.2%

08/30 . . +39 . .LONG . . +0.8%

08/31 . . +48 . .LONG . . +0.0%

09/01 . . +52 . .LONG . . +0.1%

09/05 . . +62 . .LONG . . +0.8%

09/06 . . -19 . .SHORT. ..-2.1%

09/07 . . -43 . .SHORT. ..-0.8%

09/08 . . -62 . .SHORT. ..+0.1% . Intraday @ 12:45pm ET

Normal target for LONG: . . +65 to +75

Normal target for SHORT. . -65 to -75

Oil per barrel is at 66.70.....BELOW its 55 week moving average of 66.90......the next SUPPORT ---(yup you may laugh now)...is at the 200 week moving average at 47.35..........

re:OIH

stopped out for .7% loss.

bsi87

yeeeeeeehaawwwwwww...the bears will win this battle boys...

Covering my gold short.

bsi87

There is that little up day i was expecting. As for oil dropping down to the mid 40's based on a moving avg, how is this possible when supply and demand get in the way. How can oil fall based on a chart when supply data can totally reverse its downtrend?

Trader 2006.

Oh boy

It is suck to be bear in this market.

die AAPL GM

perfect rally on cntracting volume today. It going according plan so far. A little bit of spike Monday morning and then a new downdraft should start.

Costas1966

hoping for a HUGE PUMP-UP in AMZN with the new video download, I will f***ing load up on Jan 07 puts.

AMZN up a bit today, AMZN will most likely run into the upper 30's low 40's like it has done in the past years on anticipation of holiday sales. I dont see how it could even be worth 30 bucks a share.

Trader 2006.

costas agree. I hope they take the NDX to 1600+ area. Will load up with even more QID.

Trader 2006.

bsi,

Thanks for your detailed short trade on AAPL yesterday. I went long 2 days back at 70.10, sold it yesterday at 73.20 and went short at 73.15. Lets see how it goes, another day to go.

anyone catch cnbc today, one of the talking heads said that housing will slow, but will pick back up next year. It was very funny.

Trader 2006.

what is wrong with all of you bears??? Can't you see NOTHING CAN KILL THIS MARKET???

hey guys, its been a while, nice to see some of ya.

been trying a new strategy, looks like its working like a charm, so far...

anyways, I ran some scans, and I found MTH as a nice shorting coming really close.

a lot of the housing stocks are getting close to key support levels.

Im keeping an eye on kbh, and tol really.

but MTH looks pretty prime.

sitting by the computer for another 12 mintues just watching tickers flicker...

Im still really hesitant on AAPL, i think it will break down, since today was a key break of resistnace, but is doing so on a really bearish candlestick - wouldn't trust the breakout as anything convincing...

BZH looks ripe to pluck as well... Im looking at Puts probably tomorrow, today is a really bad looking top... i need conviction.

traders came back on wendnesday went back on vacation today again? very low volume up day, don't you just love those?

As far as aapl goes, sign of weakness late day, should see $67ish by Tuesday next week baring the announcement of iCancerCure.

Nice weekend!

-J

would iDildo work for now?

"anyone catch cnbc today, one of the talking heads said that housing will slow, but will pick back up next year"

gotta say, apparently Mr. Market agrees; 2 days of bad news from the home builders and most of the stocks are up...some by quite a bit. JOE announces things are so bad they are completely giving up home building and the stock is up $2 or more at some points today! The p/e is in the 50s!

Gold miners, after breaking out to the upside on Wed imploded yesterday and today.

Meanwhile the Dow completely refuses to die.

where is my martini?

Trader 2006

Your point is well made....my understanding is that technicals PRECEDE fundamental information and therefore provide a window of opportunity for the investor.....that would not be there if you were using fundamentals alone....also if you go back 5 years you will see the run that OIL has had...and to loose a third of its value would not be too surprising...

My best ....

Post a Comment