Opportunities Abound

I'm not worried.

See the serene look on my face? That's the look of a calm bear. I take today's huge gains on the market in stride.

Sure, I got stopped out of a lot of positions. But that's the purposes of stops. It saved me a lot of money. Losing money is OK. Losing a lot of money by not having stops, hoping things will turn around somehow, is not OK.

I'm not going to offer any specific stock suggestions, although, believe me, tons of them abound. Just a quick market overview in the face of a very ugly rise in the market.

The Dow, up well over 200 points today, made the "topping" pattern (intraday) mentioned a few days ago moot. However, it is still well positioned for a fall. It's pushed up against its former support line. I'm not sure how the weirdness of "day before the July 4 weekend" and "short July 3 trading day" will muck things up, but we have to ignore such circumstances and consider them ordinary trading days.

Now, if the Dow pushes based the zone I've put in green, it's a very different story. But we aren't there yet, and we may never be.

The S&P likewise is still in good shape for the bears. Notice how the succession of lower highs and lower lows is still very much intact, even with today's explosive rise.

Same deal with the S&P 100 (the $OEX). It broke below its trendline. It is clawing its way back. But it's still in a bearish situation.

The Dow Transportation Index is a bit of a surprise. It had a breakdown earlier, but it's managed to shake it off. I'd say this is the least bearish of the major market indexes.

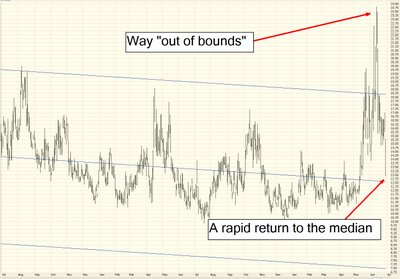

One nice thing about today's action is that it creamed the $VIX, which means that puts on the S&P just got a lot cheaper (in both intrinsic and premium terms). Notice how the $VIX has reverted to the median of its linear regression channel.

You might want to look in oil services for good short opportunities - or the OIH itself. To me it seems like this has shaped up as a beautiful bearish play.

The same analysis applies to the Gold and Silver ($XAU) index. A rapid retracement to a broken support line. Looks great to me for some puts.

Take heart, bears. In the summer of 2000, even though in retrospect we can see the market was already going into bear mode, lots of stocks were reaching new lifetime highs. The bear market started in March 2000, but people didn't really cave in to it until later that year. Our best hope at this point for some serious damage will come from disappointing Q2 earnings, which start reporting next month.

In the meantime, don't let the fact that the 17th interest rate hike is probably the last for a while substitute as a great reason to rush into the U.S. equity market. It's idiotic.