Opportunities Abound

I'm not worried.

See the serene look on my face? That's the look of a calm bear. I take today's huge gains on the market in stride.

Sure, I got stopped out of a lot of positions. But that's the purposes of stops. It saved me a lot of money. Losing money is OK. Losing a lot of money by not having stops, hoping things will turn around somehow, is not OK.

I'm not going to offer any specific stock suggestions, although, believe me, tons of them abound. Just a quick market overview in the face of a very ugly rise in the market.

The Dow, up well over 200 points today, made the "topping" pattern (intraday) mentioned a few days ago moot. However, it is still well positioned for a fall. It's pushed up against its former support line. I'm not sure how the weirdness of "day before the July 4 weekend" and "short July 3 trading day" will muck things up, but we have to ignore such circumstances and consider them ordinary trading days.

Now, if the Dow pushes based the zone I've put in green, it's a very different story. But we aren't there yet, and we may never be.

The S&P likewise is still in good shape for the bears. Notice how the succession of lower highs and lower lows is still very much intact, even with today's explosive rise.

Same deal with the S&P 100 (the $OEX). It broke below its trendline. It is clawing its way back. But it's still in a bearish situation.

The Dow Transportation Index is a bit of a surprise. It had a breakdown earlier, but it's managed to shake it off. I'd say this is the least bearish of the major market indexes.

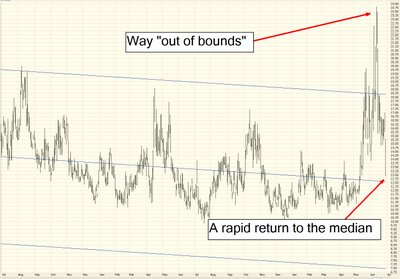

One nice thing about today's action is that it creamed the $VIX, which means that puts on the S&P just got a lot cheaper (in both intrinsic and premium terms). Notice how the $VIX has reverted to the median of its linear regression channel.

You might want to look in oil services for good short opportunities - or the OIH itself. To me it seems like this has shaped up as a beautiful bearish play.

The same analysis applies to the Gold and Silver ($XAU) index. A rapid retracement to a broken support line. Looks great to me for some puts.

Take heart, bears. In the summer of 2000, even though in retrospect we can see the market was already going into bear mode, lots of stocks were reaching new lifetime highs. The bear market started in March 2000, but people didn't really cave in to it until later that year. Our best hope at this point for some serious damage will come from disappointing Q2 earnings, which start reporting next month.

In the meantime, don't let the fact that the 17th interest rate hike is probably the last for a while substitute as a great reason to rush into the U.S. equity market. It's idiotic.

31 comments:

Sure can't figure today out. Confused beyond most words that don't only have 4 letters.

Anyway, looking at support and resistance, trendlines and volume . . .I can't believe what I saw today. Higher rates, slowing growth and a big spurt. Guess I will sit on the sideline longer as I try to figure out what is going on. :)

I like all the S&P charts. My guess is that we are getting close to another fall, but will see how that plays out in the next few days. I don't see may great bargains I am willing to jump into. Earnings should provide a little more clarity on trading direction.

Tim - keep up the posts!

Im confused as well, this rally is so overbought. Most stocks I stayed away from the last month due to FOMC meeting are up 15-20%. Man did I miss out on great opportunities.

As for Gold I think gold could go higher, it broker $600 today I think 625 is possible in the next week.

besides that all I hear is Pause Pause Pause. I have been hearing it since 2005 and have to say enough is enough. They will pause, and when they do im sure the markets will rally 3-5% but after that its anyones guess. The housing market has kept the economy on its toes for the last 5 years. Now that the bubble has popped and ARMS are reseting left and right foreclosures are going up. Not only that but I think this economy could be in for a slowdown in early 2007.

Mike

Another reason for the huge rally, market got 25 bp instead of the 50bp. If it was 50bp markets would have tanked big time.

Mike

costas we might get a sustained rally but there is no possible way the downside is done with. I dont think 4 weeks of selling was it. It couldnt be that easy. Most stocks are up over 15-20%. A stock I could have bought just 2 days ago for $86 is now trading above $94. What are the chances of it going back to $100 or even topping out a $110+ the stock im talking about is EEM. I just cant seem to find myself chasing stocks I could have bought just days ago for alot cheaper. I think this rally is a headfake and that the next major selloff wont be a pretty one. I would not be shorting gold or oil. I think both will head back up causing more inflation problems and interest rates to go to 6%%%%%. NO pause anytime soon will cause more market selloffs in the next 3 months. They should take it to 6% and call it quits....The whole talk about a pause after the august meeting has this market in rally mode. If the federal reserve does not pause in August expect the market to fall hard. Earnings are the only thing left to keep this market rally intact without that forget it. I think markets have another 2-3% jump then reality sets in. Im calling this rally a trap and a headfake that if you have the opportunity to take profits TAKE THEM!!!!

G2006

hmmm... interesting take.

I agree with Costas right now. Today was just too big of a market turning point, that I can't see a rally fizzle out that quickly. The bulls need an excuse for a run, and I think, today they got it.

I don't doubt that the Bear is coming, but hopefully not before July 21.

Thats when my july's expire on the puts I sold someone else...

Many stocks cross below bollinger line in mid June, seem dirt cheap for some investor, VLO and OXY was my entry in mid june, but didn't stick with it long enough.

I think market rising too quick too fast, afraid might get opposite reaction if earnings are missed from large cap company.

overall, volitility still persist, think im less nervious holding to stock when VIX index has few swing(like from Jan to mid May)

VIX

Tim, thanks for the analysis. I was starting to wonder if the world was still making sense. It does in the broader view. I sometimes get too myopic to see the overall picture, and that is why I like coming here because you help me take a step or 50 back to see the big picture.

For those that don't understand what I'm doing, I'm basically trying to understand the market in a real-live sense, thus the day-to-day analysis, then apply that experience and knowledge to a longer time-frame. Not sure this is a good way to learn, but I learn best hands-on. Though I'm tempted to start my own blog so I don't disrupt Tim's thoughts.

What is cool to me is that last night I had traced that trendline that DIA (just like the DOW) bumped up against today. I also drew two more parallel lines under it $2 apart. The interesting thing to me is that the bottom one is where the 6/14 low hit, and since then it has been hanging around the middle line, and hit the high-Fib between them. Now it hits the high-line - does it still resist?

I definitely have some more learning/experiences to do, especially in the area of applying the stops. I should have jumped out of all my puts yesterday morn when I saw all of them sitting happy. Live and learn...

I think stockshaker said it on another post: bull/bear, it doesn't matter. The current psychology in the market says that the rally will continue. The bulls have been looking for an excuse to buy and they've found it. The market was hovering at support levels for weeks just waiting for a catalyst to go either up or down BIG. They got it today in a psychological move by the Fed to soften up its tone and wording in their statement.

Bond market plummetted, 2-yr yields dropped IMMEDIATELY to 5.19%. The dollar dropped like a rock within SECONDS of the .25 point announcement.

That tells me that it's no "relief rally." It's the real deal and the big money players are adjusting for a longer term move back to 5.25% on the 2-yr bonds. It's almost as if everyone (except me) knew this was coming and synchronized their watches to make those moves at precisely the same moment.

I couldn't even imagine shorting right now. I suppose of the rally continues up into the 11,300+ range and stalls, then some shorts might be in order.

But for now, you really have to face facts, the bear has been completely gored. The bulls have the reins and will not let go unless earnings are piss-poor this quarter. And I think that's unlikely.

-Tony

hey tim, if u have time, can u let us know what positions u kept? also bsc closed above 139 so i assume that one is closed. thanks for all your input

haha, TONY! Wasn't I opposing your views a couple days back, when I was all BEAR BEAR BEAR, and then today, I changed my view.

I think that is a lesson for all: technical analysis allows you to completely remove emotional sentimate in your trading.

I too, lost money in my puts, but I am sure if this rally is to persist, for those who went long/sold puts, your loss will be covered, as well as your profits will gain thereafter.

Time will tell.

The market goes down and the bulls stay away. The market goes up and the bulls come here to laugh and pat each other on the back. Human nature, I guess.

stockshaker: If you go back, you'll notice that I was not bearish nor bullish, but I was actually trying to see things from both perspectives. I said that there was a definite possibility of a rally, but honestly I don't feel that those conditions were met. The wording of the Fed statement weren't strong enough in the bull camp to warrant that type of a move yesterday. But they made the move anyways.

I stayed away from the market yesterday, although I probably should have gone long somewhere along the line. Could have made 5% or more on just about anything in the entire market.

I guess I don't understand it, though. When the market drops 120 points, everyone jumps in and says it's oversold. But when it goes up 220 points, everyone says it's a rally and the buyers will continue to step in.

I've read a lot of opinions that there are several (if not all) sectors that are fairly valued now. So I guess I would be hard-pressed to identify any "value" sectors right now. Trading is the only way, using technical indicators as you mentioned (and also that I've said many times here before).

Good luck.

-Tony

9:47, DIA bounced off the trend line set yesterday afternoon. Then it bounced the trend down set this morn. Both lines intersect at 10:00am. Nice pennant.

Winds blowing from the North I say. As DIA breaks south.

Could we be bear all day today?

Anyone see GM this morning, tried to short above $30 but there were no shares available..go figure

Watching the intraday is fun today. Tracking off of what happened yesterday, it seems that every trend line I've drawn, the drop hits the line and pauses for a moment, then like a scared bug, scurries to the next line.

DIA looks like it is finishing its topping pattern that it started at the end of trading yesterday.

I'm running out of ideas to draw lines from!

GM at that would have been an awesome catch!

mark, the downtrend line for today has been broken; what 2 points have u used to draw the current support on dia? thanks.

Any comments today? Gold is screaming, the dollar is sucking bigtime.

Odd, the Fed confirms a .25 raise and offers NO inplications of a pause (regardless of what the talking heads are saying), yet the dollar tanks and the bond market rallies.

I just don't get it at all.

Anyone else confused here? Is it time to go long yet or what??? There's nothing worse than sitting on the sidelines in cash, which is the absolute WORST place to be right now, as the dollar is tanking.

I would never have guessed that the equities market AND the gold market would rally like this after pretty much NON-NEWS from the Fed. All they did in reality was raise the rates, which was already priced in, and they RE-ITERATED their data-sensitive stance on forward inflation fighting.

I see nothing concrete that indicates to me that the market is any better off today than it was 3 days ago. Yet I've missed out on 5-10% gains on nearly every single stock across the board.

This is very frustrating.

POST FROM 11:24AM.

you sound just like me, could not have said it any better. Im confused as well. Nothing has changed from 3 days ago, any why gold is rising AGAIN is beyond me. I think everyone was thinking 50bp, so when we got 25bp is was sort of a relief for an excuse to buy. Im not falling for it I think the market heads back down next week once "inflation fears" start popping up again. Markets only up like this because its the end of the quarter and they have to make up at least something they lost in early june.

Like you I missed out on a ton of profits. I bought alot of stocks when the market was around 10800 but sold them off when the market would make a mini rally one day and continue to sell off the next day thinking we were headed down to 10500-10650 area, but before you know I was about 100% cash with no stocks from 10900 all the way up until 11200 which has cost me. Im not worried, I think this rally will end and back below 11k we will go. Only thing that can keep this rally intact is earnings which are only 2 weeks away. IF earnings dont provide much expect a selloff going into the fall. Again I just dont see 6 year highs anytime soon. Most stocks in the last 2 weeks already look overbought. The market needs another catalyst after earnings to get it going again. Besides that I see no other catalyst at the moment.

G2006

Yes, things are overbought, but the thing you have to concern yourself with is where the stocks go when they "consolidate." Watch for the higher lows and you'll see that the rally is in place.

It might be prudent to take some small starter positions each day that the stocks on your watch list start to sell off. After July 5th, that's what I plan to do. I think the bulls will look for anything positive from earnings this quarter so they can (as you said) reclaim some of the losses from the first quarter.

I have looked at the gold situation a little and I think the main reason that gold is rallying and the dollar is falling relative to the Euro (in particular) is the fact that the market is getting the sense that the Fed is CLOSE to finished with raising rates, yet the rest of the World hasn't even really STARTED raising their rates. So, on a RELATIVE scale, the dollar will become weaker as other central banks look to raise their rates and strengthen their own currencies.

If this is truly the case, then theoretically, it will never really be "too late" to buy some gold as a hedge against this. And it also implies that it will be a multi-year progression of weakness for the US dollar vs. Gold, so it won't be a quick rally for you to scalp a quick return, but rather a long-term investment to maintain your portfolio's value against the market's decline.

Someone pointed out (I think on CNBC) that in "real terms", the DJIA has actually LOST approximately 1/2 its value against Gold in the past 3 years, even against the backdrop of a "bull" market in all 3 major indices. I found that very interesting.

-Tony (soon-to-be short-term bull)

Anon and others - if the dollar continues to fall/stay this low = bad for imported goods inflation, but good for exports. We all what will happen if inflation overshoot the target..........but what do the bulls care? Nahh they just stampede following the others. Anyway, so what if interest rates max at 5.5%, what then? The big big question will be HOW LONG WILL IT TAKE FOR RATES TO FALL? That should be one (of many) concerns for the bulls, but oh no all they can do is crow about the top being virtually reached. Anyway interest rates arnt the be all and end all, its ridiculous to have an obsession on this subject to the exclusion of everything else

If the federal reserve stops at 5.5% in august this could mean much uncertainty for the markets. Lets say the federal reserve does pause and the following month we get data thats showing more signs of inflation, then what will happen. Markets might sell off pretty hard on news that they may have to start raising rates again only to put the market in panic mode. I think the markets are in a no win situation at this point. If they pause it may be too early and if they go too much it could really bring on a recession going into 2007.

With gold and oil going back up this means more inflation worries. I think Oil could easily top $80 a barrel in the next 4-6 weeks WITHOUT a problem. This would cause more worries at the pump and pocket. Gold could make its way back to $700 by the beginning of fall and end the year at $750-$800 without a problem. The dollar could be trading below 80 and that could be a real problem. To much uncertainty and everyone knows the market hates uncertainty.

To many short term bulls coming back. This could easily pop the markets 3-5% at max, then it will be time to short.

G2006

Did anyone notice window dressing between 3:45-4:00 today. RMBS, SLAB????

is it just me, or do others see distribution on the major indicies: dow, nas and s&p?

vol is great today and they closed at or near their lows for the day - this is great for bears...

now:

1) the end of quarter is behind us

2) we have some weeks before options expiration friday

3) and july 4th is like the unofficial start to may

sell in may (and june) and walk away...

I was going to say about an hour before the close, that on a typical day, this market would have ended much larger up or down. Since it's Friday (and not just an ordinary Friday at that), everyone has taken off and probably will not worry about the market until Wed.

I agree with most in here that there is too much negative news to ignore, but for this one weekend it will be. I expect Monday to be rather flat too.

DIA, DOW and others held below the long trend line. DOW dropped 60 in the last hour... Interesting. Could be bullish on Mon if the bears don't come out slaughtering, but don't expect the high to go much more than today's high.

If the long trend holds like I expect, then the slaughter will likely happen Mon afternoon and definitely Wed when the real bears start coming out of the woodwork and the bullish warm fuzzies wear off.

Monday isn't normal, it is a hic-up in a long weekend. I want to ignore it, but it will be there.

CMI is just about ready to be taken for a spin. It will probably top out Monday, or it is in super rally mode and breaking from the pack. If it breaks over 123.10 and not push off, it may hit 126. But that should be about as far as it goes unless it is a real freak and heads up over 130.

It has a long way to drop come Wed...

SIRI is also topping, and should head down and hit 4.27 (low fib) around 7/17.

The current DIA resistance goes back to last year and used to be a support line:

10/13/05, 10/21/05, 10/27/05, 5/22-23/06, 5/30-31/06, and the last 6/29/06.

I don't have any set point where I drew any support line, I just picked what appeared to be within the current pattern running parallel (or as close as I could make it) to the line above. $2 seemed like a good drop, and another $2 happened to hit the bottom on 6/13.

I started the support lines on Feb, 1. Not that it really matters, as long as they are parallel to the first.

How did I validate the $2 lines? I measured the channel that another line was supporting. Curiously, from max high to max low (direction matters) is about $4, and from min high to min low was about $2. That makes it really easy to plot. It's probably a smidge over $2, but not enough to matter much within a year or even two.

I tend to fudge a touch where Tim has to have it perfect. I wouldn't mind perfect, but I don't have the time to spend on perfection right now.

the 50 dmas for the indices should be a good place to enter new shorts next week

Sometimes in the face of overwhelming evidence to the contrary and the finest analysis possible - the market is correct. I.E. Just because the crowd is wrong much of the time - some of the time the crowd is right. That's just logical.

There is no explaining it - it just is. But if you need an explanation just say "end of the quarter mark up" three times and get on with life. A number of those shares bought Thursday are already sold and most will be gone before Friday next.

I made money this week and I hope you did too. The PSQ shares stopped out for a small profit and the TEVA shares stopped out for a small loss and the gold shares went ballistic. How nice. The only mistake I made was thinking on Monday that oil was done and so I sold off my oil shares. The best decision was to take a short vacation to the sun and fun of Atlantic City where although I lost my budgeted amount I had a great time with my bride (of 40 years).

As is my habit lately given the state of the world I reloaded oil and increased gold for the weekend. Monday should be a very quiet day and Wednesday - Friday back to normal - whatever that is.

I'm not into predicting having learned a long time ago that I suck at it but it seems to be the game of choice in these parts so here goes.

Look at the weekly INDU it holds the key to the future. (queue the spooky music) What I see is three weeks ago a hammer, this is followed by a spinning top (indecision) two weeks ago, followed by a larger spinner this week. I think we are going to see an intermediate top form at about 11200/300 and another return to 10500/750 over the next 4 weeks.

I base this on my thinking that the MACD is showing an extremely overbought configuration, the Chaikin Oscilator is diverging from the market as a whole, and the bolly's are tightening. blah blah blah

I think some of the regulars around here have paralysis by analysis. That's what I like about 'Cane - he puts his bet down, says there it is, and win lose or draw he stays consistent with his belief.

Good trading next week.

In attempting to understand the market, I gather info from 2 other sources, Glenn Neely and Robert McHugh, both of whom put out market anlaysis based on a variety of factors.

Interestingly, they both called a drop early this week and a strong rally thereafter during the week. Neely was even more impressive because for almost two weeks his message was to short the S&P at around 1275 "when" it got there and that is just about where it peaked (so far).

Anyway, both of them expect a substantial decline starting either this coming week or after the holiday week, with Neely focusing on a substantial 3 week decline. They both believe that it will be as or more intense then the first drop which started in May.

Targets and timeframes are therefore almost exactly what John Wheatcroft (last comment post) has indicated in his last post.

Therefore I'm looking at the next 5 to 10 days as a key timeframe. If the market moves up much beyond another 2% or 3% then I believe it will invalidate many of their assumptions on where we are (as well as many of my trendlines). If it stays week and/or begins a slow decline then I think the larger drop will likely occur as they and John predict.

For those posting sources (McNeeley, etc.), would you mind giving links? Not that I don't trust you, just nice to see someone else's complete thought.

Thanks!

why is this market in rally mode after WMT news and ISM data. SHORT THE MARKETS

Post a Comment