Answering Your Questions

Hello All,

So far I'm glad I relaxed the posting rules. The discussion is a lot more active. The only downside so far is that Blogger isn't emailing me the postings (even though it is supposed to do so). So it's hard for me to keep up with what people are saying - particularly when they are directing a question at me!

I pulled a few recent questions and wanted to answer them here, since they seem broad enough to be of general interest.

"How do you find so many trading setups, considering you're a pretty busy guy (I'm assuming)? Do you just sift through mountains of charts, or have some software to help scan for setups?"

Great question. The main way I get trades is looking at a core set of charts I follow. I have a number of watch lists set up; they are named Candidate Calls, Candidate Puts, Core List, Current Calls, and Current Puts. I shuffle stocks in and out of these watch lists based on their current state.

I don't tend to use any technical indicators at all (ironic, isn't it?) I use what you see every day - trendlines, basic patterns, Fibonacci retracements - all drawn objects.

From time to time I'll run ProphetScan and Prophet Patterns to sniff out things I haven't followed before. Yes, I'm a busy guy (too busy, I think). But trading is at the core of a lot of what I do professionally, so it's time well spent!

"What kind of strategy could one use to trade a small trading account (like $5,000 or so...that's the most I can save by end of year)? Can one effectively trade with an account that size? I figure I could only afford to hold 2 or 3 positions at a time to keep commisions from eating me alive (even Scottrade's $7 adds up...in my paper trades it's taking on average 20% of my profits!)."

If you're comfortable with the risk, I'd say trading small options positions (maybe $1,000 or so per position) would be probably best. Keep in mind you have very little cushion and you could wind up with a $1,000 account total value in no time. But good use of contingency stops will help. I certainly wouldn't trade a bunch of tiny positions. Just try to pick 3 or so best choices.

"Any reading to recommend?"

I like Trading in the Zone quite a bit. There are a ton of books on technical analysis, and I don't really like any of them very much. Oh, except for Thomas Bulkowski's book Encyclopedia of Chart Patterns. Ummm, and I'm writing a book which comes out early next year, and you will all be required to buy and read it. Oh, and those are just raw links to Amazon. I don't get 50 cents if you buy the book or anything. Just trying to help!

"What charts are you using?"

ProphetCharts, which are God's own charts. This is an unreleased product at this time. But they're the most fun you can have with your clothes on.

"If you have a few hundred thousand to trade, do you recommend sitting by your computer every day and quitting your day job? I'm very serious about this!"

If you can make enough money trading to support your family, I recommend you stay home all day and play with your kids (or spouse....) and let your stops take care of business for you. Seriously, good trading shouldn't mean you have to be glued to your screen all day long. Taking the time to look at the charts at the end of each day and making sure your stops are correctly placed is a must. Be overparticipating in your trading account is usually bad for your financial health.

5 comments:

Aaah Tim,

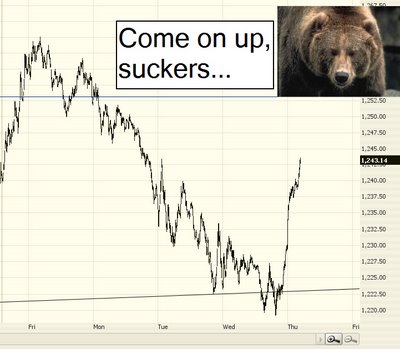

You've outdone yourself with that chart above. "come on up, suckers" , what a way to sum things up! Best chart I've seen so far.

Thanks,

AJ.

Hi Tim,

Great blog. With the amount of buying that goes on with just little bounces I would say there are many bulls waiting and wanting to buy buy buy. If this is the case, the downtrend we have seen has done nothing in terms of fear. I agree with you and see more downside coming and perhaps it will stick.

Glenn

Thanks for your response to my questions Tim! And to bsi87, I'm actually reading that book by Elder right now. The psychological explanations of crowd behavior are fascinating.

So Tim, why don't you use any technical indicators? I'm still in the bear camp, but I couldn't help noticing a huge bullish divergence of higher lows on the Dow's MACD Hist. chart as the Dow made new lows. Anybody else notice this, or find it cause for worry? Advance/Decline is still pointing to more downside though.

Mr. Wheatcroft,

Don't let the conspiracy theorists run you off. Your wisdom is greatly appreciated.

Peace

mcqf16 - thanks - I'll try to stick it out. Up till now I've been enjoying Tim and the rest.

Today was a standard market-is- extremely oversold-and-I've-got-a- lot-of-cash-doing-nothing-rally. Whew! I made mine - hope your guys made yours. And as I said I sold off everything before 10:30. Currently I have positions in XLE and TGB. Oil and gold. I'll probably hold both and even add to the positions for the weekend. I like holding gold and oil over the weekend.

We should slow down a bit. I anticipate a gap up in the averages but a smaller range-day than today and maybe even a close on the down side.

The three sisters (DIA, SPY, and Q's) all gapped up to open and ended on a white candle but the Q's candle was a bit weak. That's ok - I try to avoid the 4 letter stocks anyway. As I say - MSFT is a 4-letter word.

Remember it is expiration day tomorrow and another Summer Friday to boot. After about 11 A.M. the market will be done for the day and it will be time to go to the beach.

Tim - I don't know whether this is a bull market or a bear market and, as a rule, I could care less. If I think the market is going down I load up on Rydex inverse funds and go play golf. When the turn comes I cash out and get back to digging.

For those of you who are thinking about trading for a living - there are easier ways to make money. My advice - forget the books - one persons experiences will never by yours. Read everything you can regarding technical analysis (free on the internet) and then trade. You will make mistakes - we all do. Take notes and try to avoid making the same mistake twice.

Post a Comment