Just For Fun

The Dow was up over 100 points today but then started to ease back to close up 67 points. One reader was puzzled by my mention of the market being in the 'doldrums.' I guess the Dow up that much isn't exactly doldrums, but my portfolios were basically unchanged. So it was pretty boring.

Just for kicks, let's take a look at some of the mentality back in 1999. All these books were published within months of each other in late 1999. Great lesson in contrarian thinking........

Not to be outdone.....

And then, in a desperate bid for attention......

Where was the Dow 1,000,000 book? I guess the market crashed too soon.

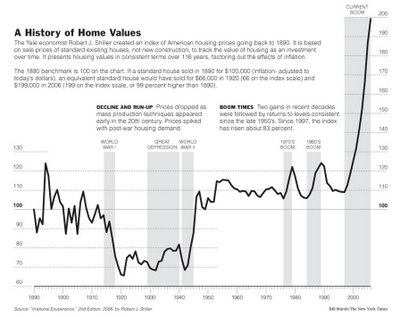

In last Sunday's NY Times there was an amazing article on the real estate bubble. I know this is a really tired subject, but this one graph is breathtaking. The latest surge in real estate completely dwarfs anything seen in the U.S. (...said the man with two overpriced houses in Palo Alto, California). Scary, scary stuff:

39 comments:

is SNDK a giant head and shoulders now?

I know this blog is for bears, but I still have one observation that possibly has some bullish overtones.

SPY closed at 130.48 with a P/E of 14.63...meaning earnings are at 8.91. Over the past 25 years, earnings have grown at 8.37% (currently S&P are ptojecting 11%). On a discounted basis, using 14% as the discount rate, the fair market value of SPY should be 133.47. If S&P are correct and earnings grow at 11%, the fair value would be 153.81. With long treasuries at 4.80%, there is a lot of incentive to buy stocks instead of bonds.

Just an observation.

John

will the market ever crash .... PHUCK.

if you look at the news, the economy ... it should be.

In 2002 Glassman was a resident fellow at the American Enterprise Institute, a Washington public policy think tank, where he specializes in issues involving economics, technology and financial markets.

He is also the author of "The Secret Code of the Superior Investor" (Crown, 2002).

longer the doldrums the better..for the bull, do believe up swing is coming in Oct.

bol band channel bit upward movement compares to one from last Wed.

Wed.

Today

Upswing in October??

That would be, like, the first time... ever.

Good luck with that trading strategy.

Dear fellow bears:

I know it has been a tough for the last several weeks, but that's what you get with irrational markets. We all know the fundamentals of this market are el-stinko, and the technicals (at least on my charts) look downright scary. It helps to remember the immortal words of JK Galbraith in times like these (from The Great Crash, 1929):

"Indeed the temporary breaks in the market which preceded the crash were a serious trial for those who declined fantasy. Early (and often)...it seemed the end had come...And then the market took flight again. ****Only a durable sense of doom could survive such discouragement.****" (Twighlight of Illusion chapter).

So, take heart fellow bears, the end will come and the farther this thing stretches out, the more nasty the outcome is likely to be.

One final note....3 month TBills are paying about 5%. Might not be a bad idea to load up and watch history unfold.

Best of luck to all, and thanks for the website Tim.

Jim

John,

This blog isn't for bears. Tim may be a dyed in the wool bear but many are traders. One could have bought TLT at the end of May and outperformed the mkts during past three months.

This blog is definitely not for fundies since most believe only trailing earnings are "real" (and sometimes not even then) and projections are just projections.

When yields were over 5%, there was a lot of incentive to go long bonds as part of an asset allocation play.

good luck

bsi87

PS John, there are times to be long and times to be short and times to be flat.

bsi87

AAPL is setting up nicely again for a short. If it breaks the 200-day, it could be an easy retest of the breakout point a few weeks back.

Look for it to break below $66.62 on good volume for a short entry with stops above $67.50 (today's intraday support).

Good luck.

-Tony

I am still thinking NVidia.... NVDA might tumble at some point in the near future. Today it got an upgrade....traded up then encountered some selling pressure for the rest of the day. Insiders CEO/CFO just sold a lot of shares....

They are going to be restating earnings, which leads me to believe that their is some bad news looming.....

We will see.

I'm not sure what's up with all of the news/fundamentals analysis on this board. It seems that we're all short term traders here, and correct me if I'm wrong, we're all trading on price action. Yes, the economy may be slowing, but I doubt that will affect what you do tomorrow. It's something to keep in mind, but short term, it doesn't account for the recent rallies we've had. You would have only caught those if you were anticipating price action.

Made some bucks from shorting AAPL NURO recently. Now I am still short NVT CBK TMA SYKE NUHC...men, am I too bearish here?

I still think this market should have a pull back very soon.

SNDK AAPL down on Mon. INTC will face resistence at 19.4. These guys have been used to manululate the NAZ heavily recent days!

Blaster,

I use a Triple Time Frame. I look at the 26 week EMA for indices/stocks and note whether it's trending up, trending down, or flat. DJIA and SPX are trending up, the others flat to down. But low volumes in most cases.

When I switch to the daily, there's very little volume, the indices are near their 20 day BB, and nontrending in most cases.

I have opinions but I don't trade on 'em.

Good luck

bsi87

Volvosan,

Don't you think all those facts are known and incorporated in the estimated growth rate of corporate earnings? Decisions by major investment funds are not made by an individual sitting in a cell. They are made by a group of very intelligent, thoughtful people.

Our purpose here is to attempt to front run them...not an easy task. But one way to help is to understand their method of thinking. If they have no alternative investment but the stock market, guess what they will do.

As far as alternative are concerned, most are restricted to bonds, stocks or real estate. Very few have the option of commodities or even foreign stocks.

Now if you were attempting to decide where to invest your several billion per month surplus and you could only buy real estate in what appears to be a declining market, bonds at yields that are still low historically or stocks with an implied return of 14%, what do you do? Why do you think the large caps are running?

Good luck

John

great point john, im as bearish on the economy as any here, but as some one much smarter than i said long ago,

"the markets can stay irrational longer than you can stay solvent"

truer words never spoken . take it from someone getting killed in puts lately,

More recent posts have correctly included mention that as each piece of bad economic news or'bad' data is made public, it is digested by the current bull run just as much as us bears suffering from sore heads. Unless a negative major news item springs up from nowhere, I dont think the markets are heading lower this year. Look at what has been thrown at them......it couldnt be worse, except for outbreak of war. Yet the markets have stayed resiliant. Everyone expects data to be bad as the economy slows and thats acceptable, as long as it doesnt snowball in to a recession. There is nothing to indicate that it will either. Real estate will suffer, but in the main people survive these things they adapt and manage. Same with managing high oil prices, poor dollar rate etc etc etc etc. The only recipe for a crash, as far as I can see, is if the market go up too high and too fast. But again there is no sign of that. Bear in mind this bull run is focussing on the otherside of what a perceive short term economic slowdown may bring. All should bear in mind that grow has been at a rip-roar pace for many months and so a pull back from that to a slower pace is both healthy and desirable. I guess the bear in me is slowly starting fade. Uuugh

Hard to be successfull in this market with a strong bias (Bear & Bull). There are folks that can do it, eg Tim K. but majority of the mortals can't. Unless you can filter out the news and simply trade the market direction, it's a losing battle.

The Trader II

Whoa, John!

I don't see the 14% implied return for equities. I see underperforming asset classes across the board. I see managers grabbing large caps for liquidity. I see complacency as measured by the VIX/VXN.

PS John, remember that I added to my OIH short on Friday? Traders were going short oil and oil service in anticipation of Ernesto. Nothing is as good as it seems nor as bad. There'll be a time to load up on energy plays but not now IMO.

bsi87

There goes AAPL. Down 2% this morning already. And if the market weakens further, look out below.

-Tony

Correction:

Traders were going long oil and oil service in anticipation of Ernesto. But if one looked closely on Friday, 1) volume wasn't even up to the average, 2) the stock was approaching the 50 DEMA from the underside (tough resistance), and 3) it rejected that price level in the face of what should have been a breakout point (kangaroo tail reversal as Elder calls it). It was a relative low risk trade to add to the short position.

Now it's in a descending right angle triangle with a 130 base. If that goes, there's a 40 pt downside. But the way it's trading and other indicators, I think it'll bounce off the 130 area...again and test the 140-141 descending resistance line.

Street.com sez there's a big move to load up on TLT puts. Putting on limit orders to buy some at 20 and 50 DEMA.

bsi87

This may be a "duh" to some of you vets, but, bsi87 - your limit orders on TLT - are you using thestreet.com as a contrary indicator or are you looking to buy puts?

Thank you

Tim, i was in CME, good but exited early on Friday< thought It hit support and started to make a move up. I know this is a stock for the big boys, So i locked in the profits only to cry yestrday and today.

Now as much as I know I really don't feel confident about re-entry now with such a drop in a short period.

Could you look at the chart and give your thoughts?

I feel i would need another confirmation, like falling through 420. on volume.

TLT bottomed in early May. Hit the bottom of the 20 week Bollinger Band.

Despite no "respect" (GRIN), it has just motored along since then. Nice gain, not much work. Hulbert got negative on bonds this morning. Ditto the Street. I'm looking at a retracement to the 20/50 DEMA to go long but bought some IGE already so gotta watch my exposure.

bsi87

It all starts with CAPITAL PRESERVATION!

To invest in stocks bcause 5% in bonds is not 'good enough' is a weak strategy. The 14% on stocks is not guaranteed now is it???

Also, remember that years ending in 5 have so far produced positive returns ... except in 2005!

What sort of a moron would invest in stocks just as the biggest housing bubble is about to burst???

'da bulls are smokin' ganja, that's why they are so complacent!

Trader Fred

the 50 MONTH mov.avg. has NEVER been higher on the DOW as it is now. A few more months of farting around at these levels and the S&P500 is not far behind in matching the 1204 it set in the go-go years. Food for thought ... the drop is coming, BUT WHEN???

Sola,

The thing that ISN'T discussed about buybacks is that the companies apparently don't have enough internal capital projects that meet a hurdle rate. Thank gawd they're not out buying companies and creating a kingdom for the most part. And how much of the buyback offsets the options grants that are on the books.

bsi87

the drop will come in 2100

and then we'll look back and say, "oh yeah, the bear came and went."

because right now, thats what i see.

michael, wow, man, IGE is so prime, good shorting stock! Triple top, and today failed bullish trendline. Good volume.

very nice pick. The macd is confirming the further downfall.

Trader Fred, if you need any ganja, I'll hook you up buddy, because Im gonna watch the Dow go to 12,000.

Im on the money-makin' bandwagon!

Okay "STOCKSHAKER",three(3) stupid comments in row is enough for one day. YOU go smoke yout GANJA.

Shake,

Long IGE.

1) 26 WEMA still in uptrend.

2) August 17, IGE showed a kangaroo tail reversal. Got as low as 97.82, reversed, and closed up on the day.

3)Entry point is about halfway down the tail or 98.42.

4)Trailing sell stop is 97.72, 97.62 limit. Risk is about 80 cents per share, top of 20 week BB is 106 or roughly 7 pts upside.

MACD diverging on this selloff.

I hope some of you have fun trading today. Wow!

The Trader II

hey michael, a good one to watch at least. From what I see, i see failed price patterns and failure to go above (and sustain) 101.82 high

Whatever the case is, it is prime for some type of movement.

The only bullish indicator (that I can see...) is how buyers have made the price come up dramatically from today's low.

And yesterday was a doji, which is never good...

Anon 11:32 - you've got quite the mouth on you. judging from your anonymity, and your pretty lame comments, you must be my dealer.

I've seen several tick readings over +1500 today...a rarity. This market is experiencing panic buying at times.

I truly don't get it. The Fed minutes sounded pretty hawkish to me. Good chance of Fed raising rates; so why is the 10year bond yield falling?

I think it's time to step away from the market until things start making a bit more sense...at least to me.

The markets want bullishness. Its crazy, but shooting up like this on the FOMC minutes shows how reckless the bulls have become. Why does it all remind me of the wild partying in early 2000?

Hanging man or hammer on all indices?

re:PCU

Cornerstone Value play. Buy limit 89.52. ATR is 2.60 so it hops around.

Do your own homework.

bsi87

Post a Comment