Fed Day is Out of the Way

Well, today's post-Fed rally lasted about as long as a bull in bed: 30 seconds or so. These guys are such turds. They bid up the market like mad in anticipation of a pause. BFD. Is a slowing economy great news for earnings? The market is doomed, people. Get real.

Here's a minute by minute chart of the DIA. You can see the massive micro-rally take place here if you look really close:

The $VIX is well positioned for a long, meaningful upswing. That'll be great for the bears.

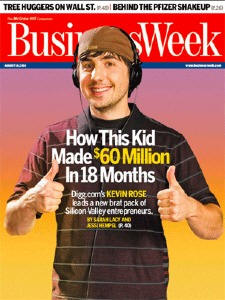

Oh, do you need a good contrarian indicator? Check out Business Week's cover story. It features this kid on the cover claiming he's made $60 million on his Internet idea. He hasn't. It's bullsh*t. The editors dreamed up some hypothetical value for his firm, multipled it by his stake, and came up with the figure. I have no doubt this chap will get rich, but isn't this jumping the gun a bit? Smells like 1999, doesn't it, folks?

I've got something like 50 positions in the market, all of them puts or shorts. There's no way I'm going to show you all the charts, but let me throw a few interesting ones your way. Setting a good stop price is going to be up to you.

CAM:

IPS:

LEN:

OIH:

PBR:

PD:

Oh, let's do a hurricane5 update. Nutrisystem - target price of $600 - current price today, after getting smacked over 7% - is $45.58. And Hansen - target price $120 - currently at $29.45. Way to go, 'cane. I wonder if he is lurking to see what people are saying. Nah, I doubt it. Way too painful.

Anyway, congratulations to all of us for having the brass nads to get through this ridiculous Fed nonsense. Now we can turn our attention back to grinding bulls into hamburger.

61 comments:

A note of caution - volume was very low today, so a further follow through on the sell side by be a tough act. In fact even todays little sell off was a struggle, which is rather worrying when you consider that todays infamous 'rate pause' is in fact the most damaging outcome for the bulls, they are just too dumb assed to realise it..........yet. The danger is the herd remains in their current brainless state of minds and continues to prop up the market - no rally, just annoyingly narrow trading range just might be the stagnant short term outcome that noone wants to happen

i was taken back by no raise and a pause. I was wrong, thought there was going to be a 1/4 hike. As soon as I saw the market take off then start heading down I entered back into SDS and made a bit of money. CSCO is helping the markets tonight but I have no idea how long it will last. Im hoping for a mini rally so i can get more SDS and DXD under $69.00. I dont see any huge rally to 10500. If we do Ill be shorting everything.

Possible shorts:

EBAY

SMH

BRCM

EWZ

AMD

AMZN

I'm usually cautious, but I don't see it that way, downosedive.

The ONLY volume that occurred today was on the downside. Heavy volume picked up and the markets sold off. Once the Dow reached around -50 or so, the sellers backed off. But that doesn't mean they're finished selling.

As I've said before, excess liquidity funnelling into the markets will always continue to prop them up unrealistically. This could be 1995 all over again where we see an inexplicable bullish rise in the markets, except the economic situation now is much, much worse, so I doubt it will happen.

I still remain cautiously negative on the markets with some shorts on SDS and DXD. I'm waiting for a bounce rally on the Naz before buying QID.

I don't think we'll see a sustained rally, NOR do I see a sustained selloff. The market priced in a pause and got it. But now what??

Nobody knows.

That being said, I think people will turn to the slowing economy as a rationale for selling off the markets a bit. I think we see the 1900s on the Naz, the 1230s on the S&P, and we revisit (if not break) 10,700 on the Dow within the next month. Heck, that's only 400 points away.

On a related note, I'm a bit surprised to see that gold did not rally today on the Fed pause. I think that perhaps the pause was anticipated, so the response was muted. Also, I think that the market is still pricing in another rate hike before the end of the year, so it's possible that gold will hold steady until people see clear signs that the Fed is DONE and will let the dollar fend for itself. Then you'll see some fireworks with gold (if not before then).

-Tony

Tony, you are possibly right on many counts, except a revisit to 10700. I just cant see a mini short term downturn, much as I desparately need it to clear the short positions I opened at that level and have hung on to ever since. Hopefully, I will be proved wrong and you will be right! By the way gainers out weighed loosers by about a quarter before the rate anoucement, so it wasnt the sustained volume of selling that we all should have seen. Still, its early days yet......just needs to get obesessed with any negative aspect and that may well act as a catalyst to drive the market down. Heavens knows, there's enough options to choose from!!

tony you mentioned:

"I still remain cautiously negative on the markets with some shorts on SDS and DXD. I'm waiting for a bounce rally on the Naz before buying QID."

shorts on SDS and DXD????

dont you mean long on SDS and DXD

As for QID im looking to pick some more up at 68-70 area.

well. that turned out beautifully didn't it? Technically, we are primed up for a nice downswing. Which I am gearing up by dumping some coin in a BEAUTFUL looking stock, called the QQQQ, or I like to call, my bank.

Tim, those a fantastic graphs, but also take a look at HON, and FDG. theres also KOMG which I had calls last month, but had to turn into a bearish spread because of a sell off - not as good of a profit, but something nonetheless.

Im waiting for ADM to fall below a $39ish support level.

I like how the housing sector still managed to fall at a ridiculous pace, despite the rate hike pause. Wierd. It falls when the rate increases, and it falls when teh rate doesn't increase. I love those puts.

But, as everyone knows, there seems to be irrationality with the markets, and for some reason I would not be surprised if tomorrow, the markets rallied on something insignificant.

Its like: The economy slowing? Im so happy, let me make the dow climb 5 billion points! Dow 300,000 here we come!

Im kidding, of course.

Sorry for the confusion. I meant I took out some short positions on the Dow and S&P via SDS and DXD. Those are double-short ETFs, as is QID (as you already know).

Downosedive: I don't care what the adv/dec ratio was BEFORE the announcement. I only care about what it was AFTER the announcement. Look at the volume, look at the direction. And again, look at the volume. That's not to say that the markets are going down in flames. I wouldn't be surprised to see some unrealistic optimism pushing the markets even higher on low volume in the near term.

I'm still cautious, as I said. I haven't bet a ton on anything yet. Just some starter positions on SDS and DXD. Head fakes are a signature of this market ever since May. I don't consider this market having any clear downward direction unless it breaks past 10,700 on good volume. Or if it makes new highs past 11,700 (which I seriously doubt).

We'll see what happens to finish out the week.

-Tony

To answer the earlier question, I just buy regular puts, in the money, at least two months out. Nothing fancy.

CSCO blew away their numbers. Big up day tomorrow.

Yeah, like CSCO is a major market force anymore.

Chance of seeing 11700 on the dow is 5-10%, and if it did touch 11700 i would think 12,000 would certainly be possible but I just cant see it. I think its impossible now. To many things going on. If there is a huge up day tomorrow where the indices gain more than 1% im buying SDS and DXD, I just dont see how any rally can hold up. The market is not done with its volatility. Expect great volatility in the next few weeks.

Im predicting 6% by the end of the year and with the Federal Reserve Pausing its only to do worse for the markets in the next 2-3 months especially in late fall. Any strong data will only keep the markets down on anticipation of more rate hikes. The federal reserve should have hiked rates .25 with a pause. Leaving out the 25 basis points was not a good idea. If inflation shows up again the next meeting in september may bring on 50 basis points. The next huge drop in the markets will be blamed on inflation, slowing corporate profits, housing bubble popping, and rates going to 6%. Dont believe the hype on any rally this market is headed lower.

have to agree CSCO is not the same as it used to be. Alot of the market leaders have lost there way especially CSCO. DELL, INTC, AMZN, EBAY and ORCL dont move the markets like they used too. CSCO is stuck between 17-22.

Was watching cramer. He said EBAY, AMZN and AOL are done with and that the new net leaders are NILE, IACI and VCLK.....what is he thinking. I believe that AMZN, EBAY and AOL are done with but to hype up NILE IACI and VCLK what is he thinking. Too FUNNNNNNY

Yeah, Jim Cramer, there's another great guru. Check out http://www.cramerwatch.org/ which pits Cramer's picks against those of a monkey named Leonard.

The monkey is winning.

cool!!!! thanks cramer! I was preparing to short NILE. Looks like Cramer pump up will present an opportunity soon

oh come on, what do u think? Crammmmer is trying to help people out there, he is trying the maximum possible way to rob the people out of their livelihood. So, there is no way in the hell that this Crammmmmer ass-hole will ever beat the monkey.

i was looking to short nile too I think it heads back to 26-28 range

If you look at $FTSE and $AORD, the day after the interest hike, they both went up. Maybe wait a bit and short it around 2-3PM EST.

BLOG OF DA'FKKING YEAR!!

Tim,

Can you please provide your (chart) analysis on NILE?

I agree regarding NILE. Cramer's pump just put an extra 4% on the table for the shorts. The stock is clearly headed downward, trading at a forward P/E of 34 right now. $32-33 is clearly an area of heavy resistance. And if all else fails, the 200-day SMA (right now at $34.85) has pushed the stock back down 3 times already since February. Looks like a great short setup, especially if it goes up to the $33-34 range tomorrow after the Cramer pump.

Gotta love it. Thanks for the heads up on NILE.

-Tony

CSCO not a major market force? Just a tiny $100bn company. Chump change really! LOL. And why are futures up then?

And why are futures up?

Because when the cattle ship sinks the bulls cling to whatever flotsam remains before the bears, (excuse me) sharks move in to feast.

Anon at 5:51pm,

Yes, the futures are up. Please buy as many stocks and as much as you can. May be get some NTRI, HANS and AAPL

So no hike on the rate equates to no hike in the market. Hike the rates and the market hikes.

I think I got it. :p

eddie: I'm surprised that you talk about the huge down days back in May and June, yet you completely ignore the REASON for those huge down days.

Are you at all aware of the BoJ removing 30 trillion yen from the system? They did it in 3 stages, 10 trillion yen each time.

Look at a chart of the major indices. Can you spot the 3 stages?

A cooling economy and a soon-to-be downtrending market don't necessarily have to result in huge volume, huge point selloffs. It can just as easily (and more probably) equate to a sagging of the markets and a sandpaper-like movement, gradually eating profits of bears and bulls alike.

My intention is to have a plan; that the market will go down, eventually, and that the indices will be lower by November than they are right now. I can't try to out-guess the short term market direction, but I can try to estimate what the overall correction might be, going into the historically worst period of the year.

Good luck.

I may be biased to the bearish side and so may Tim, but I think Trader Mike is kind of neutral-to-bullish. Take a look at his post tonight (http://www.tradermike.net/) and the charts there. Especially the OBV in each chart. I think it clearly shows a gradual drain of money out of equities. Many retail longs have been burnt in the last 3 months, and mutual funds don't get major fresh inflows till next tax season. So guess where the money is going? Out of stocks, into fixed income, gold, and plain old cash. So the short term outlook does seem bearish.

Daily put/call hit 0.91 yesterday. The market is extremely oversold by this measure. Last time it got this high was 04/05. A big rally followed.

costas 1966 and the group

I dont like what I see and feel. The futures are showing a rise (yet again, as is the case every pre trading session) and the market opens in 2 hours. The whole thing sinks of continuing strength on the upside

To sum up:-

a) we are all agreed on a whole string of negative economic data, that by rights should be causing a market slide, but isnt

b) the market volume during the last couple of weeks hasnt been particularly high, altough thats typical for the summer season

c) whats driving the market upwards then? Its sentiment. Pure and simple - Bull sentiment dominates over Bear sentiment, ok an occasional set back but each one is reversed and the move upwards continues

d) bad economic data is now seen as good news because it is believed to weaken the case for any further rate increases. In fact the next call will be speculation on when the rates are going to come DOWN. Already I can see comments from the analysts on this topic. That specualtion is in danger of providing a further strength to the market - perhaps enough to carry it through this dire eeonomic period to the extent of negating the enevitable future poor reporting season

e) the only possible speculation for a downturn can be based on the historical DJA performance and the repeating 4 yearly cycle, which is due in theory to happen between Oct 2006 and March 2007. Now thats a nasty wide time period and until or unless that downturn hits, the market will continue rising and so hurt all attempts to short the indices

Worrying times for this bear who has stacked losses of £7000 on DJA short positions - I need a miracle, but I dont think it will come. The regular speculations of members here about retesting the recent lows of 10700, would be my saviour, but I just cant see that happening - can you?

" Bernanke just proved the world he is a dove. The market will have to come to terms with that."

The bond market doesn't seem to worried about Bernanke being a dove, or that inflation will become a problem. 10yr and 30yr yields rose a mere 2 basis points yesterday.

"I am not sure why bulls are so gung-ho in wanting to buy,"

p/e is the lowest it's been since '95. The market may not be cheap, but bears cannot seriously claim we are in bubble territory any more. That's why I fail to undertand why some of you think the 2001/2 drop is just a dress rehersal for a much bigger crash. Based on what exactly?

Gold and silver did a huge reversal. If they don't stop it right here we might get a massive inflation run which will left all sectors. The metals have traded lockstep with equity. Have your stops in place and becarefull folks.

bsi and costas - thanks for comments - they all go into my 'melting pot' in trying to decide my next move..........

need the markets to still go higher, so I can load up on QID, SDS, DXD.

Costas, could this be the same kind of rally where the big boys first screw the shorts and then the longs.

This rally was expected to flush out the retail shorts from yesterday. It has happened to $FTSE and $AORD. Tomorrow will gap down. Then next week will be options expiry manipulation so depends on the value of the maximum pain for the option expiry.

To be fair to Hurricane5, he has been a long term bull. I think his calls on nutrisystem and hansens still have some validity. I don't think 80 bucks in a year is too far a stretch for NTRI (he said 120) and HANS is probably going to post strong numbers the next year. Is it worth 120 as well? Probably not. Is it worth $55 in a year, yeah it could get there.

HANS is holding up very well in the 29 range, still below 120 MA at ~30

Sanjay, do u still have all your shorts in HANS intact?

Dow red. lol never ceases to amaze me what the MM's have done these last couple weeks. as previously said, the markets will do what makes people loose money, that is why good markets look bad, and bad markets look good. right now that market has been looking good, but underneath lies the problem.

Glad I waited yesterday to enter my QID position. Was able to catch it with the Naz up 1.33% today. Could be all downhill from here.

I love those new ETFs. Lets you capitalize on what you know is going to happen, without the risk of worrying about unrealistic intraday rallies.

Someone else mentioned that the market leadership has diminished. You see utilities, energy, precious metals, and health care leading the way now. Not a good sign.

I'd personally like to see some heavy distribution days, but as long as the markets don't rally hard, I'm not too concerned about the long term direction.

DOW is putting a battle at the 11,153 level

Markets doing nothing now. EOD rally into close, or continued selloff, and clues? For the Nas to be up over a percent, the breadth looks god awful.

My shorts AAPL ACLI are working good!

LOL. USO 2PM meltdown, as predicted. Kiss OIH goodbye.

No but guys, Ive really screwed up - I civered my short positions today by counter balancing with long positions, so Ive gained absolutely nothing from this fall. I just dont know what to do......whether to close all or some of my shorts, or whether to close all or some of my longs, hummmmm

I am guessing the big boys will screw up the new shorts in the last hour?

downosedive - unless your longs are strong uptrending stocks, I'd recommend you to close most of them. Look at the daily charts of the indices. It's more and more probable that the following days will favor the bears. I said 'more probable', because in the markets, nothing is certain, but at all times, the trend is your friend.

Just my 2 cents. Held my recent shorts through todays bull trap and seeing some nice gains. Not exiting yet, because the technicals are more and more in my favor.

I know that you fellow bears can appreciate the steely nerve required of holding puts on the NDX

At one point I actually had my finger on the send button to get out at 1517

phewf

Some of you are overthinking and overtrading. Get short, have your stop and stay short. There was nothing in today's action that should had stopped you out.

About time we drop, GEEZ. 7 mored days of selling would be nice.

I know people are looking for volume, dont forget its summer.

Anyone looking at PCU? It's at the bottom trendline of a bearish rising wedge. Might be a good swing trade to go long at $90 with tight stops. Could be maybe $100 on the upside if it regains some momentum.

Anyone agree?

BTW, holding full positions in DXD, SDS, and QID now. Should be easy money long term.

-Tony

bsi and anonymous - thanks for the comments. Sure, I followed the 11250 resistance comments, but then there was a period when even the hardened bears were saying , go with the flow dont stick to shorting if the market trend is up and sure it did seem up. If I cash in the longs now I will loose £3400. Now do you see my dilemma? And if I keep the shorts Im down £5300 now, ok if the market continues downwards because the loss will reduce, but what if it doesnt go down. Can you imagine - a loss by cashing in the longs and an increase in the loss on my shorts. Now thats what Im trying to get the nreve to deal with, but as anyone in a similar situation will know, the decision is 100 more difficult when its your own money, humm. Anyway Ive shared something very private in public with you all, so I guess Im inviting you all to share and develop as a community bear forum, under the chairmanship of Tim, by reveal this persoanl dilemma

"go with the flow dont stick to shorting if the market trend is up and sure it did seem up."

Just as I posted earlier, bad markets will appear good...remember that, the big guys and MM are here to take your money, not to help you by providing a better picture of the current direction of the market.

i still stand by a re-test of 1220. it may not, but well see. Did you guys see the trannys get destroyed today, look at the volume! dont expect a confirmed 1280 breakout with market action like that. Also the breadth i commented on as being horrendous when the Nasdaq was up 22 reared its ugly head.

Folks, gotta look under the surface, this last rally has been like a used car with a brand new paint job, but no engine.

bill, indeed you are right - 'those pros, whoever they actually are, aint here to give a damm about anyone other than themselves and making loads of money. I agree bad can trun good and vis versa, which is why I find it so difficult to sell at such a high loss.

By the way, you are so right about the car! Spot on!

Tony, im short PCU @92.31. i guess i need to tighten up the stop.I was thinking 85.00.maybe im dreamin?? im a rookie but im in the frey. Short on aapl as well!!Go Team! ChrinicTown

Downosedive: I don't know what your loss is compared to your principal, but it strikes me that you need a plan. For both your longs/shorts state (on paper) an exit strategy (stop)for each position. You could always post your longs/shorts here and ask these smart folks for their take. I can tell that its gnawing psychic health, and I wish you a successful conclusion on your positions.

yes, when i saw the dow/spx/naz all up like bonkers, i have to admit, i was a litte weary. But look at the graphs on teh indices - even at its highest point, the dow/spx were hitting its resistance level.

I don't know why everyone was freakin out over a bull trap, because any type of bullish move would be to blow away this resistance level.

It was more like a last gasp of air before going back under.

Downosedive, buddy, I know how you feel man. I remember watching my account go from dollars to pennies when i first started. And you better believe i took a year afterwards to just study the markets (didn't even make one single trade).

The key to what i learned is that let the prices dictate what you do. Don't let emotions play into anything.

I don't speculate at all. if the markets hit a resistance and start falling = puts. bounce off support = calls.

If im wrong, and it breaks thru a resistance level, I convert to a bull play. and vice versa.

TA allows you to play without getting attached to a play.

And if you are letting emotions play, that means you need to sit back, and just learn.

Theres nothing wrong with sitting out for a while, and theres nothing to feel bad about it.

Im just telling you this because I've gone thru a similar stage. and im pretty sure I am not the only one in this form to have gone thru some really tough times.

study, buddy - you'll be a much, much better trader.

dammit. did anyone look at the HON/KOMG picks I had posted yesterday.

If you did, and you played it, good for you.

FDG still looks primed to take a fall.

I would have a stop out at around $30 (this is a resistance of a price pattern downward channel).

Thanks leisa and stockshaker. Yes I should have taken more time to study and work a stategy, but.....I did a few smal trades and they all produced a few small profits - no losses. Well of course, then I got drawn in by trying to cover my first loss and so it has grown from there. I am sure I am a typical gambler, pure and simple and as you know a gambler good at giving advice, but lousey at taking advice! I look for some hope of guidance through this sight as the comments made relate so well to me. But then I go and mess up by doubting, which cause me to chop and chage direction. What a mess!

DOWNOSEDIVE

I have to say that I feel for you.

I am relatively new to TRADING

Kinda forced onto me by circumstances

I've been involved in the markets for a few years, but those have been bull years.

these are different.

I had the same thing happen to me that it appears has (is) happening to you. I got lucky and only lost 5-7000 on a spike in my favor and I covered immediately

to hell with the losses.

I preserved the other 70% of my acct and then got real lucky in late june and made 10 times my loss.

PATIENCE for right time and signals, then take another run

good luck

bsi - I will take alook at Elder's Triple Time Frame by searching the net - I havnt heard of this ans yes I do trade daily and some positions I close the same session, but usuaully I hold them until they show a reasonable profit and then close when I feel the market may turn down with a view to reopening the same amount once the market has moved in my favour. The losses I keep running with as my past experience of both in built stops or manual stop decisions has been dreadfull, absolute disaters. Perhaps the Triple will help with better timing so that Im not left holding the loosers, quite so much...

Thanks darcy, by God could I use some of that luck! Well, ok , judgement then! I juggle every day to try and improve my positions by various methods. I think a lot is down to a lack of confidence in myself, as well as the markets. Until late Monday this week I couldnt see anyway the market would fall, but it has. My further specualtions continue on Tim most recent posting.........

THANK YOU!

I AM LEARNING SO MUCH!!!

Post a Comment