Fantastic Sell-Off

The last few days have been sensationally fun. The market is behaving beautifully from a technical perspective. And, no, I'm not jazzed just because the market is down. On the contrary, I think it's going to go up (yes, up) in the very short term, creating more great shorting opportunities. And, in the meantime, we might even make some cash going on the long side (yes, you read that right).

Here's the Dow Jones 30 for the past year or so. As you can see, the medium-term trendline was violated by just a hair, and the market closed at exactly the trendline (I do not draw these trendlines after the fact, folks; these are honest, pre-drawn trendlines).

The $VIX spiked big-time today, which is no surprise considering the Dow was down nearly 250 points at one point.

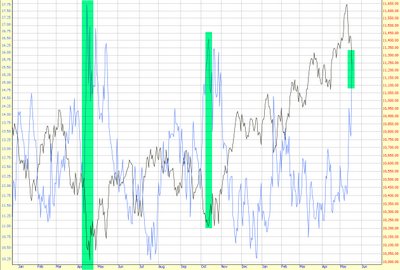

Look at the graph I've made below, comparing the $VIX with the Dow 30 (click on any of these images to see a much larger one). Notice the very high correlation between big $VIX spikes and short-term bottoms in the market. This is one of a number of reasons I think today may have been the bottom for a bit (how long the 'bit' is remains to be seen).

Here's another interesting graph where, again, I've highlighted the points of interest for emphasis. It shows the DIA (which is the Dow 30 ETF) with its volume. Notice today's huge volume. Two other recent instances of a big volume spike likewise marked the establishment of a short-term bottom.

Yet another interesting graph (isn't this fun?) is below. It shows a channel with a midline on the SPY. You can plainly see the SPY is right in the middle of the road (think Pretenders.....Learning to Crawl). It seems a natural "point to pause."

The NASDAQ 100, which has been extremely weak (it's been down 7 days in a row, right?) seems oversold at this point.

One specific 'buy' I'd suggest is Apple Computer (AAPL), my employer from many years ago. I think we've got a nice inverted head & shoulders pattern here, as well as firming at the Fib retracement level. Plus, it went up today (yes, up) which is extraordinary considering the market's action.

For my bear friends who think I've lost my mind, fear not, I'm not only still bearish, but moreso than ever. I think days like today help sow the seeds of doubt. But I really don't want to see the market keep sinking. I think more likely we're going to see a recovery. That could very well establish some exquisitely beautiful shorting opportunities before the carpet gets yanked out from people again.

Many of you have been posting questions to the comments board. I'm going to try to answer them en masse sometime soon. Ta ta!

1 comment:

Tim,

if you dont mind sharing, what program/platform do you use to do your charting? i ask because i am looking for a platform where i can store/save my annotations and trendlines and where i can have a log-scale.

thanks!

walter

Post a Comment