My Nude Pictures of Ernest Borgnine

Finally, a skosh of relief for the bears today (only those truly secure dare offer the word skosh in their blog). The market was down over 100 points several times today (but just a skosh) and wound up down 80. Freakishly, the QQQQ left the day unchanged.

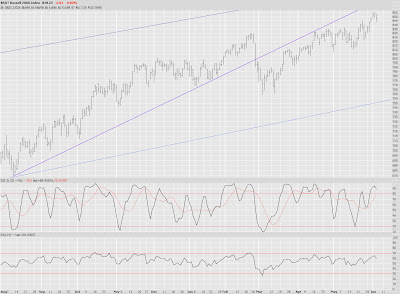

In any case, I made some nice green on some intraday Russell 2000 option trades. I'm too war-weary from the past year to hold these suckers overnight, but I can at least say I like the current $INDU chart more than I did 24 hours ago:

The Russell 2000 (side question: has anyone found ANY other index with a reasonable bid/ask spread on the options?!) has been rather strong lately but edged down about half a percent today. No sea change by any means, but we take what we can get.

And, for good measure, here's the S&P 500:

I haven't put a chart up of the $UTIL for a while, but whether you've noticed or not, interest rates have been really pushing higher lately. (Remember those? Low interest rates? The reason the market's been so bullish.........remember?)Worldwide interest rates have been surging, relatively speaking. Gentle Ben's remarks today pushed them higher still.

My suggestion of Coach (COH) as a short is decent thus far.

I am short a lot of housing stocks. Today was a good day for those positions due to the interest rate movement. Essex (ESS) is particularly attractive.

Just yesterday I said Google was a nice looking long position. Today (of all days, considering the market's weakness) it made a nice lifetime high. So - clink! - here's to another zillion dollars for all the adolescent Google zillionaires out there. I'm talking about their employees. Not you.

KRC is another sharp-looking housing short.

I've been charting the thirty components of the Dow Industrials recently, and 3M Corporation (MMM) is a favorite of mine. I've got some puts on this. Continued Dow weakness would be very kind to those.

Oh, and one last thing. JakeGint's pondering as to what "we" saw in George Carlin left me shocked. So here's another clip.

29 comments:

gary

Your last comment to me noted. the futures are pre market today are down over 80. 160 point fall and will it get worse? I dont know. Im sitting on a 2000 dollar loss since going long on Mon evening. Was short before that and shouild have stayed that way. I would now be in profit. I cant hang on to long positions clocking up these kind of losses each day, no more than I could when in short positions. what a mess.

The batons now with TOMthetrader - he seems to have his fingure on the immediate pulse

Nose dive,

You told me very clearly what your problem is. If a .5% move in the S&P is causing you pain then your position size is grossly too large. Swinging for the fenses is the guaranteed way to blowout your account. Nosedive shame on you if you have been trading since 1987 you know this. Every minor correction so far has been at least 25 points in the S&P you have to at least hold on for that much correction. Get your position size correct and you will start making money. I would also advise that you pay more attention to the weekly charts and ignore the dailys. You will get a much clearer idea of what's really happening from the weeklies without the daily noise. I would highly recommend that you breakdown and at least take a look at the sample COT spreadsheet on my blog. You need a proven system and the disipline to follow it. Maybe the COT will work for you and maybe its not your thing but right now you appear to be trading on emotional swings.

The NDX seems to have decent bid asked spreads. But it has been a bear graveyard lately. I have some july puts and a june bear call spread that is getting near my stop loss point.

Yes, we will open down today but how many times has the marked stayed down. It will take a few weak closes to get me more bearish.

It will take a negative COT report to get me short. Not even close yet. It will come eventually though.

No offense, I hope, Tim, but that piece didn't exactly move the needle either. Stringing cliches to show their absurdity is mildly humorous, but even this bit plodded from amusing to overkill. The best parts get overshadowed by the sheer volume, if you know what I mean. "I get hate mail from my love child" was funny, but "gigabyte in a nanosecond?" Too much of the latter obscures the former.

Anyway, it's likely a taste thing. I was brought up on the comedy of Monty Python, Peters Cook & Sellers, Rowan Atkinson, Richard Pryor, Eddie Murphy, (early) Chevy Chase, Bill Murray and finally Chris Rock, in that sequence.

I don't think Carlin holds a candle to any of those. He's more schtick than style, IMHO. But each to his own.

Holy mackeral, I gotta give Toober more kudos here...

Even though I didn't get them myself (I do adhere to Tim-discipline on a couple of things, one of them being never buying short term options, no matter the attractiveness), those GOOG June 520's look like the call of the year thus far.

That freaking GOOG is so strong right now, you can SEE the buyers slavering to pick it up every time it makes the tiniest dip.

Hi, Group;

Let me introduce myself. My name is Bob Blu and I live in Centennial, CO. I use Thinkorswim and became acquianted with Tim's work and this blog when he did a live chat on TOS a couple of months ago.

I have been trading options for a year and a half. Primarily I trade the RUT. Started out with FOTM credit spreads and Iron Condors. I have come to appreciate that ITM or ATM debit spreads offer a much safer risk/reward opportunity.

My aim is to play the swings in the RUT. Generally speaking, it appears that the RUT offers two to four good opportunities per month. Good opportunity defined as something in the neighborhood of a ten + point move.

I am currently using Slow Stochastics and Williams % R as my indicators to trigger entry/exit points. I selected these using the SWAG (scientific wild ass guess) method. Hardly perfect but so far I am profitable after a whopping two months of trading this strategy.

I just finished analyzing the last ten years of RUT performance using this strategy. I determined the average point swing and number of winners vs. losers.

I don't know enough to determine if I have found anything meaningful or not. Furthermore, I believe that there are probably much better tools to determine swings than I am using. To that end I would welcome any input from anyone interested.

Thank you,

Bob

I think that this market is finally acting rationally - people are taking profits and the NDX and DIA puts I use to hedge my longs are singing sweetly this morning.

Buy the dips and stop whining when we go up 200 points next week.

gary

Correct, my stake size is too large and I now have no coherient strategy. I guess by being continually bearish it was a matter time before a down correction came to benefit. Ive missed it and got caught by changing to long at the wrong time. It just shows you need to either take a bear position or a bull position and stick to it. God what a freaking mess Im in

Nose dive,

How about you try something different and quit trading your emotions. The COT is as bullish as it's been in years. The market is getting short term oversold. You might want to contemplate holding those longs for a while. The odds are in your favor to do so. However if you flip again you will guarantee a loss and you will be going short just as the market is getting oversold.

downosedive, if you are long right now, with this market so overdue for a correction (even if only a 5-8% one), you should be hedging with some sort of puts. many people use OEX puts, and probably buy out-of-the-money. and speaking of which (the VIX is based on 8 different OEX strikes) - the VIX has jumped clear out of its trading channel and THAT is very bearish if it doesn't return, but heads higher.

gary

By the way Im soley on the Dow and not the S&P, I presume your past comments all hold just as good for that indicies??

Im inclined to go with your thoughts as in hindsight they are pretty similar to my own, now ive had some time to try and calm down. This fall is a tyhpical correction as it isnt linked to any radicle news. In fact Mr B's speach yesterday merely confirmed that in fact the economy is actually strong enough not to even need a rate cut. Now is that bad news. hell, noooo. So ally the sell off is blown way way out of proportion, which is typical of a correction is a real hot bull market. Yes, I feel a return to strength is inevitable and I certainly dont want to be holding shorts then. Just hope that it will be soon though. But Im not falling in to the trap of taking out short positions, so I will just have to stick with what Ive got and put more margin payments down to finance that

yuri, thanks for the advice, fine if the market continues to fall, but costly if it doesnt surely? Your view conflicts with gary's, so its down to who do i trust!! gary is a mine of information and seems to know how to use it. He has and continues to be absolutely confident in market direction

Nose dive,

Now you are starting to think rationally. However I wouldn't put up anymore margin. You already made the mistake of taking on to big of a position don't compound the problem. Just sell some of your long position.

I might suggest that everyone take a look at the weekly charts. The SPX is down 1.2% and the Q's are down .67% how does that suggest that this is anything other than a normal pullback?

Bob,

Just an FYI, Williams %R is exactly the same thing as a fast stochastic, except that it is on a negative scale. Use the same settings on both and compare.

Tim,

QQQQ has penny options available and its very liquid too. Hope all options are available in pennies. I found that OEX options(also available in pennies) are not that liquid.

Today is good day for bears. I've already close 70% of my shot position. This crazy market has tendency to bounce off in last hour, I want my money in my pocket :-)

"Anyway, it's likely a taste thing. I was brought up on the comedy of Monty Python, Peters Cook & Sellers, Rowan Atkinson, Richard Pryor, Eddie Murphy, (early) Chevy Chase, Bill Murray and finally Chris Rock, in that sequence."

Wow, WEIRD. All the above are awesome comics. I guess we diverge on Carlin. Oh, well! To each his own!

This is your shot bears to buy this pullback and ride with us bulls back to 15k Dow by December.

Thanks, Chuck. I knew that stoch. and WLR measure the same thing. I didn't realize that the fast stoch was identical. I have been using the slow stoch %K in conjunction with the WLR. Because WLR moves so quickly combining the %K seems to smooth it out.

But I am sure open to a better way and welcome further observations and suggestions.

Bob

gary

Yes, a classic pullback and laughably on a surprisingly strong report by Mr B. Agreed, fellow bears take note! This is a chance to close your short positions before the rise continues. I am a bear, but I cant ignore the strength of this market. With the help of gary, tom and others, it all boils down to having the confidence to follow the trend. Painfull, but slowly I think Im coming round to thst (???). Tim continues to provide a valued perspective and helps make sure that feet remain on the ground!! Eventually the bear will return, but it sure wont be soon

The Mr. B thing supplied "interest rate jitters" for the media to latch onto.

And some selling opps for fat bulls.

Meanwhile the ten year is up today.

Hey ,

I am wondering if there is any credibility to my 200 point down 200% short play now ???? Anyone want to know what the next move is ...Oh it was just luck ??? You haven't 10X your money ?? Ask all the members who traded on IM today and saw the profits are members raked in !!! DXD SDS July PUTS !!!! OK enough bragging and onto tomorrow ...you should all know by now this is a Bull Market and this is a typical Bull market correction but some sectors have not even budged !!!

I will be on my site and devising the game plan to make my members more money after our fund is up 9.3% this week ...Not too shabby for very little risk with Ultras and in the money puts !!!

Tom http://www.ttthedgefund.blogspot.com

Jake,

Agreed, chris rock, pryor, eddie murphy are some of the best comedians around, But so was carlin. He's got some of the best material ever written. The guys a genius. As for the others, they are funny as well and i like most but THEY are the exact definition of "schtick". You can't get any more "schticky" than Mr bean, black adder or the flying circus. Funny but simple humor.

And, as the late, great Johnny Carson said it best,"Chevy Chase couldn't ad-lib a fart."

Comparing George Carlin to Chevy Chase should be a crime punishable by being forced to watch Fletch 2 and 3, over and over and over and over.. until your eyes bleed.

I didn't even know there was a "Fletch II." Was he in it?

"Fletch" however, was a masterpiece.

As was Caddyshack. For those alone he is forgiven much. But I was talking about his movies more than him as a standup (as a comparison to Carlin).

You may recall that Carlin is an absolutely awful actor, so we can't really measure apples to apples between the two, especially since I don't think Chase does standup at all.

As for calling the Python's incredibly original and arguably, groundbreaking material "schtick," well... I'd love to know your definition of the word.

And Carlin gets a lot of love, I'll admit. So maybe it's just me. I just don't find him funny.

Tom,

Yes, we are not worthy. You win today.

Woohoo.

tom, sure you're up 10% this weekk w/ little risk. Are you as dumb as you sound......Show us a statement or something to back up the ridiculous gains you supposedly achieve(>200% according to your blogsite). If you can show us all these incredible gains I will personally donate 5x what you ask for on your site. I am tired of you promoting your BS over here.

I'll remind everybody that there is no such thing as a prediction in the stock market. Until we develop a machine that will allow us to see into the future they will only be a guess never a valid prediction. Tom do you really think that with the S&P down a huge 1.23% this week anyone believes you are up 9%. Maybe with huge leverage but huge leverage will eventually guarantee huge losses. No one has to my knowledge ever been able to consistently better about 60% on their trades in history. Do you really want to tell people you have a system that wins 100% of the time. I suppose you have some swamp land to sell to. Folks remember the old saying when it sounds too good to be true it is.

looks like the 3rd down day, it must be a bear market this time.........heee the stuff on this blog is just tooooo much.......

Post a Comment