Some Day This War's Gonna End

It was a good day today. At first, I was distressed to see the Dow blasting higher, well past the 13,600 mark. It was up nearly 100 points. But I noticed something. Looking at the $RUT and the $SPX, they were not at new highs. In fact, it looked like the Dow's strength was just pushing them into making a right shoulder on an intraday head and shoulders pattern. So I bought more puts.

That was the right move. The Dow went limp, soft, and squishy, and we enjoy a nearly 200 point intraday turnaround. Every single position of mine was way in the green.

Oh, please remember to sign up for MyBlogLog, which now has nearly 100 members! It's free, and it's a fun way to see the other folks that have made the trip to The Slope of Hope.

Now, I am maintaining my cautious and newly humble disposition, so I will say, in the face of today's fall, that we must exercise caution. Just look at all the recent falls in the past few months. Every single one of them was just a blip - a momentary pause - before the market shot higher still. So a grudging respect for the bulls is in order.

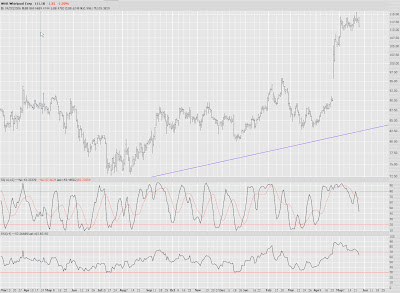

I mentioned Bunge Ltd (BG), and it is doing beautiful. The perfect presentation of lower highs and lower lows.

I mentioned yesterday that housing stocks had pushed up to their necklines, and I was going heavily short to enjoy the hoped-for fall. It did just that. It's nice when patterns behave as they should. Here's Essex (ESS) as just one example.

InfoSys (INFY) at long last cracked beneath its neckline. Now we can get serious about making some cash on this one.

PSB also enjoyed the aforementioned housing H&S fall.

Vornado (VNO), suggested by a reader here last week, is another honey.

Whirlpool (WHR - has that for a boring company?) is flipping direction too. Good.

And now, your thought for the day.

27 comments:

Indeed, it is a good day for the bears but they must follow through tomorrow. One good thing is that they finally have the interest rate moving in the right direction for them.

(position : short SPY)

IYR is showing identical pattern to your individual REITS.

My SRS did grandly today. I did exit my position, leaving a bit on the table, but okay with that.

Felt good to be 200% short the markets with SDS DXD and QID but had to fold the bear tent as seasonality and oversold readings convinced me to take off the bear suit so I got you 4 down days ..you are on your own now !!!

Tom

http://www.ttthedgefund.blogspot.com

"Now, I am maintaining my cautious and newly humble disposition, so I will say, in the face of today's fall, that we must exercise caution. Just look at all the recent falls in the past few months. Every single one of them was just a blip - a momentary pause - before the market shot higher still. So a grudging respect for the bulls is in order."

is this time same?

we had onece, twice, third, fourth,... then finally might not.

NZD/USD also moving the right way.

All eyes turn to Shanghai tonight...

Seems virtually every real estate related chart I look at has massive head shoulders patterns. Pretty uncanny...

brian. Real Estate almost always has the exact same chart...it has always kinda boggled my mind.

i am half tempted to close my akam put in order to get into one of these others that seem like they are going to move more strongly, but i am sure that the moment i pull out of it due to sideways motion, it will fall off a cliff as well as whatever one i decide to get in will move sideways or against me....fun stuff! *smile*

Nikkei down 225 points as I type. Ugh!

"Nikkei down 225 points as I type. Ugh!"

Ugh? More like: YAY!

Well, FXI (china ETF) got hit today. Broke through the neckline it had previously broken out of...so takes some steam out of the bull case. But so long as it doesn't break 104.90 it's still alright. After that...cut and run (disclosure: I actually don't have a position due to changing brokerage accounts...not opening new trades until everything is settled).

BSC took a hit today...that one hurt. I'm sure Tim is cheering though.

EWZ (Brazil ETF) shaved off 3.5% today!

Asian Market had to reflect our selloff. So far their decline is at par with our. Globex futures shows little positive net change AH.

I got stuck on wrong side of market today. Its oversold in solid uptrend so we should be going up tomorrow.

First the good news, (for bears that is), this is the beginning of a nasty decline, the real deal. Now the bad news; the decline is going to end up being a brief but likely sharp respite from the bull. Now the really good news, if one is a bear, which one should not be, as per the admontion, "be careful what you wish for, because you just might get it."

Mark my words, when the bear shows up late this summer/early fall, it usher something much worse than the '00-02 recession. We are going to have a Depression, just as sure as night follows day. My favorite candidate/catalyst for the onset of the Depression, which the bogus WOT, the wars in Iraq and Afghanistan were all designed to both camouflage and forestall, will be the Chinese shares market which is destined to develop into an epic crack up.

Someone mentioned the SRS. Yes, it has done very well, and over time will continue to do so. Do not believe any happy talk on the housing front as it is pure bunk.

"someday this wars gonna end"

classic!

You're not gonna make money on INFY shorting it here. The stock has bottomed.

You have to figure the China market will hold up (or be propped up) through the Beijing Olympics. I'm guessing the US markets will go weak before China's.

It seems too early for a major correction, but clearly the action of the last few weeks has been a short-term blow-off. One catch... since energy is so overbought, weakness there could hold up the rest of the market for a while.

What was up with the Utilities, anyway? They traded like dot-coms over the last few months. Definitely a warning sign (and notice that they started to show weakness several days before the broader market).

TK i agree with Beanie, be cautious with INFY, this might be the best entry point it will give for a long long time.

"You have to figure the China market will hold up (or be propped up) through the Beijing Olympics."

Could someone please explain to me the logic of the above statement? Please?

Edwardo,

Just wondering where you got a working crystal ball. I've been looking for one for years. LOL Be careful of trading your bias. BTW no matter how much you personally guarantee the market will drop it really doesn't have any influence on the indexes. I still have to invest under the assumption that no one can see into the future. In that regard the trend is still up and the COT as of last week was extremely bullish.

"I still have to invest under the assumption that no one can see into the future. In that regard the trend is still up and the COT as of last week was extremely bullish."

That is self-contradictory.

You say no one can see into the future.

Yet you put tremendous faith in what the "big boys" are doing.

Did the big boys not get burned from 2000 to 2002? Surely they did.

Well, Shanghai appears to have partied on, oblivious to everything. And don't kid yourselves; that has a lot to do with our own liquidity-drunken stock bulls jamming the tape higher today. So does this. Temporary, my eye.

I wish I could be spared the pain of the global collapse this reckless, irresponsible behaviour is guaranteed to beget.

Tim,

Actually it is not contradictory. The commercial players are for all practical purposes THE market. So when they signal their intentions in the futures market they are basically telling you what they are doing with their money. So they aren't trying to predict the future per se. When you and I buy or sell it has no effect on the markets what so ever but when Goldman Sachs or Morgan Stanley or the CA pension fund, etc. buy or sell it has a profound effect on what the market does. These large players are required by law to state their positions in the futures market every Tuesday. The report comes out on Friday afternoon. Its like playing poker with Johnny Chan except he has to show you his cards. It doesn't mean you will beat him every hand but you would have one hell of an edge.

BTW The COT signaled a sell in the summer of 2000 and stayed short all the way until Mar. 03. I'd say they caught the bear market pretty good.

I'll add that if you knew how to read the report it would have got you out and long for the 2 large counter trend reactions also.

Go long! Go long!

Yesterday was a bear trap!!!!

We are likely going higher next week.

I'm about 3 sessions away, from throwing in the towel. how the hell do we have a up day, after a day like yesterday.

2x inverse 200% short 100k =200k buying power ...very simple just like being 200% long like we were today QLD !!! Nice to be on the right side of the trade all the time !!!

http://www.ttthedgefund.blogspot.com

Tom

24/7

Post a Comment