The Stalemate Continues.........

Twelve stinking points. That's all that got lopped off the Dow after the Fed announced no change in rates (as everyone expected) and that inflation was indeed still a concern.

The intraday chart below shows what happened. After a nice pre-announcement drop, people sort of clung to their chests until the announcement, at which time the market did its usually insane up-and-down which-way-is-up madness. Most of the day's earliest losses were wiped clean.

I took a snapshot of $MSH earlier in the day since I thought it was worth considering as a short. Keep it on your radar screen.

The $OEX is sporting a big ol' hanging man for today. These don't happen that often. Just try to find another one that's even close on this chart. These usually suggest tops. Of course, we're in a market where bad news is good news and good news is great news, right? So - - the hanging man will probably muscle the noose off his neck, jump to the gallows, and start twirling around with an exciting Up With People dance.

As I've mentioned, the Transports are the only really bearish index with us, and it continues to behave nicely. Thank you, Mr. Rail.

Just to get an idea of the quagmire the market is in, look at the American Stock Exchange Major Market Index. Four days in a row of virtual carbon copies. Booooooooring!

I haven't shown my positions in a while. I've trimmed this a lot from the days of holding eighty positions! I'm much more into cash now, as this market continues to idiotically lurch higher.

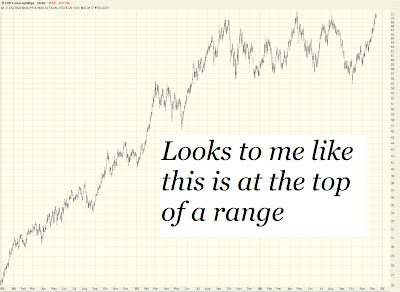

Now - some individual stocks. Conoco (COP) seems to be a safe bet, as it is at the top of a well defined trading range. As always, though, upside breakouts can and do happen! So be careful.

This one isn't a short or a long - just kind of a puzzler. One of the strongest stocks lately has been Campbells. That's right - soup. Consumer Defensive plays are all the rage, I guess. I guess I've been in the Silicon Valley too long. I find it curious how people can get all excited about someone who puts alphabet soup into a can and sells it for 79 cents.

Google (GOOG), one of my more speculative put positions, is weakening a touch. Using my employer's "three arrows" method, we can see here that we've got a triumvirate of down arrows.

Goldman Sachs is my favorite investment bank short right now.

Heinz is another one of those "huh?" stocks, like Campbells. Ketchup. I guess it's all the rage.

MDC has retraced to its neckline nicely. I don't love this enough to make a position out of it, but it's well worth considering.

Merrill Lynch is a sky-high pattern which I've also secured as a short position.

Meritage (MTH), mentioned here many times in the history of this blog, has also retraced to its neckline.

I have not touched OIH for a while. I had a great time with it during the summer. It seems to be at a real stalemate right now. We're all just watching it for a breakout in either direction. I am guessing down. Surprised?

Fred Hickey is one of the few gurus I really enjoy reading. He had a really interesting mention in this week's Barron's where he was slamming tech stocks. One of his short recommendations is one on which I own puts, Research in Motion (RIMM). The article says, in part:

"In an echo of the 2000 tech mania, the analysts covering Research in Motion don't seem to be fazed by the fact that its market cap is now up to $26 billion, or 11 times sales." He notes, in contrast, Motorola (MOT), the cellphone giant and a key competitor, with sales of $42 billion, versus $2.4 billion for Research in Motion, yet its market valuation is only two times larger and 1.3 times sales. Palm (PALM), another competitor, sells at less than one times sales. Fred's calm assessment: Research in Motion's "valuation is certifiably insane!"

Lastly, Tesaro (TSO).

On what can we pin our dreams next? Crappy retail sales? That's tomorrow morning. Hope springs eternal in the bearish breast!

12 comments:

I figured GS would jump up to around 782 per share after lunch, maybe tomorrow. Next week I am looking for gs to be trading at about 2000 per share.

Tim,

Are you considering going long or short on MDC? Your comment is not clear.

TIA

You buy GS and you deserve to lose money like its 1999. Cramer is pumping new IPO issues(ARTE, GUID, IPGP). He is telling viewers to pay up to 35% premium over where they price at this week. Let the bubble days begin?

I love how Cramer pumped yesterday (I think, maybe it was last week, who knows), and today it absolutely tanked.

I agree about GS. On another blog, someone also mentioned RIMM's valuation as compared with MOT. It was mind-boggling.

So many things are in the upper stratosphere, it's not even funny.

I just have to laugh when bulls keep trying to justify the ridiculous valuations. We may BARELY stave off recession next year (but inflate the hell out of the US dollar in the process), and people are looking for market P/Es pushing 20??

Total insanity.

That being said, where *ELSE* is the tremendous flood of liqidity supposed to go??? There are NO other investments out there!

These markets absolutely suck.

-TonyB

Tim,

Once again many thanks for an excellent read. I cannot wait for your book to be published so I can enjoy a good read.

Hickey? No tellin how many 100$ Nov puts that poor man had on RIMM. When I read that "certifiably insane" ya just knew he had been splattered.

What about woodrow's dramatic call week before last? "This is the top!"

yesterday's drop was due to Best Buy's dissapointing earnings numbers.. a consumer discretionary component.. today, there will be some numbers on retail.. let's see if these numbers add up??! Anyway, my long position on S&P yesterday was burnt and stopped at 1408 b4 the index march up..

NAZ should hit 5020 tomorrow on a news of a astroid heading towards earth. the news was bullish on wall street.

Surprise surprise! they do have a new thing called iBuzz previously mentioned on this site 'The iDildo'

Just google for iBuzz and you will know :-)

Incredible day, this market didnt deserve its rally back to 12300+. I was touting that the fed would do nothing at this meeting. Why the rally into the last 2 hours of trading day has baffled me. However seeing weakness in RIMM, AAPL and the transports is making me somewhat happy. Im looking for IYT to drop below 80. The markets are still overbought. Would like to see the DOW trading around 11600 to get any long positions going.

TRADER 2006.

Until the last bear is converted to a bull, this market will keep chugging higher like a good girl turning tricks on a Friday night. Yes it's insane, but never underestimate the other guys greed.

I truly believe that the DOW has to set a resistance level down, that might not happen 'till 12,600 - 12,800, but it's coming. After that we will bounce between 9,500 to 12,700 for the next decade or two. Just seeing how idiotic you bulls really are gives me solace that you do not know the meaning of value. Anyways, we are here to teach you a lesson. Money does not come easy ... it has to be earned.

Why don't you idiots start demanding a respectable dividend from your companies? Yields shd be double what they are. Stocks are riskier than bonds you fools!!!

Google sucks balls with this blogger shit!!! I have to re-type that stoopid word verification shit like 5 times!!!

"Google sucks balls with this blogger shit!!! I have to re-type that stoopid word verification shit like 5 times!!!"

Yeah, it can be tough to read. But believe me, the absence of comment spam makes it worth the extra effort.

Post a Comment