Time Premium & Uncertainty

I first want to thank my readers for many terrific comments posted to yesterday's entry. I encourage everyone to check them out; lots of good input.

Naturally, all eyes were on GOOG this morning. Although the stock got clobbered yesterday in after hours trading, getting as low as about $350, it wasn't down as severely this morning. Make no mistake, a 40-point fall is still really nasty, but the price seems to be gravitating toward its 78.6% Fib retracement instead of the lower 61.8% retracement at $330.

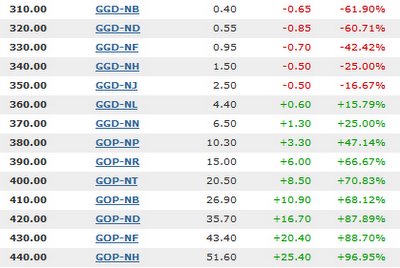

What's really interesting is how the time uncertainty collapses after the earnings are known. I saw a lot of speculation a few days ago of people who were buying $350 puts at very low price, hoping to make a killing. Well, the world of options isn't entirely fair. So even though the calls are getting destroyed........

Only the puts well above the current stock price are enjoying decent gains. And, frankly, gains of 90% aren't that sensational considering the once-in-a-blue-moon drop of $40 overnight in a stock's price. But, let's face it, there was a huge amount of volatility priced into GOOG already.

One last thing - a stock I've mentioned before, ASYT, is doing great shooting away from its inverted head & shoulders pattern.

3 comments:

GOOG is still terribly overvalued. Evan after this 10% 'correction', the market value of GOOG is about a 1/3rd of XOM. What gives? The world will not come to a halt if GOOG shuts down. It will if Exxon does! How quickly people forget about the tech bubble! How long until a better search engine comes along? The pig has been fattened up, get ready for the slaughter!

That's it, Come on where is all the objectivity.

First of all, mea culpa for telling you to buy calls instead of puts. Unlike you, I wish you no ill fortune. I hope you sold your puts at the open to capture most of the profit because if you don't you will lose most of your put profit if you wait until the close of the trading.

I manage my family's hedge fund. I bought a boatload of goog in 2004 at an average price of 112. Every now and then I add to my goog position with every significant drop. This morning, I added to my goog position at the average price of 389.6 because I consider that a significant drop(18%). I am still holding these positions and don't plan to sell them because I think Google will be the first trillion dollar market cap company in the world. I did buy some goog calls on Monday but yesterday afternoon I sold them at breakeven not because I knew the earning won't be satisfactory but precisely because I felt that the time premium is too high and the trade is too crowded that it will be difficult to make money after the earning report.

Yes, I am an unabashed bull. I feel that we're still very early in this super bull market. If I have to guess, I will say we're in no more than second or third inning of a bull market game that may go to extra innings. Why do I think so? I am an American and thus a very optimistic person. Allow me to digress a little bit. Judging from your attitude, you don't seem to be an American because you don't have the quintessential American optimistic spirit. With a name like Knight, are you a Brit? Anyway, let me clue you in on the culture of the Yankees. We are an extremely optimistic and innovative people. We're also the riches people in the history of mankind. Right now, there are three billion people (Eastern Europeans, Chinese and Indians) who are desperately trying to be like us. That means they will crave our capital and our knowledge know-how. So we're in a catbird seat. In this environment, our companies can't help but make boatloads of money. BTW, it will be the same case for your innovative Brit companies as well. Do we make mistakes? Of course, witness WCOM, Enron and the Invasion of Iraq ( which by the way, you Brits are also involved.) But we are man enough to admit those mistakes and powerful enough to overcome them (Well, at least we hope Bush will finally come to his senses.)

One thing that puzzles me is that you claim to be a stock technician but with so many indices making new ALL TIME HIGH, and with new high/new low list for today looking like this : 298 to 33 in NYSE and 219 to 21 in Nasdaq, how can you remain bearish??? Take it from an old pro, it is much easier and more profitable to be bullish than bearish in this super bull environment. Occasionally, you maybe right but end up making just a little bit of money just like your goog puts today. If you are not careful, they might take your technician card away from you. Just kidding.

Post a Comment