Revisiting FOREX (NZD/USD)

I've posted a couple of different times about the attractive short position in NZD/USD (which basically means the New Zealand Kiwi should fall in relation to the US Dollar).

This continues to be a good trade. Over the past several days the US Dollar has been very strong, so NZD/USD continues to get pounded.

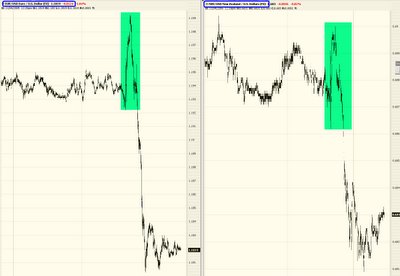

As the graph below demonstrates, these markets are extremely volatile (the graph on the left is the past several days of the EUR/USD and on the right is NZD/USD). As the highlighted portion shows, these markets can spasm on news in one direction and then flip around and rush the other direction. Trying to trade on too short a time horizon is almost always a money-losing proposition in the FOREX markets.

I am not sure if NZD/USD is temporarily oversold at this point; it was definitely hammering out a short-term bottom near the end of trading today. The big picture remains superb for shorts. But, having fallen so far, it isn't as safe a bet in the short term since it could recover to the upside. Over the course of weeks and months, however, this still looks terrific.

2 comments:

Fridays in the forex are funky. I think we should be careful about identifying a bottom in the afternon since volume dries up to almost nothing. However, the fact remains that the market has stalled for the last several hours at the .682- for a while. I am shooting for an ultimate low of at least .65. I have based that on past performance rather than an obvious support level.

Ever thought about helping out people like this guy?

http://www.helpjimbob.co.uk/blog/

Post a Comment