Are the Bulls Losing Their Grip?

Dedicated bulls should worry about this: the market is starting to make sense to me. Last week was a really good week. This week was a really good week.

Now, if we were at the tail end of a two-year long bear market, it would be easy to shrug this off. "Oh, yeah, Tim the permabear has been doing well because everything has been falling non-stop." But you know that's not the case. The Dow was at its highest level in human history earlier this month, and it still has over 98% of that value. So I've been able to score big profits trading virtually entirely bearish positions in a market which has been in anything but a free-fall.

So it's making sense. Leading up to this month, I was starting to lose my mind with how nonsensical, bizarre, and random the market seemed to be. It would be like living in a town where cars stop at green lights 80% of the time, pedestrians occasionally walked along the middle of the highway, and baby carriages were parked on the roofs of buildings. After a while, you start to lose your mind in that kind of environment and question your own sanity.

But the town I live in suddenly makes sense. People stop at red lights and go on green. Baby carriages are safe. And pedestrians remain on the sidewalks. And the market goes up when I think it's going to go up. And it goes down when I think it's going to go down. It's a nice change. Let's keep those buggies off the roofs for a while, shall we?

If you read my post from earlier today, you know I spent a little time this morning at the Palo Alto Apple store watching the crowds line up for the JesusPhone iPhone. If you didn't see the post earlier, check it out. It's got a cool little video I made.

I'm trading the Russell 2000 options actively, both intraday and on swing trades. A tight stop on the IWM ETF is at 84.19 right now, which was the high for both Thursday and Friday.

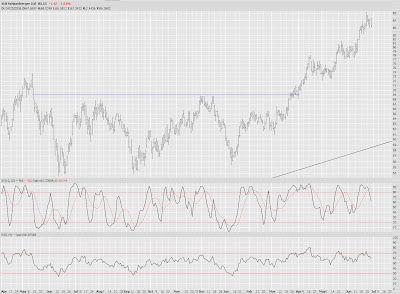

There's really no good instrument for trading the MidCap 400 ($MID), but it's a fascinating graph to me. The markets seem to be revving up to be in swoon mode.

I haven't traded the NASDAQ (either index or hardly any stocks) for a while. It's been relatively defiant of the recent weakness in the market. But I have a feeling this group is going to start joining the downdraft party.

Side note, now that I mention NASDAQ - congratulations to RIMM owners, particularly call owners. I see some of the calls were up literally quadruple-digit percent levels today!)

Oil services are looking terrific for shorts/puts. HES is particularly well-formed and liquid.

McKesson (MCK) is another beautiful stock. One of the best examples of exploiting Fibonacci fans that I've ever seen.

RadioShack (RSH) has been on an enormous upswing of late. (Rumor has it that AJC has joined the Battery Club multiple times to keep her bedside electronic accouterments fully-powered, thus the earnings spike). But - - just like JC Penney is JC Penney - - Radio Shack is Radio Shack. And that's all you need to know. I've got puts.

Next week should be relatively quiet with a big fat holiday right in the middle of it. Have a safe one (most of you, at least), and I'll see you on Monday.

Late breaking news! I was there for the Big Event (the 6:00 opening of the doors at the Apple store). It was a madhouse. Police, news crews, and hundreds of people (half of which were taking pictures).

You know the funny part? People waiting three days to be near the front of the line. And one hour later....one hour......I was able to just walk right in through the front door without a wait. Great use of three days (and nights), fellers. Anyway, here are my two iPhones perched on the kitchen bar: