As the Air Leaks Out....

Well, it was a pretty interesting day. Early on, news got out that Ken Lay had died. You can still read about his innocence from the man himself. Did I ever mention that Enron seriously considered buying Prophet back in 1999? True story.

I was reading a story about Kenny boy, and I noticed in the Google ads this link; it's sort of hilarious, in a way:

Well, I guess that puts the nail on the coffin of any Enron talk. Unless Skilling jumps off a bridge or something. Adios, Lay-man. We knew thee all too well.

I've got some more short (or put-buying) recommendations for those who dare. Unless they want to hop on the GOOG/HANS/NTRI train with users named after natural disasters. For the rest of us, I present these symbols and stop prices....

BNI 84.88

DO 88.25

DVN 65.25

ET 23.46

LSS 58.30

MLM 95.15

NXY 59.10

XLE 60.15

20 comments:

i was looking at ET as well, i like how RIGHT TODAY, it joins up price for price with the channelling that forming wtih tops being 4/21, 5/11, 6/02, and today.

beauty!

But im still bullish, so I will prolly watch this play unfold from the sidelines.

even if it goes down tomorrow, I don't think the sentiment will change, becuase the SPX has a huge support at around 1256, so, it still has some play before I start getting worried.

The naz, landed nicely on a support level that I have

but dow still has a 11,100 support level which I think is pretty substantial.

So even though the puts look prime, I'm thinking it may be jumpin' the gun a little bit.

and i don't like getting disqualified.

go Portugal!

and again, I must be saying this same comment over and over, that I should have a copy/paste button for previous messages.

volume was again, pretty slack.

but what is the story with oil burning up?

damn 75!

But wasn't it last month when oil was tumbling, but so was the markets?

I used to think there was a inverse correlation between the sentiment in the market and that in oil, but last month totally killed my theory.

before anyone posts otherwise, YES, I just heard Portugal lost.

the day just gets worse and worse.

Go Italy!

lay looks like such a douche in that photo i can hardly look at it.

Did you omit the symbol for DVN, stop at 65.25? I assume the filename tells all?

What is everyone's expectation/sentiment from the employment numbers on Friday? Will that finally set this market on some sort of definable direction, or do we waffle in the doldrums through summer?

ok, its been a slow day at work, so ive had time to check out the markets, read a lot, search a lot of stocks etc etc.

i found a couple really good finds, for all you bears:

MYOG

DOW

that is only if you are bearish on things, which right now, im not, but these still look very much PRIME.

hurricane5, good call on those picks....please do share on your next picks...thanks.

No volume on the downside today. This is usually a sign of selling exhausation. Falling markets dont wait, they usually fall pretty steeply. If this is truly a falling market, we need to see some steep slides soon. The short term trend needs to reverse from bullish to bearish for confirmation of a bearish trend. That happens when DJIA breaches 10900.

Kapil, you must be joking about the volume signals. "Selling exhaustion??" Granted, the sellers have definitely hit the sidelines during the last week, but there is still PLENTY of sellers in the market just waiting to unload.

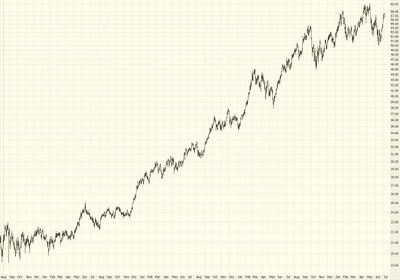

You have almost 4 years of increasing liquidity being pumped into the markets. Do you really believe that the drop in May/June has "exhausted" the sellers?

There hasn't been a REAL down day in the markets for 3 weeks now and many (actually, nearly ALL) of the quality stocks are up 10-15% or more over those last 3 weeks. And you think the sellers are exhausted??

The selling hasn't even started. Just my opinion, of course. N. Korea has really thrown a monkey wrench into the system, though. I was just on the edge of starting to rebuild some long positions today, but I'm not so sure that we won't see the serious selling start up again.

In light of recent events, a re-test of 10,700 might be in order before the bulls can take the baton again. This is a wierd market.

-Tony

AS MY PREVIOUS POSTS, THE MARKET NOW READS EVEN THE SLIGHTEST SIGN OF A DOWNTURN IN ANYTHING AS BEING GOOD - QUOTE "Stocks rebounded in early trading Thursday as lower oil prices and mild June retail sales helped Wall Street steady itself from steep losses in the prior session.

Retailers saw slower same-store sales last month, a sign that high gasoline prices and rising interest rates were beginning to strain consumer spending and slow the economy. The results fed optimism on Wall Street that the moderating economy will prompt the Federal Reserve to halt its string of rate increases.

Investors showed little reaction to a slight dip in weekly unemployment claims" UNQUOTE. HOW PATHETIC IS THIS AND OTHER SIMILAR RISES? BUT NEVERTHELESS, ITS SENTIMENT AND ITS SENTIMENT THAT IS DRIVING THE MARKET IN AN UPWARDS DIRECTION. LOOK AT THE WHIMPISH MARKET REACTION YESTERDAY TO THE MANIAC IN N.KOREA. THE MARKET MAY RISE NEARER TO 11400, BUT NO FURTHER, BUT AS TO ANY EXPECTATION THAT IT WILL FALL BACK TO 10900 OR 10700 WITH EASE IS HIGHLY UNLIKELY INDEED. I THINK IT WILL STAGNATE BETWEEN A TIGHT RANGE FOR THE SUMMER (11100 TO MAYBE 11400), AFTER THAT I WOULD LIKE TO EXPRESS AN OPINION. YOU ARE ALL CORRECT IN YOUR BEARISH ANALYSIS OF THE ECONOMY AND THE MARKETS, BUT BULL SENTIMENT OUTWEIGHS THIS. ANON, YES I DO THINK THE BEARS ARE EXHAUSTED AND BEING OVERTAKEN BY BULLS EVER INCREASING CONFIDENCE IN CHASING UP THE PRICES. I DO HOPE I AM WRONG BECAUSE I WANT AT LEAST ANOTHER PLUNGE, IF NOT A FULL BLOWN BEAR MARKET

the major indices are still stuck at around the 50 dma

i would say the markets are still undecided right now ... not enough volume from either the bears or the bulls to really make the start of a new trend

but with most technical indicators close to overbought levels on a daily basis i would rather be a bear than a bull at this point

interestingly the djia's 50 - 100 dmas are almost exactly at the same point ... it looks like the big trend we get, whether up or down, is going to stick for a while

With respect, I would not call a full reversal of yesterdays fall, a bearish act. It is currently continuing firm in aftermarket trading over here in the UK. Also mentioned in todays traders upbeat comments as a factor behind the DJA rise was a fall in oil BELOW $75 - can you belive it! 4 weeks ago there was near mass panic about the oil price at the $70 level. See how sentiment drives the markets at present and not economics. And the sentiment as most of us agree is currently bullish, even though IT SHOULDNT BE, based on the logical and factual analysis that is posted to this site and with which I very much agree.

I used to be wondering behind the rationale - FED, economics, oil, and wondering, WHAT could carry the markets to go up higher? It is ridiculous!

But then, the best answer, is the one that is so irrational, that it makes sense.

I am still a firm bull-liever, and I think the only reason why the rally is even continuing is the hope of a better short term - Earnings and Payback.

People like things to go up, and right now, its finding a little bit of a bottoming (and some upward movement), and this creates hope. and people are gulping it down like a cold slurpee in the desert.

See, hope, my friends, is what the American Dream is made of, a sense of finding an opportunity and prosper.

People want to make back the money they lost in May, and right now, with teh markets going sideways (as opposed to further downwards), people thing the bottom has happened, and now its bargain season.

Speculators may take this opportunity before earnings is fully underway.

Plus, technicals support it.

SBUX is getting a beatdown aftermarkets, I hope the Hope lives tomorrow.

A firm bull-liever (for the short term),.

IF we get new jobs north of 225,000+ expect a sell off, anything above 300,000 and the markets could easily lose 1-2% tomorrow. This would only push the federal reserve to push rates higher at thier august meeting to 5.5%. ADP released a very strong number on wednesday, if this number holds true the market will sell off quick.

I still dont understand how this market could move higher myself. Oil rising again, commodities also rising, inflation, consumer spending slowdown, housing bubble etc. Think the only catalyst for this market right now is strong earnings...

I took a step back to look at the bigger picture (in technical analysis) and why things appear not to be going the right direction to me. And also applying what I'm seeing in a intra-day analysis to a longer view.

In the weekly view, the DOW's upper Fib line is just shy of 11300, which hasn't been touched yet by the up-trend. However, I have quite a few lines meeting this week at 11285, and that is where some pretty hard resistance appears to be. It has taken 4 weeks to recover the one-week drop from 5 weeks ago. It is more favorable for 11300 to be reached next week, Most likely either Tuesday or Wed.

My feeling is that the DOW will push up to 11285, and probably 11300, but much more than that and it will be heading for a double-topper. The pattern will be more revealing at 11462 which could happen about 2 weeks from now.

When will the Earnings Bliss be over?

For the DIA put, I would stop out at 113.00 to give a little more wiggle-room that may happen if the plunge does happen in the later part of next week like I'm anticipating, but not really expecting anymore.

Is someone forgetting to tell the bulls the bad news?

stockshaker - always welcome to see the bulls viewpoint and right nowyour comments are very much 'spot-on'. Good comments from the fellow bears here, as always. I think you are all identifying with the notion that sentiment and not economic facts 9and speculative fears) are supporting the market at this level and indeed may push it even higher despite all the economic negatives. I will stick my neck out and suggest that the pay roll figure will not cause the market to fall. Your businesses are strong enough to take on the normal projection, but not strong enough to take an abnormally higher amount of labour - at least thats the strong impression I have. However, I may soon be 'eating my own words'.............!!!!

NO no no, nothings makes sense. The payroll figs came in good ie showing a slowdown and the Supply Institue figs also showed a drop. These 2 peices of data is exactly what the market wanted for bulls, but whay happens? The market has FALLEN. The theory of bad news is good for the bulls, now seems questionable. This highlights once and for all that this market is totally in limbo - near up nor down trended. This is the worst kind of market, because of all the uncertainty of what position to take in terms of the DJA indices. How much longer will this go on for? It could be weeks or even months and that would be bad for bulls and bears, unless they are day traders because of the need to monitor, react and ride the daily gyrations of the stock market. Ughhhh!

Please excuse my spelling due to me being a 2 finger typist and the right digit being quicker than the left one!!

Post a Comment