No Rest for the Wicked

Most bloggers are taking today off. Not me! Although today's entry will be on the short side.

The US dollar, as you probably know, got punched in the nose, and that had pre-opening GLOBEX good and red. The market opened lower, spent most of the time climbing up to trim those losses, and then finally stumbled again in the end (incredibly). The intraday minute bar chart of the $INDU suggests we might have a small top on our hands. But we've certainly been faked out before. Many, many times.

The Dow Transports seems to be cooperating with a bearish outlook. The descending trendline you see is still being respected. Unlike the $INDU graph, this is on a daily basis.

I had puts on the $XAU that got promptly closed at the opening bell due to a surge in gold's value. A look at the $XAU shows that this may still ultimately form a head and shoulders pattern, it certainly isn't as clean a trade as it once was.

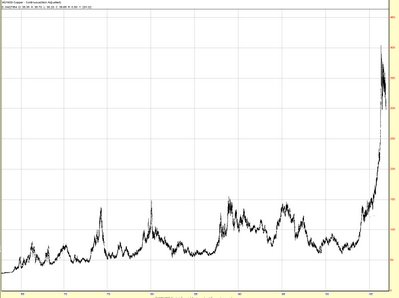

Since commodities are such a major part of the investment scene these days, let's take a quick look at a couple of influential ones. First, copper. This is a long term (multi-decade) chart. I think anyone would agree copper is in a weird no-man's-land at this point, having ascended to never-before-seen levels. Unlike stocks, commodities tend to revert to norms over time. Don't you think something looks kind of out of whack here?

Crude Oil, on the other hand, seems like it's positioned to move higher. We've had some relief, moving down from $75 to about $58 per barrel. But oil bulls may find themselves in a good position, in spite of the still relatively high price of fuel.

Hope you enjoyed your Thanksgiving, and I'll see you after the closing bell on Monday!

30 comments:

Nice to see more & more of the long term bears on this site are turning bullish. We all know what that means.I hope. Just checked the AAII site & bullish % dropped a bit and bearish went up a great deal, so maybe the uptrend continues.

What's the topic of discussion next week, abortion?

R41

Call me crazy, but I like gold here. The clear breakdown of the USD below $85 and the stability of oil at the $60 level is very bullish. Obviously, the "diversification" talk from China was squashed almost IMMEDIATELY (I suspect to keep the markets stable), but lo and behold, it looks like they may have already started to diversify away from the USD.

I like the triple top breakout of AEM as an equity play. Plus, gold itself (the metal) is reaching the magical $646 resistance/support level. The last 2 resistances were breached pretty quickly, so I expect the same to happen at $646.

Good luck.

-TonyB

I could easily be talked into a bullish position on gold. I have no position whatever in gold markets now, having had my head handed to me (how's that for alliteration, folks?) by AEM and XAU this morning.

I wasn't always bullish on gold (short term), but its recent action since the $600 level (I'm still kicking myself for not buying at $608 like I've been planning for months) has me really interested again.

As long as gold (metal) can hold the pivot point of $628, it should keep going up for a long while.

Besides, I just love the fundamentals behind the gold bull market.

-TonyB

why can't I get a chart on 'continuous crude' on prophet.net's java charts?

That's an awesome chart. Thanks.

how come you dont link to any other blogs?

Stop hoping for a market drop and stop looking at tops that do not exist. The market is in an utrend and there is no technical sign that it is topping. Sell offs are so short lived and before you know it the market is jumping to new highs. Even fundamentally weak stocks like the homebuilders and mortgage reits are going up. There is no place to hide if you are a short.

If you claim that you are a technician then there is no reason to be on the bearish side. #1 principle in technical analysis is "trend is your friend" and the trend is up. It is that simple.

As for gold it is going to 1000 or more. Every SECULAR BULL MARKET EXCEEDS THE HIGHS OF THE PREVIOUS SECULAR BULL MARKET. The previous high on gold was $850 set in at the top of its previous secular bull in 1980. We will see gold over 850.

zeus111

"How come you dont link to any other blogs?"

If I ever see anything really great, I'll mention it. I am not deliberately refraining from mentioning other blogs. I just don't bother to do so.

love the gold talk. 646 is the next big number to take out,then it goes to 665 and beyond IMHO. KRY closed above the 200 dma and has volume. I cant get enough pain. bought $rut puts ,would have made a little fri. Got greedy and the the index climbed back to almost even. Is there any way we have a down day monday considering the shape the dollar is in ? I dont see the vix going any lower, Havve we reached the top? Only the shadow knows.

I don't see anything propping up the dollar at this point. I think it starts its freefall right here and now.

Note also that the XEU has broken the 130 level. Clearly, the technical buyers have jumped in... and they're not about to let that level break down very easily. I think the dollar weakness continues for quite a while.

I am loading up on any weakness in gold. I think it's finally started actively trading again.

Good luck.

-TonyB

I suggest that oil may be in the process of forming a H & S.

Copper is dropping in price because of the slowdown in building. A good short

I agree w/ Frank Bliss.

I believe oil will return to its pre-9/11 price near $27.

I believe I read somewhere that we've 'tapped into only 18% of the world's available oil...'.

I know the 'demand' figures for crude are bullish for the price of the commodity, but I believe the growth of 'supply' will dwarf the other stats, driving my bearish view.

Not only do you have to consider that we have yet to tap into the newly discovered crude in the Gulf of Mexico (the 'largest find in a generation'), but you have to think that more & more nations will "go Brazil" for oil independence to get away from the filth in the middle east.

hey onewaystox! was some fudgepacker tapping into your anus while you read that? All the easy oil is out. Do you really think that with today's technology we have missed any big finds? The Saudi's are running out of it, they are desperately trying to appease the world that everyhting is under control and that they can meet any and all demand. What else would they say? They don't want any new technology to be a competitor to oil, and by saying that oil is plentiful, they dissuade other's from developing a competing product/technology.

Trader Fred

& y'all never thought the that once the Nasdq hit 5K that it would go back to where it was in Oct. '98

& y'all never thought that when the mkts bottomed in Oct. '02 (lower than our 10/98 levels) that we would get back to our pre-9/11 levels.

Tf...they elect fudgepackers in NJ don't they? now, let the grown ups talk.

and y'all never thought onewaystox was inbred!

Some sensible posts re oil. Never $27 again. onewaystox & frank bliss - the amount of recoverable oil and the total estimated oil deposits are two very different figures. This has nothing to do with whether the deposits are in a protected environmental zone, its purely a matter of technical practicalities and advances in technology wont change that balamce. The average per field ranges from just 1 to 10% recoverable. And yes demand from China (and Russia and the former Eastern Block countries) will rocket. Min target is 50 dollars on a bad day.........sorry but youve got it wrong.

I'm not saying that it's going to happen overnight...the run up from 10/98 to 7/06 took a while, right?

The commodity has already dropped 28.56% from its high ($79.86) to its recent low ($57.05).

A similar drop from these lows brings it to $40.76.

& beyond that? Another same-% drop brings it to $29.12.

How much lower does it have to go before you realize it's going down?

Tim how many millions did InVesTools pay you for your Prophet.net site? I can't find it in any SEC filing. Thanks for everything you post.

Everyone should be aware that because oil is traded in dollars, when the US$ declines relative to other currencies (pick your favorite basket) the US$ price of oil is pretty much necessarily going to rise.

Regarding Tim's wonder at the chart for SHLD, he should read the history of the career of Ed Lampert.

ahhh what a dayyyy...looking for triple digit losses on the dow

This market is a breeding ground for PHSYCOPATHS!!!!

where is the PPT when you need 'em? it's been like what, 3 days without an UP day!! Geez ... talk about a sell-off!

that's all you get for today ... 130 points ... the market will probably take back 40-50 of that so we'll close red -80 points

come on bearz!! what's going on here?? Don't you like the markets up everyday???

The QQQQ's look to have held the bottom of their trading range. I am getting prepared for another burst of short covering.

where is the support on NDX?

Tim , I hope you hung on to those

$rut puts!OH Happy Day!

Amazing, the PPT didn't rush to the rescue today. They finally let the indices drop for a change.

Bought long into AEM on Friday, gold looks to be on the move. On a bad day for the Dow, I'm up over 2% in AEM. Not bad.

QID jumped today. Wish I would have bought some on Friday. But hell, who can predict the day-to-day action of this crazy market anyways?? I half expected the Dow to go GREEN after 2 PM!

I was shocked and awed by the conviction of the sellers today. Now if we can only establish a TREND, we can start shorting this POS market.

-TonyB

This selloff was needed. I just want to know if volatility is back. I was getting tired of this one sided market. Im glad it didnt turn around mid-day, many, many people thought it would and not seeing it turn around is probably hurting alot of longs tonight.

QID did have a very, very nice day. Looking for 55-56 in the short term if this market decides to fall further. Looking to buy QID on any drop below 50.

TRADER 2006.

Post a Comment