Post-It to Self: Short Everything!

Thanks, 3M, for helping take the market down Friday. I've mentioned MMM as a great short idea more than once. Glad it finally succumbed.

My disposition on the market has never been sunnier. I am shorting everything I can. Buying puts on everything I can. Owning nothing. My belief is the market is heading for a sustained, profound fall and my intent is to profit handsomely from its demise.

There are certain sectors that seem especially juicy for a fall. Oil services. Gold and Silver. And, to keep it simple, just the good ol' S&P 500. Here are all the positions on which I own puts (note to newbies: click on any image to see a much larger image):

Looking at the DIA with bearish goggles shows a well-formed head & shoulders:

You can see the same market as bullish, since there have been a trio of progressively higher highs. Even with this point of view, you can see the market is headed for some very serious resistance to overcome:

THe OEX chart is noted as:

Oil Services (OIH) have a ton of high-volume options, and thus represents another great put-buying opportunity given the state of this chart:

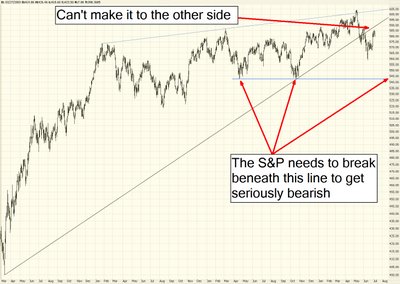

The S&P 500 is falling away beautifully from its median line:

XAU (Gold & Silver) looks at the top of a right shoulder on a forming head & shoulders pattern:

The XLE (oil sector) represents great opportunity for short selling in the stocks that comprise it, as well as the XLE (or OIH) itself:

CX:

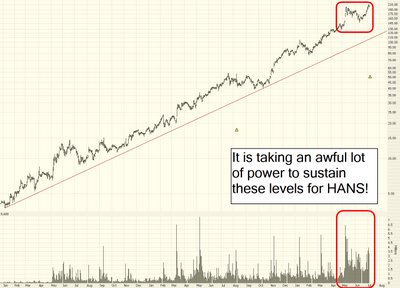

Sugar water seller HANS seems primed for a fall:

TEX appears to have double-topped:

TXT:

This upcoming week should be thrilling. Good luck!

33 comments:

Tim:

I have been brainwashed and agree with where you think we are in the market and I agree that the companies you have identified are good shorts. For what its worth Bill Cara, Glenn Neely (Neowave) and Robert McHugh (the last 2 put out a newsletter or email) all agree with your assessment. Hard fall, coming soon.

So far I am comfortable selling the stocks you identified short but don't know that I have the skills/knowledge to pick the right puts to buy.

Can you share some of the puts that would interest you (price/timeframe). Or, can others?

Thanks

MIke

Tim:

I have been brainwashed and agree with where you think we are in the market and I agree that the companies you have identified are good shorts. For what its worth Bill Cara, Glenn Neely (Neowave) and Robert McHugh (the last 2 put out a newsletter or email) all agree with your assessment. Hard fall, coming soon.

So far I am comfortable selling the stocks you identified short but don't know that I have the skills/knowledge to pick the right puts to buy.

Can you share some of the puts that would interest you (price/timeframe). Or, can others?

Thanks

MIke

Simply stated:

+ At least two months out (e.g. buy Augusts at this time)

+ Slightly in the money

+ Decent volume and open interest

Tim

Love your site..thanks loads.

Will your new release of prophet charts include pivot points and their resepective support resistance lines displayed on the charts? also, will we be able to pull up the NASDAQ advance-decline lind ($ADQ)?

Jim

Beer goggles or bearish goggles? lol

What you try to point out is in fact a *completed* head and shoulder formation on the Dow.

The left shoulder finished and the neckline was pierced (11,075). Price then fell to 10,700 for a measured move.

So the head and shoulder is finished. It completed itself and found support at previous levels.

As for your other bearish comments...I'll archive this post and come back to it in a few months :o)

The short term trend has turned bearish and is now in alignment with the intermesiate trend (bearish). Good time to start shorting. Lets see if 10700 is breached or we have a higher bottom. GOOG also looks like a good short at these levels. Its doing higher lows but lower tops. Wont be against the market very long once we start falling.

Anybody know which Gold ETF can one buy puts on?

You're probably right about gold and oil, but since when are they the entire market? Financials are doing fine, so are the consumer stocks, and interest rates look to have peaked out, judging by the TLT. Biotech is perking up. We could have a large rally when oil and gold go down and the rest of the market goes in the opposite direction.

We're working on pivot points at this very moment.

And I didn't say gold and oil were the entire market. I simply pointed them out as fine examples of sectors to short. My index charts as a whole speak to the broader market.

since may 18 dow could be forming a reverse head and shoulder

Old Soldier - thanks. Very kind words. I enjoy writing this blog, and I'll try to keep to the principles you outline.

Jockhunter, even if oil and gold are weird/different, I still love their charts. They could be graphs of wolf nipples for all I care - - I just want a good chart to trade.

Technically HANS is not bearish by any means. It is showing signs of strength. I would have to agree with Huricane on that one. If you are shorting HANS you are trying to predict a top, not really trading in my opinion.

However NTRI looks weak and has more room on the downside play.

The cleanest opinion so far in favor of the bears. I am still in in favor of a little more upside from here - but this rally likely won't last much beyond a month (and less than the 2-3 months I thought we would get based on the relative position of market internals like the Bullish percent index and the Nasdaq Summation Index).

Nice work Tim

Kapil,

I confess, HANS isn't a bearish pattern. And my mentioning it as a potential short is really based on little more than "gee, this thing is ungodly high, and how can it possibly go any higher?" So not my best work, I confess (I stand by my other charts, though!)

So I'll give it to you (and 'cane) that this is an incredibly strong stock. It has defied the bears for a long, long time. Let's face it, and SOME point it's going to soften (no stock is a superstar forever), but technically speaking (ahem, the name of this blog) there's no concrete reason to short it.

Very fun! The power of the Fib.

I had left my Fib lines up from Wed. and Thurs for the DOW. On Friday it paused at every one I had plotted and dropped down to the 38.2% Fib line drawn on data from 5/9 and 6/14.

There it did a little fish-hook action at the end of trading. Volume is still low, which is probably from people taking some much-needed vacation for the week.

I see the market in a crossroad depending on how people feel over the weekend. Is Friday just weakness over one company, and thus the earnings from the others fuel the market back up to make a double-top? Or will the bulls panic, afraid to loose some hard-earned-back cash?

Next line to cross down will be 10927.

Regarding bonds, now is not the time to start buying.

Wait until after the August hike and a clear indication of a pause before buying bonds.

Just my opinion.

-Tony

Where can I get a quote for wolf nipples?

Tim-- the head & shoulders pattern on the DIA is well-defined as you say, but it needs to be considered that it may have already played out/resolved. It broke below the neckline, dropped less than standard projections, but still significantly, and moved solidly back above the neckline. This market is full of h/s patterns, but so many have moved back above the right shoulder and overcome the bearish bias. While I am not by any means bullish on the market as a whole, I think it is very possible we make little progress in either direction over the next few months. The fall could well see something more dramatic.

CAN YOU ALL, PLEEEEZE READ THIS....ON 6 JUNE 2006 ONE OF THE SITE I FOLLOW ISSUED A SELL NOTE ON THE DJA AT 10794. ON 7TH JULY 2006 AFTER MARKET CLOSED AND THE DJA HAD FALLEN 135 POINTS, THE SAME SITE ISSUED A BUY NOTE ON THE DJA AT 11090. NO EXPLANATION, JUST AN ABSOLUTE SIGNAL FROM THEIR CHART MODEL. NOW WHY WHY WHY, WOULD A SITE DO THIS AFTER THE CLOSE OF BUSINESS ON THE VERY DAY THAT THE MARKET HAD A BIG FALL AND APPEARED TO BE FIRMLY TRENDING LOWER. WHY? THERE IS NO REASON TO SUGGEST TAKING A LOSS OF 294 POINTS WHEN THE MARKET APPEARS TO BE HEADING DOWN BIG TIME......UNLESS THEY ARE SO SURE THEIR MODEL IS RIGHT, THAT THE DJA IS SO CERTAIN TO GO UP SIGNIFICANTLY. THIS COMPANY WILL CEASE TO HAVE ANY FOLLOWERS IF IT HAS GOT THIS WRONG, SO WHY RISK SUCH A MAJOR DIRECTION CHANGE.....UNLESS ABSOLUTELY CERTAIN IT WILL GO UP? THIS FITS IN WITH ANONYMOUS COMMENT, AS ALWAYS HE IS WELL INFORMED WITH OPINIONS WORTH TAKING ON BOARD. iVE SAID IT A NUMBER OF TIMES DURING THE LAST WEEK OR MORE, I CANT HELP FEELING THE MARKET WILL GO UP - NOT FAST AND NOT TO CHALLENGE ITS PEAK, JUST MAYBE BELOW 11400, BUT THEN IT WILL BOUNCE BETWEEN ABOUT 11100 AND 11400 UNTIL SOMETHING KNOCKS IT OUT OF APATHY. AS ANON SAID I THINK IN TERMS OF OCT/NOV 2007. BY THE WAY WAIT UNTIL 2007 BEFORE CONSIDERING BONDS. SORRY TIM, BUT I THINK YOUR CONFIDENCE IN A FALL MAYBE OUT OF THE SHORT TERM TIMESCALE. A NUMBER OF THE REGS APPEASR TO BE THINKING ALONG THESE SIMILAR LINES BASED ON THE COMMENTS ATTACHED TO THIS PARTICULAR BLOG. ALL THIS IS ODD TO COME FROM ME, WHO IS NORMALLY SO BEARISH, UNTIL ABOUT 2 WEEKS AGO

bsi, yes you could be right. But I'm still waiting for the right time to invest my paltry savings. It still doesn't look QUITE right just yet, that's all I'm saying.

I could be overly cautious, yes, but I'd prefer to see what happens before making my move.

I'm still waiting for gold to come back down. I'll be patient, there's a long way to the top for both the bond market and gold, so a few months here or there isn't going to make or break my investment, true.

But I'd rather wait it out. There's still a good chance that we hit 6% by year end for the FFR.

-Tony

I think these markets are headed lower, any rally is a chance to sell, I was saying this last week when the dow was in rally mode. Take profits when you can in this market. To many bears have gone to the bullish side since the last FOMC meeting. The chance of another rate hike in August is 100% in my opinion and a pause at 50%. This uncertainty is going to keep the markets very volatile. IF everyone is anticipating a pause at the August 8th meeting and the markets do not see one expect a huge market decline. Earnings are the only catalyst to lift this market. MMM already hurt the markets on Friday, who knows whats in store for this week especially with AA and GE reporting. The markets seemed very positive on the jobs data that was only off by 80,000 jobs which in the long term is not good news. They want to see a low jobs number and assume the federal reserve will be done raising. I dont agree. Bad news seems like good news and good news, bad news. I would not want to be 75-100% stocks right now. I think 50% stocks and 50% cash maybe your answer. If the markets get another push down expect them to go at least 3-5% lower than the last lows we saw in mid-june. I dont think the markets are done going down, to many negatives outweighing the positives.

G2006

tony 6% is given, no pause until early 2007 in my opinion. Imagine a pause in August only to see PPI and CPI still showing inflation, the markets would not be able to digest that. Federal Reserver going to 6%

G2006

Tim:

I appreciate your site as much as the next person, and "promoted" it at the INVEStools seminar in Ft. Lauderdale last week.

I am concerned with shorting (puts) on any oil/energy stocks at the beginning of hurricane season. Last year I saw quite a few oil stocks jump when threatening storms headed for the Gulf. Combine that with the fact that so much oil production is located in unstable parts of the world that while technically ready for a fall, I am afraid of the biggest trade doomsdayer...news.

That being said, my June trades using your patterns was incredible. I hope to repeat that every month.

Can't wait to see the new Prophet.net software.

pb - thanks for the reply. My point to this group was, why would anyone bother suggesting closing a DJA indices position at a loss when the market is heading in a direction that will erase the loss and will turn into profit if it continues to trend that way. The only answer, it that their modal has produced an absolute reversal and is now at buy, buy, buy. This may fit in with your comment and indeed many of the others here, including myself, that now seem to be targeting Sept onwards as the likely start of a sustained fall. In that case it may be possible to see the DJA rise between now and then (Sept onwards), in which case signalling a BUY note now may be the right thing to do even though in 2/3 months time, a sell note might then be issued instead = a potential profit in the interim period. Should we bears now be considering short term buys, before dumping sell orders at that later time period? Thoughts anyone?

Yes, but unless you're careful, it can also be too risky to go short at this point.

Consider that unless there are more earnings warnings forthcoming, there can be no doubt that Q2 earnings will again be outstanding, so the market will yet again be bouyed up. I definitely don't see it surpassing 11,700, but then again, who knows for sure?

I successfully scalped some decent shorts for 2-3% gains or so in the last week, but the choppy market has forced me to stop out of a few others. There's just no CLEAR direction right now.

So I do agree that it's too risky to go long (and if I were to take a long position, it would only be for a VERY short time), but I also think that it's too risky to short right now.

I agree with Tim's approach of buying slightly in-the-money puts at least 2-3 months out. Some nice Oct'06 puts SHOULD be virtually no brainers at this point, especially for the majority of the Naz.

-Tony

pb, I would agree that GENERALLY, earnings would be priced by this time. But I don't agree in this particular case for Q2. The recent selloff has been harsh and has reduced investor expectations for earnings and guidance already. So unless earnings are BELOW estimates, I think the market goes higher nonetheless. Sure, forward guidance will ultimately reign supreme, but unless guidance is actually lowered, I still think the DESIRE for the market to go higher will win out in the short term and we could see a decent rally.

If you are long, this would be a perfect opportunity to get OUT of those positions. Certainly, no amount of "good news" in the bulk of the stocks in the market would cause me to take on new long positions now. But I don't see any particular reason just to "guess" at forward guidance or earnings disappointments and go short at this time.

You could scale into shorts, yes, but most trading methods don't allow for much room for error on the upside, in which case you would likely get stopped out very quickly in this market, especially if earnings do NOT disappoint and guidance is NOT lowered.

Any short play at this point would be based pure guesswork and would just put your capital at risk in the short term for no good reason. Some charts are shaping up for nice shorts or have already started rolling over, but any news or earnings surprises could easily reverse those trends. I still think that put options are the best bet. Yes, the market is undoubtedly going down. The big question is: when?

Just sharing my opinion. Good luck and please make your own trading decisions, don't rely on anyone else's advice, including mine.

-Tony

markets showing nothing at the moment, all weak, the nasdaq is leading the markets back down. The SOXX is going lower, no signs on any improvement in that sector. Would go long the SOXX in end of OCT early NOV after a big selloff.

Long PSQ and enjoying it...

G2006

Check out MEEVF right now. Trading with no spread. OCT 300 puts on MEE. Right now at $1.35 x $1.35.

Won't last!

Um, Oct 30 puts. The 300 puts would be a bit more expensive.

Wow, that HANS short would have paid a bundle today, eh?

:)

bsi: you don't think large cap value will hold up over the next year or so?? Why not?

Tim--

Will we be able to chart wolf nipples on the new Prophet Charts? That would be hot.

Also, I notice the Dow is still above a 2 year trendline. the one it broke through on 6/7, toyed with a bit, then popped back up over on Fed day 6/29. S&P is over its trendline today as well. Both bounced off them...barely. But Naz and Naz 100 is underneath. This is conflicting signals. Best to wait until all indices confirm each other, right? Shouldn't take much weakness for Dow and S&P to break through (again).

Watch for the S&P to break its 200 day again and close below it. I think the trendline that you're talking about is below the 200-day, but I don't think it makes much difference. Once the 200-day goes, I think the trendline will be broken anyways.

AA's disappointment and LU's warning today should serve to put some serious heat on the market tomorrow. But this is what I was waiting for -- some confirmation for a clear direction. Unless something drastic happens overnight, I don't see the market rallying tomorrow.

And remember, the BoJ still has 10 trillion Yen to drain from the system! This Friday should prove VERY interesting.

Sorry if it seems that I'm going back and forth, but I'm really not. I just like to wait for confirmation before acting. And taking wild guesses at AA's earnings or trying to predict who will guide up or down, or warn(like LU), is not very reliable in this market (which seems to rally on just about anything nowadays).

AA and LU just added a bit more to the short side of the equation. Let's see if GE can follow through on Thursday and Japan will likely put the nail in the coffin on Friday.

-Tony

Ok, here's one for everyone: EXPD

Since this board is mainly bearish, you should love that one as a short.

If you can figure out what's keeping that stock up in the air, I'd love to hear about it. The only thing I can possibly imagine is that it's 98% held by insiders and institutions, and they just aren't selling no matter what.

But by all standard measures of value, that stock is currently defying the laws of gravity and deserves to be shorted mercilessly.

-Tony

Post a Comment